The Role Of AI And ML In Transforming Credit Risk Management In Banking

April 29, 2025 22 min read

Navigating the future of banking with AI and ML.

Integrating Artificial Intelligence (AI) and Machine Learning (ML) within the banking sector, especially in credit risk management, represents a pivotal shift towards more sophisticated and efficient financial services. These technologies have become topics of extensive discussion among professionals and are central in reshaping how banks assess and manage credit risk.

The blend of AI and ML offers unparalleled insights and automation capabilities, enhancing the accuracy of credit decisions and risk evaluations. As quoted by a leading industry expert, “As technology evolves, it’s evident that AI and ML are not just fleeting trends but are integral to the future of banking.”

The field of credit risk management is being used to test the benefits and challenges of using AI and ML. Through trial and error, AI and ML in credit risk management are paving the way for broader applications across various financial sectors such as wholesale banking, retail banking, insurance, wealth management, and capital markets. The next step is thoroughly exploring AI and ML applications in credit risk management. This exploration will reveal both the benefits and hurdles. The aim is to shed light on the future impact of these technologies in the FinTech industry.

Applications Of AI And ML in Credit Risk Management

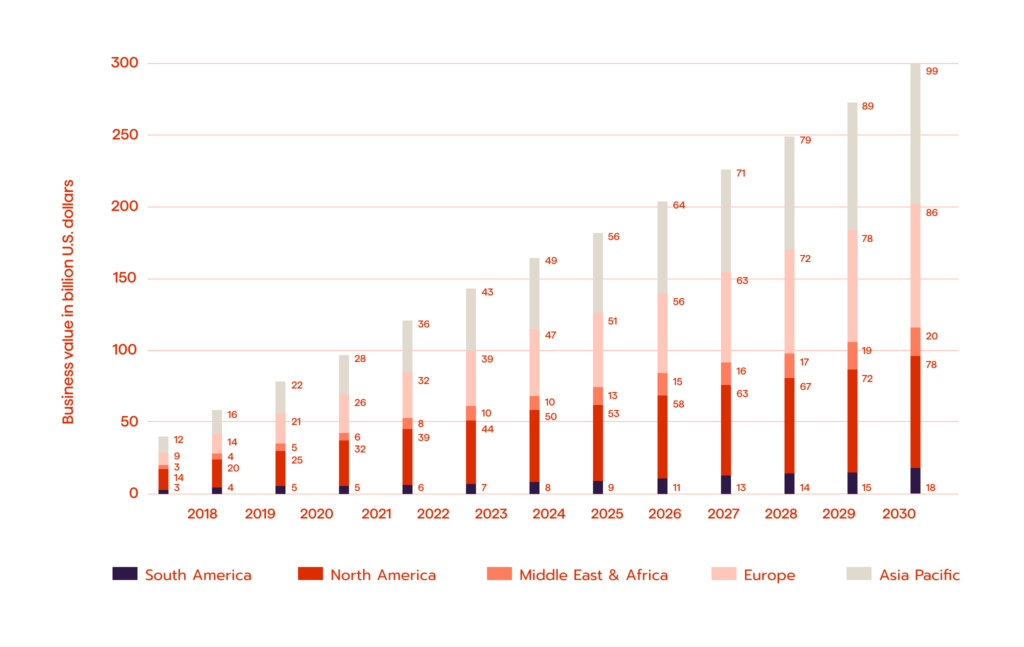

A surge in adoption reflects the significant value that AI and ML add across the entire credit spectrum. From preliminary risk assessment to ongoing account management, these technologies facilitate a deeper understanding of borrower behavior, improve prediction accuracy, and streamline operational processes. Recent studies underscore this trend, with AI in the banking market projected to grow exponentially.

According to Allied Market Research, the market valuation for AI in banking stands at $160 billion in 2024 and is anticipated to reach $300 billion by 2030. This rapid growth is a testament to AI and ML’s critical role in managing credit risk and driving the future of financial technologies. (see Fig.1)

Regardless of any prediction, one thing is clear – AI and ML in banking will be further applied and bring massive revenues. To better grasp how the technology is integrated into banking and credit risk management, one should explore several critical areas of AI and ML adoption.

Credit Decisioning

Companies with the best models have all the gains in the credit world. For example, banks often use AI algorithms to create models offering more accurate default probability and loss severity. This all comes together into better credit forecasting. This report suggests that AI is applied to improve credit approval, risk determination, and portfolio management in credit risk management.

In addition, banks using AI integrate automation and near-real-time analysis of clients to generate credit decisions from SMEs and corporate clients effectively. McKinsey indicates that tools like AI work with structured and unstructured data, later translated into more informed and precise credit decisions for credit risk management. Respectively, credit decisioning is among the first on the AI adoption list.

