Automotive Industry Trends 2025: Shifting Gears Toward Innovation

April 29, 2025 11 min read

The automotive industry is gearing up for a transformation as fast and furious as the iconic franchise suggests. The latest technological advancements and evolving consumer preferences are seriously revamping vehicle production as we know it, remodeling the auto market for good. A quick online search reveals that by 2040, 33 million autonomous cars are expected to be on the road. Meanwhile, data shows that by 2025 and 2040, EVs will make up 10% and 58% of all new automobile sales, respectively, meaning that the “good old” internal combustion engines may slowly but steadily sink into oblivion.

What other trends can drivers and pedestrians expect to see in the coming years? Will autonomous vehicles dominate the roads? What other technologies will shape the future of automotive manufacturing? Let’s embark on this journey together, where ‘driving the future’ is more than just empty rhetoric.

Electric Vehicles Among the Frontrunners of Change

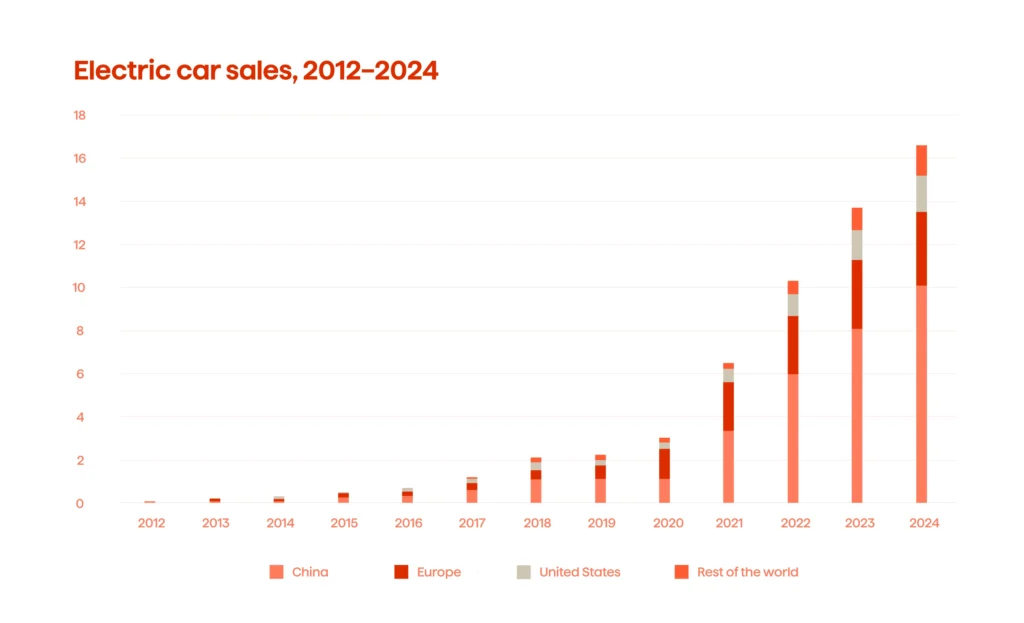

The electric vehicle revolution is already here and will continue to accelerate. What initially appeared to be a niche sector is now the foundation of the auto industry’s transition. While automakers spend billions developing electric cars, most governments worldwide have ambitious plans to phase out internal combustion engines. According to Statista’s report, global sales of electric vehicles are expected to reach an astounding US$786.2 billion by the end of 2024.

Notably, China, Europe, and the US have established themselves as the leading EV markets, with other countries following suit. Norway set a record in the electric vehicle sector in August 2024, as the number of all-electric vehicles on the road surpassed that of gasoline-powered vehicles for the first time. In terms of new car sales, Norway boasts the highest percentage of battery-electric vehicles in Europe. It also leads Europe in new EV market activity, with just 9.61 percent of new passenger car sales in 2023 attributed to gasoline, diesel, and non-rechargeable hybrid vehicles.

So, why are electric cars becoming so popular? Consumers are embracing EVs for their promise of cleaner air, lower operating costs, and, most importantly, an exceptional driving experience. Long-standing concerns about range anxiety are being allayed by advancements in battery technology, which also allows for more extended range and faster charging periods. The 2020 Tesla Model S Long Range Plus has one of the most durable EV batteries: it can go up to 400 miles on a single charge. While factors like weather conditions, climate control usage, battery health, driving style, and terrain can affect battery life, these challenges can be managed and mitigated with proper care and ongoing technological improvements.

