Avenga’s financial software engineering solutions

Every financial organization has its own vision for the future. At Avenga, we co-create digital solutions to reflect your business goals, your clients’ expectations, and BFS realities.

Trusted by financial institutions around the globe

End-to-end financial engineering capabilities

-

AdTech and MarTech

Power smarter customer acquisition and loyalty with compliant, data-driven AdTech and MarTech ecosystems built for finance. We help BFS brands personalize engagement, automate campaigns, and deliver measurable ROI across every touchpoint — all with enterprise-grade security and precision.

Learn more

-

Avenga Experience

Turn complex financial processes into intuitive, human-centered journeys. With strategic analysis, visualized requirements, and UX-driven design, we align your teams, simplify decisions, and create digital experiences that strengthen trust and accelerate customer satisfaction across banking and financial services.

Learn more

-

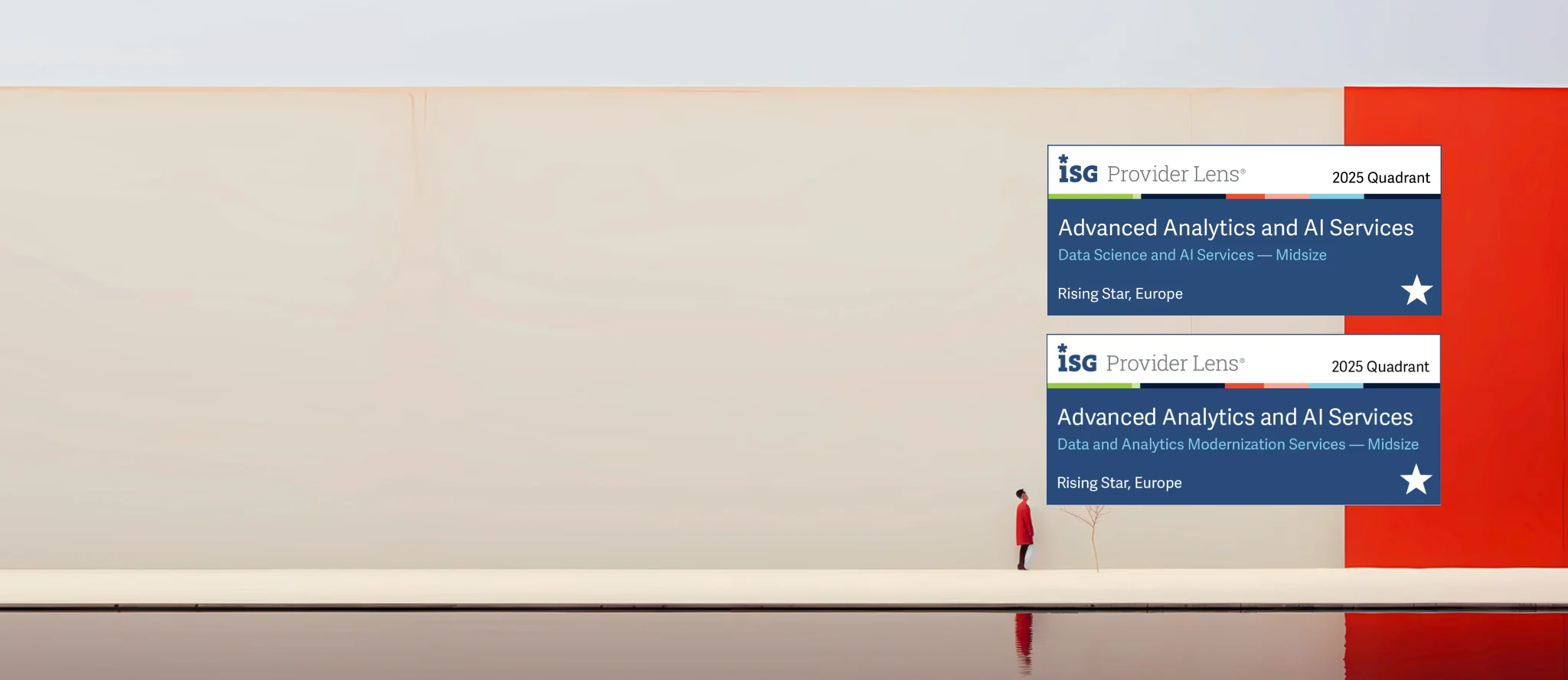

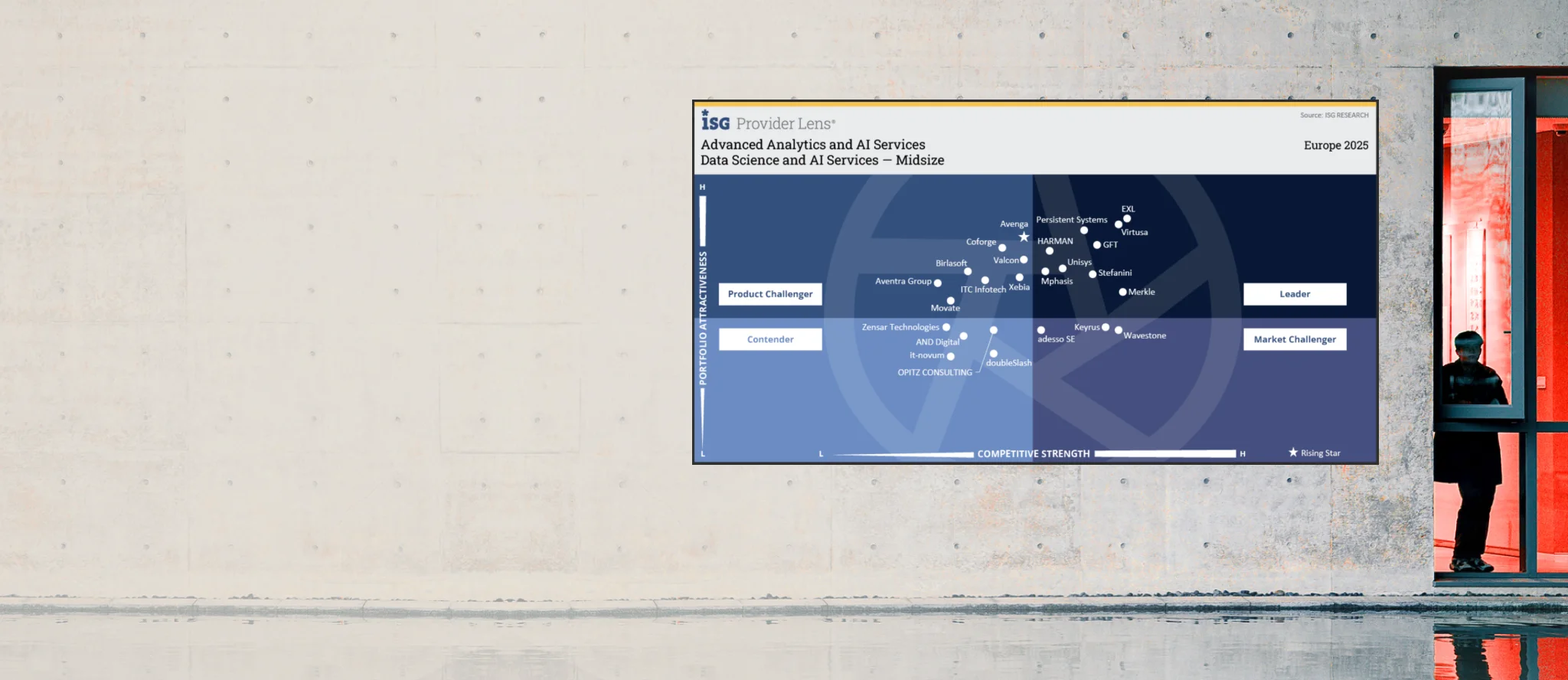

Data and AI

Make every decision intelligent. We engineer AI-powered analytics, customer experience, fraud detection, ESG insights, and strong governance frameworks that give financial institutions clarity, speed, and confidence — from risk forecasting through improved customer experience to compliant data management.

Learn more

-

Intelligent automation

Automate the heavy lifting in banking and financial services. We streamline KYC/AML, claims, underwriting, loan processing, and customer operations with secure, scalable automation that reduces costs, eliminates errors, and keeps compliance effortless.

Learn more

-

Managed services

Ensure uninterrupted banking operations with engineering services built for resilience. Our 24/7 monitoring, proactive optimization, and zero-SLA-breach culture keep your platforms secure, stable, and performing at the speed your customers expect.

Learn more

-

Product engineering

We design, develop, and evolve secure digital banking platforms, mobile apps, trading tools, payment solutions, and more — combining cloud, AI, and modern architectures to deliver future-proof innovation for BFS leaders.

Learn more

Related content

FAQ

Speak to our expert

Let’s ensure your financial institution leaps ahead.

Lenka Votavova

Head of Marketing BSFI & LeadGen Global Marketing