Enhanced credit decisioning with ML

ML algorithms excel at analyzing vast datasets to identify subtle patterns and correlations that might escape traditional analysis. In credit decisioning, ML models can process complex, multi-dimensional datasets, including transaction histories, social media activity, and psychometric evaluations, to predict an applicant’s creditworthiness more accurately. This broader data analysis capability enables banks to offer credit to underserved segments by accurately assessing risk profiles beyond conventional credit scoring methods.

Monitoring And Collections

Along with better insights into credit decisioning, institutions and organizations can apply AI to build better collection strategies. Banks receive new tools for digitizing interactive data from field visits, campaigns, and the comments of collection agents. It all reduces the burden of various nonperforming loans. AI models grant automated loan underwriting and pricing.

In terms of monitoring, banks can use AI to engage in proactive interactions with clients. The technology helps collect and analyze massive volumes of data to build a 360-degree perspective on a customer’s financial profile. As a result, such a degree of monitoring allows institutions and organizations to get the most out of loans and their collection strategies.

Predictive analytics in monitoring and collections

Predictive analytics powered by ML can forecast potential delinquencies before they occur. By identifying at-risk accounts early, banks can proactively engage with customers to restructure repayments, offer counseling, or tailor financial products to avoid defaults. This proactive approach improves collections and enhances customer loyalty and retention.

Looking For Early Warning Signals

Recognizing the early warning signs of potential risk is a big benefit for credit risk management. AI works with fraud detection and ensures compliance, as these two aspects help prevent financial losses and litigation. Besides, with criminals becoming increasingly sophisticated in financial crimes, fighting money laundering and fraud is often a part of corporate social responsibility strategies.

Banks use AI in the context of investigational initiatives directed at accurately detecting any suspicious activity that can be red-flagged as fraud. What is more, it is all done in real-time. Traditional instruments of recognizing the early warning signs of potential risk rely on many experimentally defined indications and expert judgment. Yet, such an approach includes the possibility of human error and the requirement of lengthy processing times. In turn, AI utilizes large volumes of high-velocity data and uses Natural Language Processing (NLP) to generate warning signals accurately in a matter of minutes.

Sentiment analysis for market risk assessment

ML techniques such as NLP can analyze news articles, financial reports, and social media to gauge market sentiment and its potential impact on credit risk. This analysis can provide early warning signals of market shifts that may affect the creditworthiness of borrowers, particularly those in sensitive industries.

Credit Risk Analysis

Conventional credit risk analysis often relies on complex statistical models that assume formal relationships between features in mathematical equations. AI uses ML methods that can learn from data without requiring rule-based programming. As a result of this flexibility, Machine Learning methods can better fit the patterns in data. It is done through the following classical ML algorithms and deep learning techniques:

- Logistic regression – one of the most commonly used ML algorithms. It’s a supervised learning approach, which means that a user feeds the pairs of input indicators and desired outputs into the algorithm during the training, and the algorithm finds a way to produce the desired output given a specific input. Afterwards, the trained model can predict the output given new and never seen before input without any help from a human. At the heart of the Logistic Regression model is a linearity assumption, thus it can only model simple linear dependencies.

- Random Forest Method – an intuitive supervised learning method. Here the idea is to leverage the historical datasets and build them into data trees to optimize the future process of analysis.