Furthermore, the need for EV charging stations is no longer a challenge to the electric vehicle market. While it’s true that at the end of 2023, there wasn’t an adequate supply of electric mobility hubs, the charging infrastructure in Europe has improved drastically. Currently, there are about 750,000 public charging stations with a combined 28.7 GW of charging capacity. In the U.S., however, there are only about 73,215 public EV charging stations, and although this number may seem insufficient, about 60% of all Americans have garages that allow their electric vehicle charging.

Market leaders are adjusting their strategies to align with current trends, further emphasizing the shift towards EV-only vehicles. Just days ago, Jaguar unveiled their new concept car, the Jaguar Type 00, a fully electric, futuristic vehicle that marks a departure from every other car the brand has produced. While Rawdon Glover, the managing director of Jaguar, has stated that the new vehicle will not enter production for public sale, the company’s rebranding and decision to become an electric-only brand underscore shifting consumer preferences that are shaping the future of the automotive industry. This transformation is also expected to help revive sluggish vehicle sales by 2030.

Autonomous Driving: The Road to a Self-Driving Future

The foundation of autonomous vehicle architecture lies in a set of sensors, including LiDAR, radar, and ultrasonic systems, providing cars with a 360-degree panoramic view. These sensors measure distances, identify obstructions, and capture crucial traffic and road condition data. When paired with high-resolution cameras, these tools allow self-driving cars to identify objects, lane markers, and even pedestrians with unprecedented precision.

The SAE, originally the Society of Automotive Engineers, has identified six levels of automation on the path to completely autonomous vehicles. The scale established by these six stages is essential for comprehending and characterizing self-driving technologies, which span from complete human driving to complete vehicle autonomy.

- Level 0 (No Automation): There is no automation, and the driver has complete control over the car. However, basic warning systems, such as emergency braking or lane departure warning, can be included in vehicles to assist the driver.

- Level 1 (Driver Assistance): At this level, the human driver maintains constant control of the vehicle while basic automation, such as adaptive cruise control or lane-keeping aid, involves steering or acceleration/braking.

- Level 2 (Partial Automation): Under certain conditions, the car can simultaneously control the steering and brakes/acceleration. GM’s Super Cruise and Tesla’s Autopilot are two examples. While these systems can handle major aspects of driving, the driver must remain alert and ready to take control at any time.

- Level 3 (Conditional Automation): The vehicle can assume complete control over driving under certain conditions, such as in low-speed traffic jams or on the highway. However, the human driver must take control in situations where the system cannot handle the circumstances. The Audi Traffic Jam Pilot is an example of Level 3 automation, operating within narrow conditions.

- Level 4 (High Automation): At this stage, cars can drive themselves inside a geofenced area with mapped infrastructure, such as an urban center. Even though they can manage most driving situations without human assistance, they still have limits in some situations, such as negotiating unfamiliar terrain or inclement weather, and must be controlled by humans.

- Level 5 (Complete Automation): The “Holy Grail” — the ultimate self-driving autonomous vehicle — will function without human assistance in all conditions. It belongs to a class of autonomous cars with no manual control features, such as steering or pedals, and goes into a completely new stage of mobility.

According to McKinsey research, Advanced Driver-Assistance Systems [ADAS] and Autonomous Driving (AD) technologies could generate between $300 billion and $400 billion in the passenger automobile market by 2035, driven by customer interest in features associated with autonomous capabilities and the commercial solutions currently available on the market. These technologies redefine the vehicle market because car buyers seek new driving experiences, even if it means shifting the driving responsibility to a car and becoming a passive passenger, trusting technology to navigate, react, and ensure safety on the road.

AI to Impact All of the Automotive Trends

AI is driving the top automotive trends globally. From supply chain optimization and manufacturing to personalized driving experiences and smart routing, advanced AI systems and real-time data analysis enable it all. By 2027, the global automotive AI market is expected to grow from its 2022 valuation of USD 2.3 billion to USD 7.0 billion, with a compound annual growth rate (CAGR) of 24.1%.

