What Is Retail Media & Retail Media Networks (RMNs)?

October 1, 2025 10 min read

Technological advancements in the advertising and marketing industries, changes in consumer behavior, and the need for retailers to increase revenue has given rise to retail media.

In this article, we examine retail media in more detail, provide examples, and discuss the retail media network (RMN) environment.

Key Points

- Retail media involves brands showing advertisements across a retailer or e-commerce company’s properties.

- According to the forecasts by the consulting agency BGC, companies will increase their ad spending in the retail media space to US$100 billion by 2026.

- Commerce media is an extension of retail media as it allows both retailers and their brand partners to reach audiences across the open web, not just on a retailer’s digital properties.

- Retail media ads can also come in many forms, with the main ones being sponsored products, onsite advertising, and offsite advertising.

- A retail media network (RMN) is essentially an advertising technology (AdTech) platform that’s owned and/or operated by a retailer.

What Is Retail Media?

Retail media involves brands showing advertisements across a retailer or e-commerce company’s properties. Typically, you can associate this with ads on a retailer’s website, mobile app, and marketplace, but other examples include CTV, audio services, DOOH, and email list. It is similar to traditional display and search advertising but with a focus on retail and e-commerce products and services.

The retail media environment is constantly expanding. According to the forecasts by BGC, companies will increase their ad spending in the retail media space to US$100 billion by 2026.

The driving force for retail media networks is e-commerce. The concept of e-commerce includes not only online stores, but all e-transactions, e.g., auctions, currency trading, e-banking, travel industry services, etc.

Each of these industries can use retail media to find customers and show them ads for their products or services.

What’s the Difference Between Retail Media, Commerce Media and Ecommerce?

The terms retail media, commerce media, and e-commerce all refer to the same thing—commerce, with the differences being in how it is carried out.

Retail media: Retail media involves a brand displaying ads for their products and services on a retailer’s websites, apps and platforms. Advertisements are shown to consumers to build brand awareness and influence the customer at the point of purchase. Retail media allows retailers to monetize their first-party data and audiences and create a new revenue stream.

Commerce media: Commerce media is an extension of retail media as it allows both retailers and their brand partners to reach audiences across the open web, not just on a retailer’s digital properties. The idea here is to make it possible for advertisers to reach their target audience using their and their retailer partner’s first-party data across different websites and apps. This allows brands to communicate with their target audience along the entire purchase path by showing them relevant and personalized ads.

E-commerce: E-commerce sites are where customers conduct online transactions. They can also utilize retail and commerce media to show ads on their digital properties and across other websites.

What Are Examples of Retail Media Advertising?

Retail media advertising centers around a brand showing ads for its products or services on a retailer’s website. A classic example would be Samsung advertising its new TVs on Walmart’s website. While this may sound very similar to traditional display advertising, the key difference is the place (i.e. a retailer’s website) and the fact that a brand will often utilize a retailer’s first-party data to power ad targeting.

Retail media ads can also come in many forms, with the main ones being:

Sponsored products: A brand’s products or services displayed on a retailer’s search results page.

Onsite advertising: A brand’s products or services shown as displayed ads on a retailer’s website.

Offsite advertising: A brand’s products or services displayed as ads on a different website (e.g. not the retailer’s) using a retailer’s first-party data.

Where Did Retail Media Come From?

Retail media can be seen as a digital version of retail advertising where ads for products are displayed in stores and close to points of purchase. With retail advertising, brands would utilize A-boards, in-store ads, loyalty cards, coupons, samples, etc. as a way of driving up sales.

In addition to in-store advertising, retailers also had advertising in traditional media channels at their disposal: newspapers, television, radio and out-of-home (OOH) advertising.

The ability to reach customers was limited to the reach provided by these traditional advertising channels. Reviewing whether advertising was a success or a failure was difficult and expensive.

Everything changed in 1994, when the telecommunications company AT&T displayed the first Internet ad on HotWired.com, which represented the beginning of digital advertising.

The development of advertising technologies has given retailers the opportunity to reach new customers and create new sources of revenue.

Today, retailers and e-commerce companies can use online media to advertise their products and services.

What Is a Retail Media Network (RMN)?

A retail media network (RMN) is essentially an advertising technology (AdTech) platform that’s owned and/or operated by a retailer. A retail media network gathers inventory across a retailer’s websites, ecommerce platforms and mobile apps and offers it to brands. The RMN would also utilize the retailer’s first-party data to allow brands to show personalized ads to their target audience.

The brands could also use their own first-party data and match it with a retailer’s first-party data, e.g. via a data clean room, to improve ad targeting, measurement and attribution.

It is widely recognized that the first platform that brought retailers together was Amazon. It is a modern marketplace where users can browse countless products and services, save them to their shopping carts and buy them at a convenient time from any device.

Amazon sells its advertising space to retailers via its Amazon Advertising retail media network. The new business model caught on quickly and other retailers have started to copy it.

Retail media networks have emerged to create new revenue streams with advertising to make up for low and fixed margins on products and services.

Here are a few examples of retail media networks that allow brands to advertise on the retailer’s website and mobile apps:

- Walmart Connect — Walmart launched its RMN, increasing revenue by approximately 26% in 2021.

- Walgreens Advertising Group — A RMN offering access to over-the-top (OTT), CTV and linear TV audiences.

- Instacart Advertising — Instacart focuses on fast-moving consumer goods (FMCG) using its own data. Instacart’s active user base is approximately 9.6 million people.

- eBay Ads — a platform created by eBay where advertisers can reach their customers from a base of approximately 135 million active users.

Retailers with a wide and active user base have a good opportunity to create their own retail media networks.

They can build a new revenue stream by leveraging their existing business model and audiences, the potential of AdTech and the scale provided by the Internet.