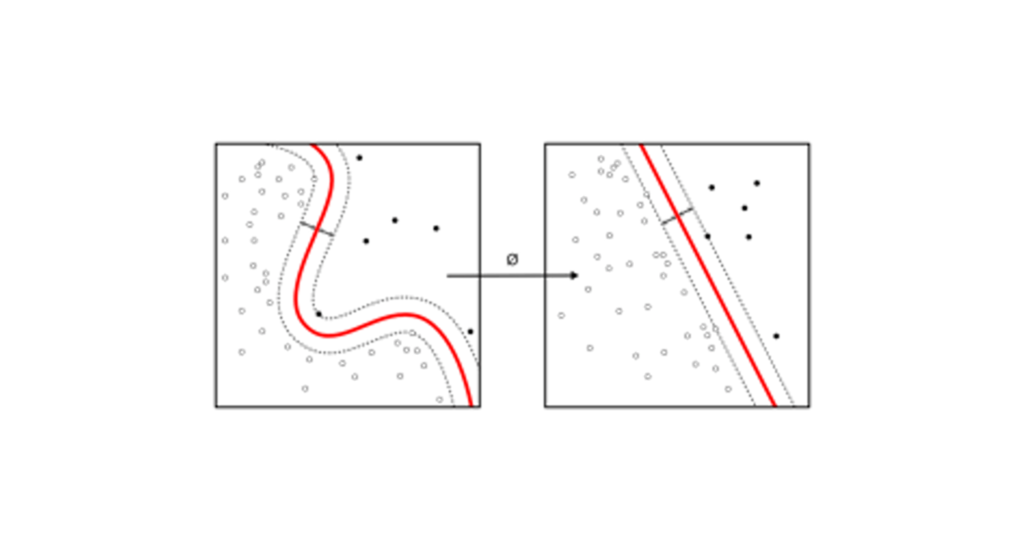

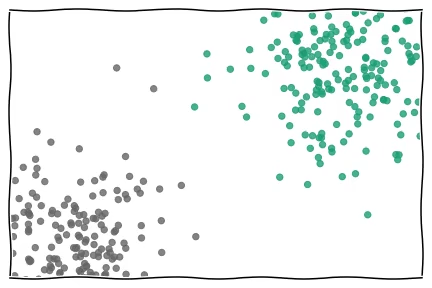

Support Vector Machine (SVM) – a vanilla SVM is a type of linear separator. We draw a straight line through our data down the middle to separate it into two classes. If we can’t draw a line through the data, we can transform the data so that the separation becomes possible.

K-Nearest Neighbors (KNN) – finding the class of the data based on proximity to old data. Tell me who your closest friends are, and I will tell you who you are.

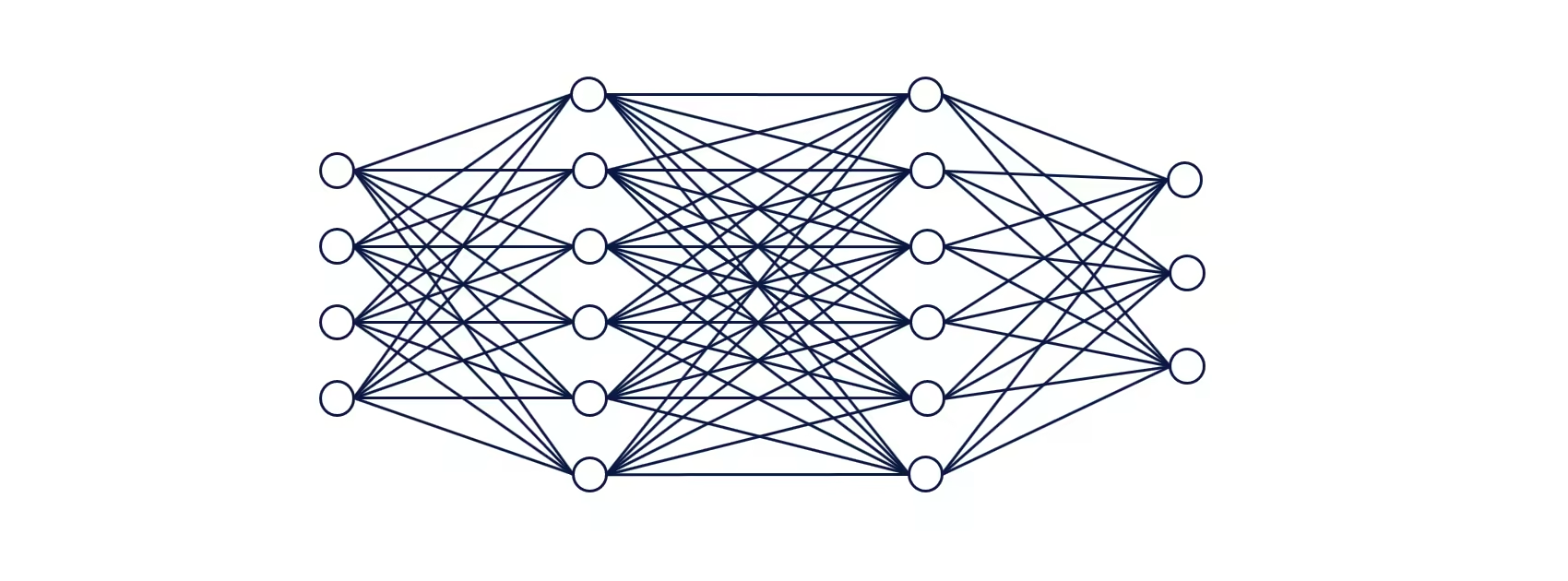

- Neural networks (NNs) – basically, these are algorithms mimicking the way the human brain operates. NNs have been shown to be effective, especially for short-term predictions. They are also robust in the sense that they deal well with missing data and correlations between input variables. However, NNs are not easily interpretable, thus it is difficult to understand why the model makes the predictions it does.

