Telecom API Market: The Whys and Hows

July 31, 2025 11 min read

The telecom industry is undergoing a major transformation, driven by the rapid evolution of network APIs. Once rigid and inflexible, these APIs are now forming the foundation of programmable, service-rich environments. As operators modernize and re-architect their networks, they are exposing previously locked-down capabilities through robust, accessible APIs. Many of these advanced APIs are being made available to developers, platforms, and enterprises—not just for backend integration, but as strategic tools to enhance network agility, monetize new services, and drive innovation across verticals. For instance, telecom APIs now support 5G signaling slicing to facilitate secure user authentication. Quietly but powerfully, these APIs are redefining how digital services are delivered.

In this article, we will cover the why and how of this API evolution: new business opportunities, monetization opportunities, and the technical evolution.

What Are Telecom APIs and Why Do They Matter?

Telecom application programming interfaces (APIs) enable third-party developers, platforms, and enterprises to programmatically access telecom network services using standardized protocols and tools. Unlike manual configurations or closed systems, APIs offer a consistent, secure, and efficient way to interact with core telecom features such as voice, messaging, location, data usage, authentication, billing, and network management. These services are exposed via REST or SOAP-based interfaces, allowing for scalable and secure integration with external applications. For instance, a messaging API can let a ride-hailing app send SMS notifications to customers through a telecom operator’s backend—without requiring direct access to the telecom infrastructure. Typically, APIs are managed behind an API gateway, which handles authentication, rate limiting, logging, and other security functions to protect and control network exposure.

From a technological standpoint, most telecom APIs interface directly with existing BSS (Business Support Systems) and OSS (Operational Support Systems). These systems bridge traditional telecom functions—such as provisioning, charging, and monitoring—with modern digital interfaces for developers. For instance, an API might authenticate a user via a subscriber database, trigger an action within the service orchestration layer, or interact with a virtualized network function through service exposure features, as defined in 5G core architectures. In short, APIs make telecom networks programmable, accessible, and ultimately monetizable. As digital transformation accelerates across industries, these APIs enable telecom providers to evolve into platform-based businesses, offering their capabilities flexibly and on demand to enterprises, developers, and partners. This paradigm shift fuels the rise of Network-as-a-Service models and opens entirely new avenues for B2B revenue generation.

The Evolution Toward Network-As-A-Service (Naas)

The move to Network-as-a-Service (NaaS) is a change in the underlying construct of how telcos function and what the telco and the digital economy can do for each other. To truly appreciate what this change means, it’s vital to understand the difference between the past telecom operational models and the programmable network architecture in use today.

From Static Infrastructure to Programmable Network Capabilities

In the traditional telecom model, telecom operator networks were vertically integrated systems. Every layer from the physical infrastructure to the business logic was totally owned, locked down, and maintained internally. Everything required manual intervention to provision new services, deploy updates, or onboard new partners. APIs, if available at all, were used internally or for very basic external functions, such as WebRTC-type APIs for handling VoIP and/or video in isolated applications. With the rollout of 5G networks, SDN (Software-Defined Networking) and NFV (Network Function Virtualization), the network at the underlying layers is now controlled by software and implemented as components. This has begun to open opportunities to expose core network capabilities such as latency control, location services, QoS, authentication, slicing, and policy control through advanced APIs. This enables external platforms and developers or enterprises to consume network services dynamically and contextually, effectively creating a network-as-a-product or application-aware digital product of telecommunications services.

| Legacy Telco Model | NaaS Model | |

| Service Provisioning | Manual, static, hardware-based | Real-time, programmable via APIs |

| API Exposure | Limited to basic functions (e.g., messaging, WebRTC APIs) | Deep network control (e.g., slicing, QoS, policy control) |

| Infrastructure | Proprietary, tightly coupled | Software-defined, virtualized, cloud-native |

| Customer Base | Primarily consumer-facing | Strong B2B orientation (enterprises, developers, platforms) |

| Revenue Model | Connectivity as a commodity | Monetized network services, tiered API pricing |

| Partner Ecosystem | Closed partnerships | Open, API-driven ecosystems |

| Network Innovation Speed | Slow (hardware-dependent release cycles) | Fast (agile deployments, CI/CD, programmable APIs) |