Autonomous driving technologies like AD and ADAS are only possible to implement with the adoption of AI. Driver assistance technology, in particular, can go as far as detecting driver fatigue by monitoring their eyes and taking measures to avoid car accidents. The systems that come together to implement such technologies are sensor fusion, computer vision, and real-time decisions to enable the vehicle to take all complex traffic scenarios easily. Significant investments in AI and Internet of Things (IoT) devices are crucial for fine-tuning self-driving algorithms, making them safer and more reliable. This also presents an emerging opportunity to connect the vehicle ecosystem, creating a dynamic adaptation of data for road and weather conditions, assisted by IoT-enabled devices.

The AI systems also learn about the driver’s preferences in music and temperature, making the driving experiences as enjoyable as possible. Many auto manufacturers are considering integrating in-car payments to ease refueling, paying for parking or tolls, and even grocery shopping. Customers will soon be able to purchase cars that are fully adaptable to their specific needs and seamlessly communicate with other software systems, such as smart home devices, traffic management networks, and personal digital assistants.

Software-Defined Vehicles: Cars as the Ultimate Connected Devices

Since we’ve already explored the use of AI in the auto industry, it makes perfect sense to discuss connected cars, which are undoubtedly one of the top trends for the future. Connected cars are equipped with cutting-edge technology that allows them to connect to the Internet, other vehicles, and external software. These cars offer numerous benefits, not just for drivers and manufacturers, but also for passengers and the environment. By optimizing driving routes, connected cars help reduce emissions, contributing to a greener future. Using data from IoT technology, drivers receive real-time route suggestions to avoid traffic jams and ease congestion, ensuring faster, stress-free travel.

And let’s not forget the entertainment opportunities! Long journeys are no longer exhausting and tedious, as everyone on board can watch movies, stream their favorite music, and play games through pre-loaded entertainment services. These cars even come equipped with Wi-Fi hotspots, ensuring easy Internet access for all passengers.

However, the primary function of these cars is not just to entertain they can connect to other vehicles (V2V), pedestrians (V2P), infrastructure (V2I), and cloud (V2C). Lastly, there’s even a term “vehicle-to-everything” (V2X), which includes all types of vehicle communication. This infrastructure ensures the safety of drivers and passengers and can even send emergency SOS messages to respective services in case of an accident, sharing all the critical information. Connectivity also enables remote diagnostics, alerts the driver about necessary maintenance, and promotes both safety and cost-efficiency.

Semiconductors: The Backbone of the Automotive Revolution

Semiconductor chips are at the heart of almost every automotive trend, from connected technologies to autonomous driving and EVs. Advanced systems that power, control, and optimize automobiles are increasingly being built around tiny chips. Semiconductors ensure energy efficiency, consistent power distribution, and power the battery systems in EVs. They also enable software updates, enhance entertainment, and facilitate smooth communication in connected and software-defined vehicles.

In short, semiconductor chip shortage would impact the current car market to an unprecedented degree because they are crucial for the following:

- Power Management: ensuring efficient energy usage in EVs and hybrids.

- Real-Time Processing: enabling autonomous systems to navigate and make decisions.

- Connectivity: supporting vehicle-to-everything (V2X) communication for smart cities.

- Safety Features: supplying energy to ADAS systems such as lane-keeping and collision avoidance.

- Infotainment: enabling high-performance entertainment and navigation systems.

The global automotive semiconductor market is expected to grow at a rate of 8.1% between 2023 and 2030. This growth is driven by the increasing adoption of electronic control units (ECUs) in modern vehicles and the rising implementation of advanced safety systems. Semiconductors are, in essence, at the heart of modern car manufacturing, reshaping our understanding of mobility.

Automotive’s 2025: Gearing Up for a Sustainable and Intelligent Future

The hosts of the iconic Top Gear, Richard Hammond, Jeremy Clarkson, and James May, have never hidden their resentment towards modern cars. “I just like the sound of the V8”, Clarkson, a man who lives and breathes cars, famously quipped. And, in some ways, he may be right: modern cars tend to look overly futuristic and even bizarre. You don’t have to go too far — take, for example, the Tesla Cyber Truck. While it has its fans (Tesla sold 17,000 of them in the third quarter of 2024), it looks and feels nothing like the cars of the past. Some car manufacturers, though, challenge this perspective. Hyundai has recently released its N Vision 74 concept, which looks like a modern sports car, promising to “open a new chapter of driving fun”.

Like it or hate it, change is inevitable. AI, automation, and an ‘electric-first’ mindset are impacting every industry, and automotive is no exception. The global market is undergoing a revolution, and we are a part of it.

Contact Avenga today to learn more about what industry experts have to say about these trends.