Discover our research, insights, and client successes to help you navigate change and accelerate value creation

Featured Insights

How Is Manufacturing on Data-Rich Platforms Different?

Featured Insights

Press Release

Featured Insights

How to Generate Value with Data Monetization in Telecom

Featured Insights

The Evolution of Quality Assurance: How AI is Changing the Testing Game

Featured Insights

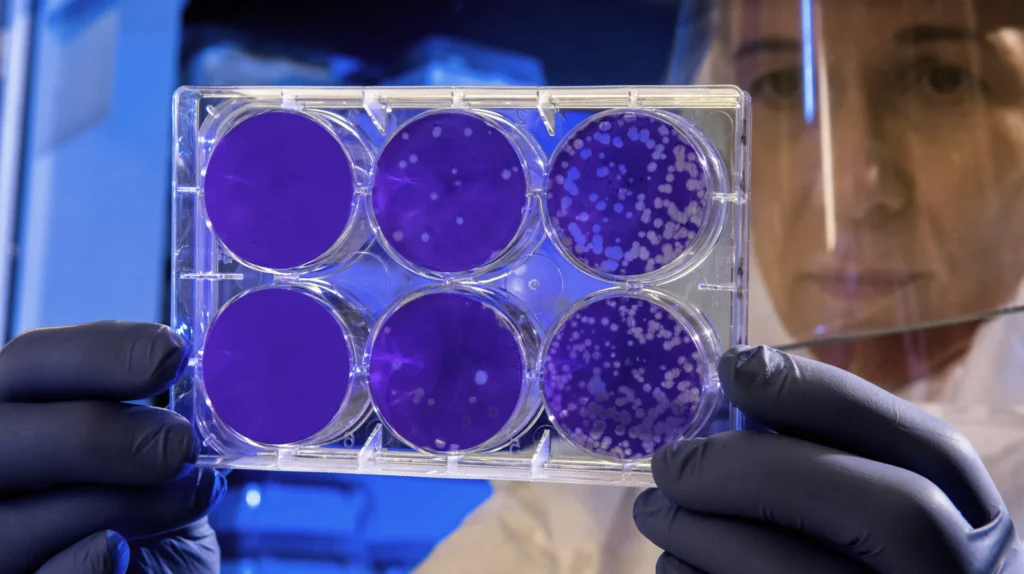

The Importance of Efficient Data Governance in Clinical Trials

Featured Insights

Press Release

Featured Insights

The Future of OSS/BSS in the Modern Telco Space

Featured Insights

Press release

Featured Insights

Microsoft Power Automate: How To Use Cloud Flows for Process Automation

Featured Insights

What Is Azure Key Vault? A Beginner’s Guide and Use Cases

Featured Insights

Generic API or Back-End for Front-End? You Can Have Both

Featured Insights

Machine Learning Research Problems

Featured Insights

Satellite Technology In 2025 And Beyond: The Future of GEO – Avenga

Featured Insights

Manufacturing Trends to Run 2025: A Practical Overview

Featured Insights

Machine Learning Vs Traditional Programming

Featured Insights

Logging Exceptions in Salesforce

Featured Insights

New Intranet Solutions In The Microsoft 365 Ecosystem