Enabling an Ecosystem of Network Applications

The NaaS model provides telecom companies with the ability to be digital enablers for a much wider ecosystem of B2B use cases. With this model, enterprises operating across manufacturing, logistics, fintech, healthcare, and other verticals can seamlessly embed telco-grade connectivity into their workflows using APIs—an almost impossible feat under legacy models. Take, for example, a logistics platform that serves an autonomous fleet of delivery vehicles. Rather than depending on generalized mobile data plans, the platform can use NaaS to request dedicated low-latency network slices in designated geographic areas, integrate real-time tracking enabled by location APIs, and prioritize latency and packet delivery —all automatically and programmatically. These types of networked applications are highly context-aware, and their orchestration requires no more than a series of secure API calls. Plus, this enables telcos to accelerate market share opportunities as the NaaS model pushes them into domains previously dominated by hyperscalers and cloud-native startups. With APIs acting as a bridge between the telecom layer and enterprise applications, telcos can tap into high-growth digital service markets, rather than operating as a connectivity-only vendor.

Naas in the Age of 5G and Cloud Convergence

The advancement of 5G networks and the rise of edge computing are driving unprecedented demand for programmable, location-aware, and latency-sensitive services. Network-as-a-Service (NaaS) provides the architecture to meet this demand—not by scaling physical infrastructure, but by scaling access to network capabilities. Thanks to standardization efforts such as CAMARA and TM Forum’s Open APIs, the industry is moving toward interoperability among telcos, enabling developers to “build once and deploy everywhere.” This shift fundamentally redefines the role of the global network, transforming it from a monolithic operator model into an agile platform provider. However, this evolution requires more than just technical upgrades—it also demands cultural change, new revenue models, and a shift in organizational mindset.

Telecom API Market Statistics

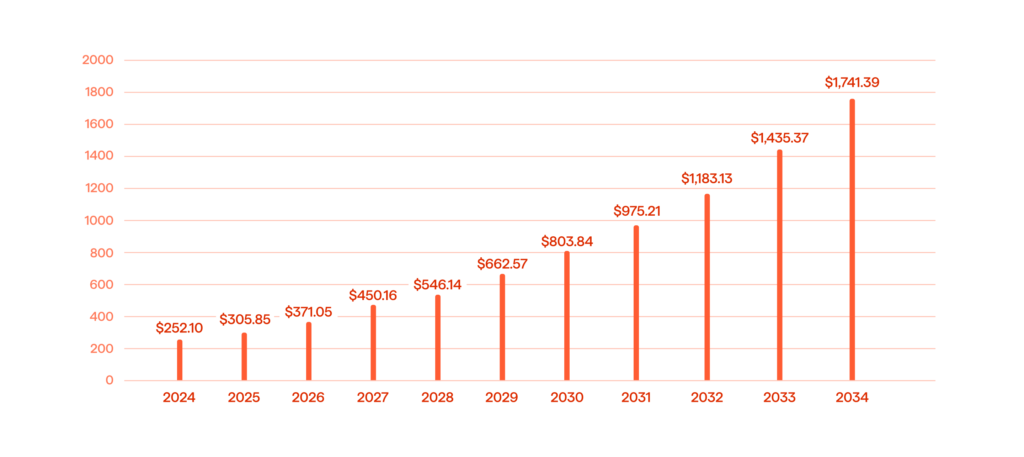

At a compound annual growth rate (CAGR) of 14.05%, the telecom API market is projected to reach USD 688.46 billion by 2030 from its anticipated USD 356.78 billion in 2025.

- There are a lot of prospects for telecom API integration because, according to Ericsson, there were over 6.7 billion smartphone mobile network subscriptions worldwide in 2023 and are expected to surpass 7.7 billion by 2028.

- It is also anticipated that the growing use of machine-to-machine (M2M) devices will drive the telecom API market between 2023 and 2030.

- The size of the Asia Pacific telecom API market was estimated at USD 78.15 billion in 2024 and is expected to grow at a compound annual growth rate (CAGR) of 21.51% from 2025 to 2034, reaching around USD 548.54 billion.

- With a 36% market share in 2024, the messaging (API) section made the biggest contribution.

- In the next five to seven years, the network API industry is expected to generate between $100 billion and $300 billion in income for operators related to connectivity and edge computing, in addition to an extra $10 billion to $30 billion from APIs.

Monetizing Telecom APIs: Models and Strategies

Monetizing telecom APIs goes far beyond simply offering developers a list of endpoints. A successful monetization strategy requires deliberate alignment with the telco’s broader business objectives, market demands, and product lifecycle considerations. As telecoms shift from commoditized connectivity to delivering digital services, API monetization emerges as a pivotal opportunity—especially within the B2B space.