These tools allow for the equitable distribution of data and create an environment for using non-linear patterns of different variables, like in credit scoring. As a result, banks receive intuitive credit risk analysis with a higher accuracy than traditional statistical methods.

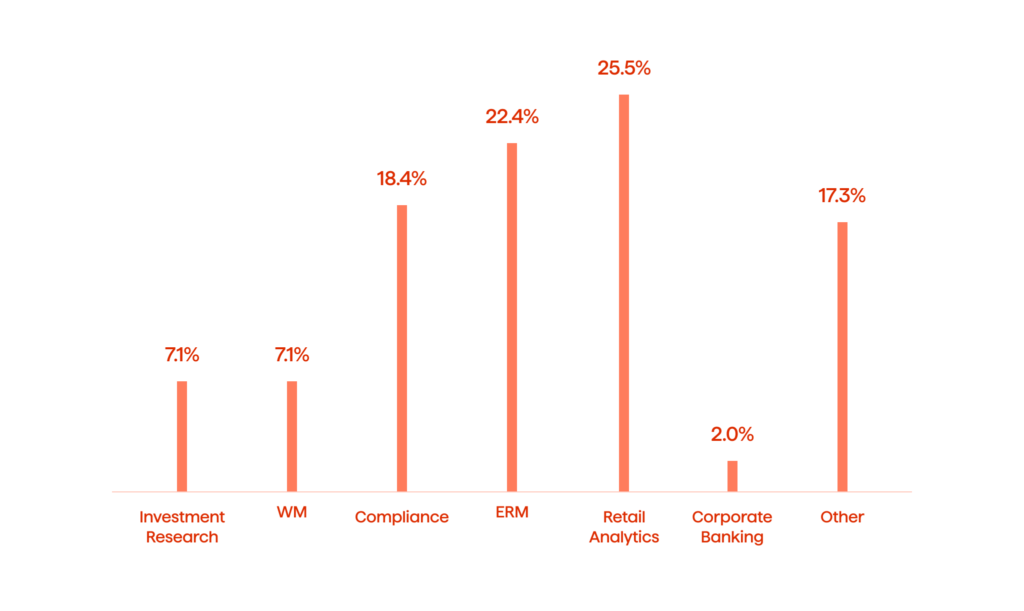

It is worth noting that the list above does not entirely encapsulate the entire adoption areas of AI in banking. There are many more segments in which experts could apply the technology (see Fig. 2).

Such a broad application area shows that AI is already bringing benefits. Further, let’s explore some key areas that are most advantageous to adopting AI. The majority of them directly or indirectly correlate to credit risk management.

Dynamic Risk Assessment

ML models continuously learn from new data, allowing for dynamic risk assessment throughout the loan’s lifecycle. ML can update a borrower’s risk profile by analyzing repayment patterns, economic changes, and emerging risk factors. This dynamic assessment helps banks promptly adjust their risk management strategies, minimize losses, and optimize capital allocation.

Advanced Fraud Detection And Compliance

ML significantly bolsters fraud detection capabilities by identifying complex, non-linear patterns indicative of fraudulent activities. By learning from historical fraud cases and adapting to new tactics, ML models can accurately flag unusual transactions, reducing false positives and improving the customer experience. Moreover, ML can streamline compliance processes by automating the monitoring and reporting activities, ensuring adherence to regulatory standards with greater efficiency.

Automating Credit Risk Reporting

ML can automate the generation of credit risk reports, analyzing vast amounts of data to produce insights on portfolio risk exposure, capital adequacy, and adherence to regulatory requirements. This automation reduces the manual effort required for reporting, allowing risk management teams to focus on strategic decision-making and risk mitigation.

Integrating AI and ML into credit risk management allows banking institutions to harness advanced analytics for more nuanced risk assessment, personalized customer engagement, and efficient operational processes. By leveraging the predictive power and automation capabilities of ML, banks can not only mitigate risks more effectively but also unlock new opportunities for growth and innovation in the competitive financial services landscape.

The Benefits Of Credit AI And ML

AI and ML enable institutions and organizations to work with real-time transactional data. It also provides models that can operate with a wide range of data points. Putting all these factors together, AI and ML offer some notable advantages.

Automated And Personalized Decisions Across A Customer’s Lifecycle

Financial institutions can use AI models across various use cases. This approach adds value by automating several decisions linked to diverse customer journeys. For instance, within the initial stage of the lifecycle, banks can use AI analytics to improve aspects like customer acquisitions, deepening relationships, and intelligent servicing. AI makes a customer’s journey seamless and more appealing for these factors alone.

