Top fintech trends 2026: Tap into the latest banking industry technology

February 4, 2026 11 min read

Fintech isn’t some shiny new idea anymore. It’s just how people expect financial transactions to work now—fast, personalized, and always on. Just look at how quickly things have changed. Since 2017, the global fintech market has nearly doubled, primarily due to startups moving significantly faster than traditional banks can. And the tech just keeps piling up. AI now enables data to be transformed into split-second decisions. Embedded finance tucks payments and loans right into the apps you use every day. Crypto is quietly working its way into the mainstream, piece by piece.

By 2026, the real winners won’t be the companies with the flashiest names or the loudest ads. The leaders will be the ones who turn all this fintech innovation into something people actually trust, that checks all the compliance boxes, and feels smooth for users—while staying nimble enough to jump on whatever’s coming next.

Fintech market key takeaways

- Fintech includes fewer “growth-at-all-costs” players as consolidation reshapes the market.

- CBDC progress and open finance expand how money and data move across the fintech ecosystem.

- Crypto regulation is tightening, pushing fintech innovations toward safer, compliant models by 2026.

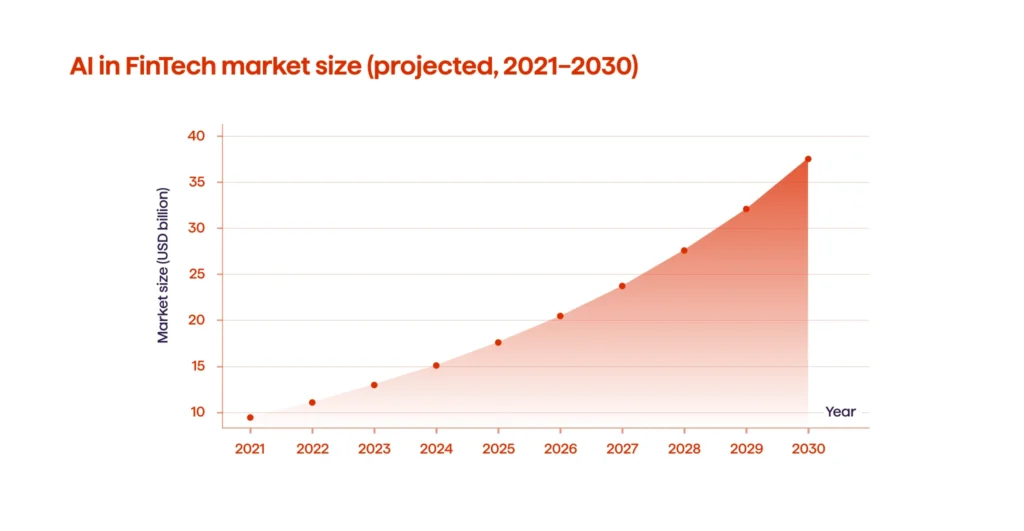

- AI becomes the engine behind the fintech innovations 2026—from fraud detection to hyper-personalized products and more intelligent decisions.

Trend 1: Fintech consolidation accelerates across the fintech industry

The days of easy money are gone, and you can see it in the numbers. In 2024, global fintech funding dropped by 12%. Out of the 70 most prominent fintech companies last year, only 33 actually made a profit. That kind of pressure is shaking things up. Weaker fintech startups are being acquired, merging, or simply fading away, while larger players are developing what they need instead of building everything in-house.

Banks are in on this, too. For them, buying a fintech company is the quickest way to upgrade without disrupting their existing systems. Over the past decade, traditional banks have acquired approximately 150 fintech firms. They typically targeted companies with digital payment tools, onboarding technology, fraud detection, and compliance software—tools that could be easily integrated into their existing data systems. You’ll see even more of this “capability shopping” in areas such as AI-powered risk analysis, digital identity, and embedded finance, particularly where the technology clearly delivers value.