- Direct monetization models

In a direct monetization model, the providers earn revenue directly from API use; generally, the following approaches are used:

- Pay-per-use pricing. Customers pay based upon volume of use – per message/call/geo-location ping, etc. Pay-per-use pricing works well for high-volume transactional APIs, such as SMS, voice, or geo-location.

- Subscription pricing. Enterprises and/or developers pay the provider a recurring fee for access to a bundle of API connections with a cap on their usage or tiered service levels. Subscription pricing would work well in the case of predictable B2B processes or SaaS integration.

- Tiered pricing models. Provide customers with a free (or low-cost) basic tier (limited usage or features), and then offer more expensive tiered pricing models offering increased access, support, or Service Level Agreement guarantees, etc.

- Revenue-share pricing model. APIs that combine into a third-party platform (e.g., CPaaS or SaaS) can be considered revenue-share based on transactions or customer acquisition using the API.

These direct approaches make API usage predictable and scalable for enterprise customers while allowing telcos to price their API usage with respect to real-world value.

2. Indirect monetization methods

In some cases, APIs may not generate revenue directly, but may still enable value generation more broadly. There are some examples to consider:

- Service bundling. APIs are bundled with connectivity services or edge computing solutions to provide a point of differentiation, lock-in, and stickiness to customers in competitive verticals.

- Platform stickiness. APIs can be offered that link into enterprise systems (e.g., CRM, ERP, IoT) that increase customers’ adoption of telco networks and IT services.

- Data enrichment. APIs can be a way for telcos to harvest anonymized, consent-based data, based on enterprise interactions, and feed it back into their analytics and AI solutions when providing insights that will be sold.

- Speed to market. API-first design internally can shorten a telco’s time-to-market for its services, giving telcos a competitive advantage when they need to roll out new offerings or white label an entailed solution for external partners.

3. API marketplaces and partner ecosystems

Ecosystem-driven distribution is one of the most promising monetization strategies. Telecoms are increasingly publishing their APIs via open or curated API marketplaces, allowing third-party developers, start-ups, and enterprises to investigate and leverage the telco’s capabilities without the complexities of onboarding.

Benefits of marketplace strategies include:

- Extended reach without needing individual enterprise contracts

- Ecosystem network effects: the more developers that use your APIs, the more services and integrations will grow

- Standardized onboarding, tracking usage, and billing through gateway platforms

Efforts like CAMARA (a joint effort of GSMA and the Linux Foundation) and TM Forum’s Open APIs are working to accelerate this model by fostering API interoperability across operators’ telecom networks. The hope is that developers will be able to build applications once and deploy across multiple telcos with very little friction.

4. Strategic positioning and value layering

With the growing number of developments in the telecom API market, operators are refocusing on monetizing these capabilities toward value-based monetization. Complex APIs with high business value, e.g., ultra-low-latency QoS for industrial automation, or low-latency location verification for Fintech, can directly capture more premium rates based on their contextual impact (vs. volume of use). Value-based monetization approaches require product/sales/technical team alignment to market APIs as value-added strategic business enablers rather than basic services.

Securing the Global Telecom API Venture

To achieve global telecom API success for the telecom industry, security is of utmost importance as APIs become the basis for forming programmable networks. Exposing network capabilities means there will be a larger attack surface, so making security as rigorous as possible will be crucial. Telcos will need to use strong authentication, an API gateway, limit API calls (rate limiting), and encrypt traffic to limit exposure to networks and customer data. Regulatory compliance, such as GDPR and the “lawful interception” requirements, will add another layer of complexity, more so concerning the cross-border consumption of APIs. APIs support sensitive use cases, such as identity verification and billing; therefore, pushing security to the back of the line is not an option. To ensure interoperability without sacrificing trust, telcos are also aligning on global security policies with the aid of standardization initiatives like CAMARA.

A Programmable Future, Powered by APIs

As the world’s largest telecom operators look to implement API-first strategies, the telecom space appears to be entering a new phase of agility and innovation. APIs empower telcos, allowing them to deliver real-time services, on-demand infrastructure, and smarter customer experiences. While API vulnerabilities remain a concern, we see more robust security frameworks, and acting collectively to address risk can help mitigate the issues. Markets continue to grow as B2B requirements evolve, making APIs indispensable rather than nice to have. The telcos that will win won’t be the ones with the largest pipes, but rather those that can turn their network assets into platforms others can build upon.

Want to learn more about the APIs in the telecom industry and how to dominate the market? Contact Avenga, an expert in advanced network capabilities.