Better Credit Decisioning

The improved customer lifecycle journey leads to better credit decisioning. McKinsey suggests that AI has a proven positive impact on the credit-approval turnaround time and the percentage of applications approved. Credit decisioning driven by technology can help scale the business while lowering costs at the same time. And this happens through the more accurate identification of riskier customers. It means improving approval rates along with reducing credit risk.

AI-driven credit decisioning is beneficial in three key areas:

- Credit qualification. AI helps analyze a large segment of consumers and accurately determines whether a particular client qualifies for a loan.

- Limit assessment. With AI-based algorithms, institutions can automate determining the maximum borrowing threshold based on several processed factors.

- Pricing. AI-first banks can offer highly competitive rates and adjust pricing according to market shifts.

These benefits ensure accurate credit decisioning. They lower the cost and ensure that banks obtain clients who can repay their loans and are eligible for new loans.

Anticipating Negligence And Fraud Detection

Having a solid anti-fraud system always works in the favor of any given institution or organization. It is a staple of good credit risk management. With credit relationships rapidly moving into digital channels, AI allows for the automated processing of the different aspects of loan applications, credit approvals, and funds reimbursement. However, the more loans a bank can issue means a higher possibility of fraud. At this point, many institutions are integrating AI-based tools that help recognize negligence in its initial stages.

For example, McKinsey offers the example of the company Ping An, as they use an image analytics model to recognize several dozen facial microexpressions of their clients to determine whether the person is being truthful in their loan application. This shows that AI can process various data points to increase the number of clients while decreasing fraud.

Also, ML algorithms are highly effective in detecting fraudulent activities by analyzing transaction patterns and identifying anomalies that may indicate fraud. These systems learn from each transaction, becoming increasingly sophisticated in recognizing potential fraud over time. Enhanced fraud detection capabilities protect the bank and its customers from financial losses and strengthen trust in the institution.

Optimization Of The Collections Process

Sending a debt to collections is among the last things a lender wants to do. This is because third-party fees from various collection agencies absorb any margin almost instantly. Furthermore, clients who receive a collections class won’t return to the lender. The reports show that acquiring a new client’s five times more expensive than keeping an existing one. This also means that optimization of the collection process can decrease customer retention and save companies a lot of money.

With AI-based algorithms, institutions collect data points throughout the customer lifecycle. It presents a clear image of who is most likely to pay back a loan. If an institution receives a red flag, meaning that a customer is falling behind on their payments, some things can be done to get them back on track. For instance, lenders can offer temporary decreasing limits or new payment plans. As a result, banks gain clients who can pay them back, and institutions do not need to invest in looking for new customers.

Regulatory Compliance And Reporting

ML can also assist banks in meeting complex regulatory requirements more efficiently. By automating data analysis and report generation, ML systems ensure compliance with regulatory standards while minimizing the manual effort required. This automation supports more accurate and timely reporting, reducing the risk of penalties and enhancing the bank’s reputation with regulators and the public.

Dynamic Risk Modelling

Unlike traditional models, ML algorithms can dynamically adjust to new information, learning from each interaction and transaction. This adaptability enables banks to refine their risk models continually, ensuring they remain accurate and relevant as market conditions change. Dynamic risk modeling leads to more resilient financial systems capable of withstanding economic fluctuations and evolving risk landscapes.

Customized Financial Products

ML algorithms deeply analyze customer data to understand individual preferences, behaviors, and risk profiles. This analysis allows banks to design customized financial products that meet specific customer needs, improving satisfaction and loyalty. Customization can range from personalized loan terms to tailored insurance products, enhancing customer experience.

Operational Efficiency And Cost Reduction

By automating routine tasks and decision-making processes, ML significantly reduces operational costs and enhances efficiency. Automated credit scoring, risk assessment, and document processing speed up these processes and reduce the likelihood of human error. The efficiency gains from ML can be redirected towards strategic areas, such as customer service and product development, further enhancing a bank’s competitive edge.

AI and ML automate decision-making, fraud detection, and other credit risk management functions. They improve financial institutions’ efficiency, decision-making, and personalization, leading to higher customer satisfaction. As AI and ML advance, they enhance risk management, regulation compliance, and innovation, making banking more secure and customer-centric.