Why Are Retailers Building Their Own Retail Media Networks?

Over the years, we’ve seen a massive increase in the number of retailers building their own retail media networks, from traditional brick-and-mortar retailers like Walmart to digital-only e-commerce companies like eBay.

Retailers have opted to build their own retail media networks for several reasons:

- E-commerce development — ecommerce has been gaining popularity since the outbreak of the COVID-19 pandemic as consumers appreciated its convenience, with many businesses having to move online because of lockdowns. Building a RMN allows retailers to take advantage of this trend.

- Preparing for the event of end of third-party cookies — retail media networks allow brands to reach potential customers with personalized advertising by using a retailer’s, and their own, first-party data for ad targeting.

- Closed-loop measurement — retailers can measure the performance of ad campaigns using their first-party data and their retail media network.

As user privacy becomes more and more important, brands will look for solutions that allow them to use first-party data to identify and target their target audience in a privacy-focused manner, as well as measure and attribute their ad campaigns performance.

How Can Retailers Leverage Retail Media Networks?

Retail media networks offer a wide range of benefits for retailers. By leveraging RMNs, they can increase the worth of their brands, streamline their e-commerce sales, compete with Google and Meta for ad spend, enhance their product development with insights and reports, and deepen relationships with their providers.

Retail media networks also allow brands to reach a retailer’s audience on other digital channels, such as:

- Ads on video-streaming services and video ads — ads that appear on streaming services during movies and TV shows.

- Audio ads — served in between content when users are listening to music and podcasts.

- Email ads — displayed inside a retailer’s or company’s newsletters.

- Social media ads — displayed on a user’s social media feed.

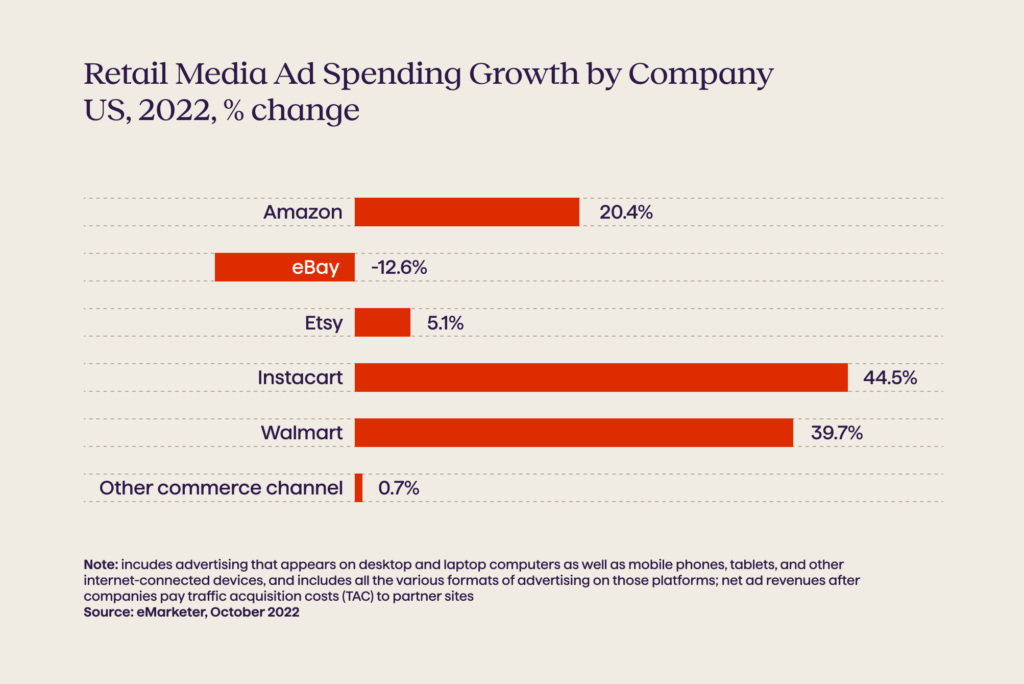

How Do Retail Media Networks Perform?

Retail media networks (RMNs) continue to experience significant growth, outperforming many other digital advertising channels. Leading retailers are expanding their advertising ventures to capitalize on this trend. For instance, Walmart’s ad business, Walmart Connect, has seen a 30% increase in the past year, contributing significantly to its profits. Similarly, Kroger’s retail media network, Kroger Precision Marketing, is forecasted to grow by 20% in 2024.

New entrants are also emerging in the retail media landscape. For example, PayPal has launched PayPal Ads, an advertising platform enabling marketers to leverage data from billions of transactions across its services, including Venmo and Honey.

These developments underscore the expanding role of RMNs in the digital advertising ecosystem, offering brands and advertisers new avenues to reach consumers effectively.

Below are some more numbers that represent the growth of RMNs.

- Amazon’s advertising business is projected to surpass $60 billion in 2025, putting it in the league of the world’s top media companies.

- In the retailer’s fiscal Q1 2026, Walmart’s global ad revenue climbed 50% year-over-year, while Walmart Connect—its U.S. retail media arm—grew by 31%, driven in part by its first full quarter leveraging Vizio CTV inventory.

- Instacart’s ad revenue surpassed $1 billion in 2024, reaching around $1.18 billion, on a 25.5% rise.

- According to Forrester, a quarter of retailers with their own RMNs earn more than $100 million a year from advertising.

- As of mid 2025, there are approximately 275 retail media networks globally, and this number continues to grow.

The Future of Retail Media Networks

The fast-moving consumer goods (FMCG) and consumer electronics industries will be intensively exploring the possibilities of retail media networks in the near future, so we can expect growing ad spending from these segments.

GroupM predicts that advertising in retail media will grow by about 60% by 2027, exceeding the expected growth of all digital advertising.

See how the right ad network can expand your reach—get in touch to explore your options.