Challenges Of Credit AI And ML

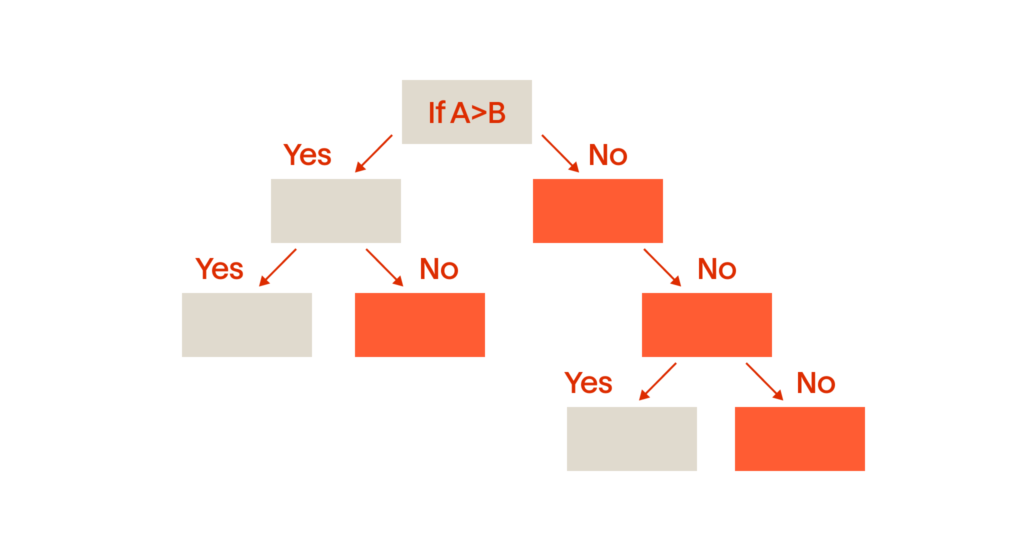

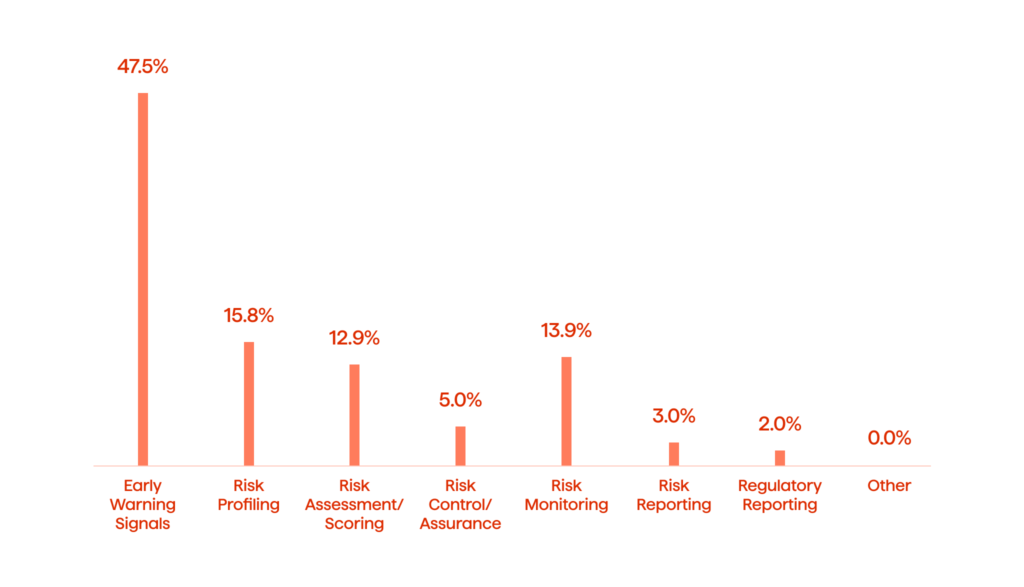

As with any new applications of AI and ML, particular challenges will follow. Yet, to understand how obstacles affect credit risk management, we should examine how banks prioritize their AI applications (see Fig.3).

It shows early warning signals detection and fraud anticipation as the top priority in adopting AI technology in credit risk management. Here are some challenges:

Compliance

Various AI solutions have hidden layers of decision-making, which can profoundly impact the outcome. Companies and institutions working with finance can find it hard to maintain the evidence influencing AI-based decisions when using such aspects as deep learning. Such a case can affect fairness and alignment with a company’s values adversely. The report offered by Deloitte illustrates how AI-based tools increase the “risk appetite” of some financial firms, thus making them forget about their mission and vision.

Luckily, various compliance guidelines exist to avoid the problem. Here is one guideline that explores how to use AI fairly and without harming customers.

Governance

When dealing with AI algorithms, there is the notion of a black box design. In simple terms, the method makes inputs and operations invisible to the users or interested parties. Black box design can lead to biased decision-making without proper AI model governance. The company Deloitte tries to overcome this challenge by improving the degree of transparency involved in the functionality of its AI-based algorithms.

The governance challenge can also correlate to the need for more business support, nonexistent links between business and quants, and ineffective internal methodological approvals. In other words, for AI to be governed properly, a company needs a well-functioning internal system of communication and one that does not include too much bureaucracy and/or hierarchy.

Quality

AI works with data. When there is data, there is always a challenge regarding its quality and credibility. Data obtained from non-credible sources leads to false outputs. False outputs result in bad decision-making. AI applications are designed to learn from the data that experts supply them with. Respectively, when it comes to data and source quality, companies and institutions often need help with problems with data gathering, the lack of appropriate external data, the lack of explainable results, and the lack of results.

Interpretability And Explainability

One of the critical challenges of ML, especially with complex models like deep learning, is the lack of interpretability and explainability. Financial institutions must explain their credit decisioning processes to regulators and customers. However, ML models, known for their “black box” nature, make it difficult to trace how decisions are made. This challenge poses significant issues for compliance, especially under regulations like the General Data Protection Regulation (GDPR), which includes a right to explanation.

Model Bias And Fairness

ML models are only as unbiased as the data they are trained on. Historical data used to train credit risk models may contain biases that lead to unfair or discriminatory outcomes. Addressing these biases is crucial to ensure fairness and prevent reputational damage. Ensuring diversity in training datasets and implementing fairness algorithms are steps toward mitigating this challenge, but they require ongoing attention and refinement.

Data Privacy And Security

The implementation of ML in credit risk management relies heavily on large volumes of personal and financial data. The privacy and security of this data are paramount, given the sensitivity and potential consequences of data breaches. The challenge extends to complying with data protection regulations and implementing robust cybersecurity measures to safeguard against unauthorized access and data theft.

Scalability And Integration

Integrating ML models into existing banking systems poses significant technical challenges. These include ensuring the scalability of solutions to handle large volumes of transactions and data and integrating with legacy systems without disrupting operational continuity. Achieving scalability and seamless integration requires substantial investment in technology infrastructure and expertise.

Continuous Learning And Model Drift

ML models are designed to learn from data continuously. However, this continuous learning process can lead to model drift, where the model’s performance degrades over time as the underlying data distribution changes. Financial institutions must implement monitoring mechanisms to detect model drift and update models regularly, which can be resource-intensive.

Ethical Considerations

The deployment of ML in credit risk management raises ethical considerations, especially regarding transparency, consent, and the potential for algorithmic determinations to affect individuals’ financial well-being. Establishing ethical guidelines and conducting regular ethical reviews of ML practices are essential to address these concerns.

Addressing these challenges requires a balanced approach that leverages the strengths of ML while mitigating its limitations through regulatory compliance, ethical AI practices, and continuous monitoring and improvement of ML models. Institutions must also foster collaboration between data scientists, regulatory experts, and ethicists to ensure ML applications in credit risk management are both effective and responsible.

In considering the obstacles presented by AI and ML in credit risk management, it’s evident that these technologies, while transformative, are not without their complexities. Compliance, governance, data quality, interpretability, and fairness are significant hurdles that require careful navigation.

Despite these challenges, numerous real-world examples of institutions have successfully harnessed the power of AI and ML to enhance their credit risk strategies. By addressing these challenges head-on, companies can unlock the full potential of AI and ML, transforming challenges into opportunities for innovation and improved decision-making in credit risk management.

Examples Of Early AI And Potential ML Adoptions In Credit Risk Management

The U.S.-based FinTech startup ZestFinance showed tangible results in adopting AI for credit risk optimization. The company used the technology to reduce losses and default rates by 20%.

Bank of England applied AI in credit risk management, specifically in pricing and underwriting insurance policies. The leaders within the institution imply that AI algorithms illustrate a level of sophistication that cannot be matched by traditional models.

Another American multinational investment management corporation, BlackRock, used AI to evaluate liquidity risks. The firm’s asset managers fed the AI algorithms with internal data and were able to calculate the price tag of cost liquidating accurately. In turn, it granted higher returns and lower risk.

Hypothetical ML-Based Scenarios

Exploring the potential of Machine Learning (ML) in the financial sector, we can imagine several innovative applications:

- Predictive Analytics for Credit Scoring. A leading global bank implements ML models to enhance its credit scoring system, integrating non-traditional data sources such as mobile phone usage, rent payment history, and social media activity. This approach allows for a more nuanced assessment of borrowers’ creditworthiness, especially benefiting those with thin credit files.

- Dynamic Pricing Models. An innovative FinTech startup develops an ML-driven dynamic pricing model for loan interest rates. By analyzing real-time market data, borrower creditworthiness, and economic indicators, the model adjusts interest rates dynamically to manage risk more effectively and compete in the market.

- Automated Risk Monitoring Systems. A multinational investment firm employs ML algorithms to monitor its credit portfolio in real-time, detecting early signs of default among borrowers. The system uses a combination of transactional data analysis and behavioral patterns to flag at-risk accounts for preemptive action.

- Fraud Detection in Credit Applications. A leading credit card company integrates advanced ML models to detect and prevent fraud in credit applications. The models analyze application data against historical fraud patterns, reducing false positives and identifying sophisticated fraud attempts.

These examples highlight the transformative impact of AI and ML in credit risk management, showcasing how they can optimize operations, reduce risks, and enhance decision-making. From ZestFinance’s reduction in losses to BlackRock’s precise liquidity risk evaluation, the successes illustrate the powerful capabilities of these technologies. As more firms adopt, AI and ML, we expect even greater advancements in managing credit risk, leading to more accurate, efficient, and secure financial practices.

What’s Next To Follow?

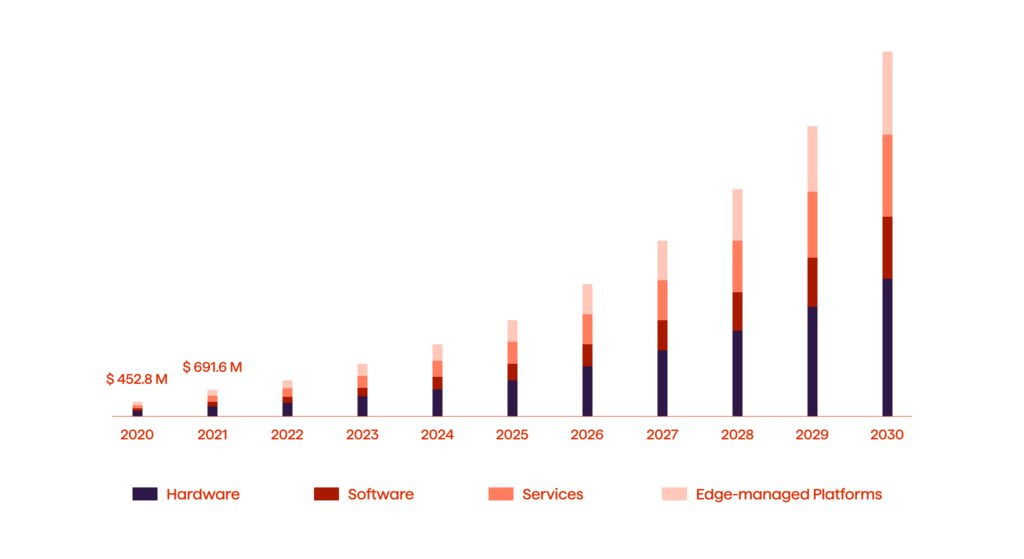

The most likely path for AI and ML is to be coupled with edge capabilities. Essentially, edge computing uses the power of in-device computing to offer deep insights and predictive analytics in near-real-time. The edge computing market is booming (see Fig. 4).

A comprehensive research report offered by Market Research Future (MRFR) anticipates the edge computing market to reach $168.59 billion by 2030. In 2023, the market stood at about $17 billion. The reason for such a boost in edge capabilities stems from the tools it offers:

- Voice recognition

- NLP and voice analytics

- Computer vision

- Facial recognition

These tools offer a foundation for AI- and ML-based algorithms. They serve as mediums for data collection and ensure that AI has enough data points to process. With an ever-increasing number of people having mobile devices, companies receive an almost unlimited stream of data that can improve customer lifecycle journeys. Yet, when further coupling edge capabilities, companies and institutions should always comply with the rules of data security and the laws regarding information protection.

Wrapping Up

AI, which has been a transformative force for over half a century, was first introduced in 1956, marking the beginning of its journey in revolutionizing various industries. Similarly, although closely intertwined with AI, the concept of Machine Learning (ML) officially came into the limelight in 1959 when Arthur Samuel described it as the ability of computers to learn without being explicitly programmed.

AI and ML have evolved from theoretical concepts to practical tools with widespread applications, including credit risk management and beyond. Today, the potential and application of AI and ML are universally recognized, enabling global-scale innovations. The adoption of these technologies extends far beyond banking and credit risk management, promising endless possibilities for those who leverage them.

Embracing AI and ML now offers businesses a crucial early mover advantage, ensuring competitiveness in FinTech and other sectors. The question is not if companies can afford to adopt AI and ML, but if can they afford not to.

For more insights into the future of banking and how AI and ML are shaping the industry or to explore how Avenga can assist in your digital transformation journey, please contact us. Let’s harness the potential of these transformative technologies together.