The downside is that regulators will be looking even closer at deals than before, especially where the combined company will have control over a significant asset (infrastructure or access to data). Therefore, your fintech roadmap for the year 2026 must be focused more on creating a cohesive platform than on experimentation: establish a profitable framework, create a governing structure that is capable of handling further developments within the industry, and design for interoperability so that consolidation is viewed as an opportunity for scaling rather than a strategy for staying in business. This is the way forward for fintech technologies in 2026.

Deliver exceptional customer experience with Avenga’s digital banking solutions.

Trend 2: Central bank digital currencies gain traction and reshape financial technology rails

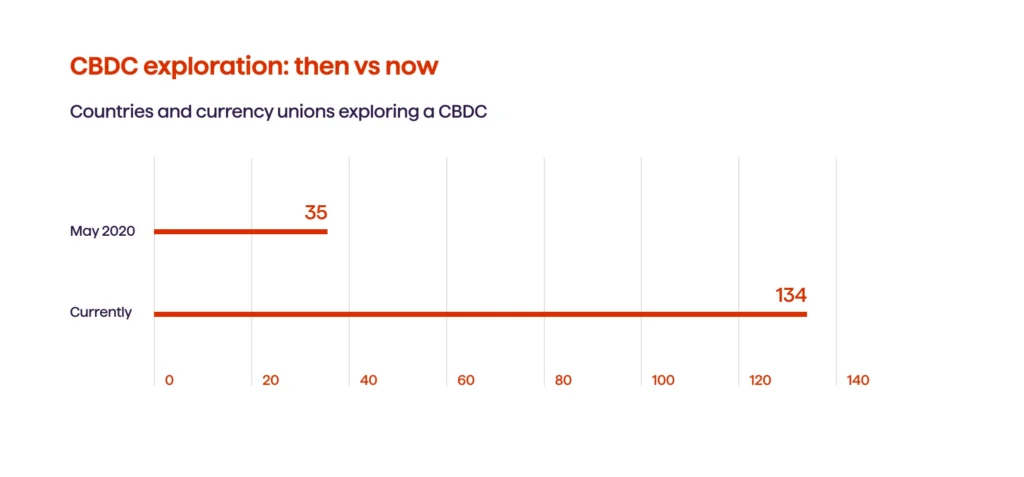

CBDCs are expected to be fully incorporated into the financial system in 2026. The scale tells the story: currently, 134 countries and currency unions, encompassing nearly all of global GDP, are either exploring or developing a CBDC. Just four years ago, only 35 were looking at it. Now, 66 are already in the pilot stage, deep in development, or have launched.

This changes the game for fintech solutions. With CBDCs, people will expect money to settle almost instantly, even across borders. Programmable money (conditional payouts, automated compliance checks) is gaining traction, and for financial institutions, this means real questions: Who’s in charge of distributing? Who builds the wallets? Who handles digital identity? Most of all, who controls the customer experience? CBDCs are one trend that won’t stay locked up in a research lab. It’s coming, and soon.

Trend 3: Quantum-resistant cryptography becomes a future fintech requirement

Quantum-resistant cryptography is starting to appear on fintech roadmaps for a good reason: encryption is here to stay. Banks and fintech platforms retain logs, contracts, identity records, and transaction histories for years—sometimes even decades. Here’s the problem. If someone manages to grab encrypted data today, they just have to wait. Once quantum computers are powerful enough, those old records could suddenly become readable, turning years-old financial data into a brand-new risk.

That’s where post-quantum cryptography comes in. These new algorithms are based on mathematical problems that quantum computers aren’t expected to solve anytime soon. The ones people talk about most are lattice-based cryptography: CRYSTALS-Kyber for key exchange, Dilithium for signatures, along with hash-based and code-based methods. With NIST making their picks and moving toward standards, fintech teams finally have a more straightforward path forward. Now, it’s all about getting these tools into real systems before quantum computers catch up.

PQC introduces larger keys, new performance quirks, and changes across various areas, including PKI, mobile apps, APIs, HSMs, and even third-party tools. In the financial ecosystem, that shakes up everything from digital banking logins to blockchain, where the way you handle signatures and verify data can make or break how systems work together. Looking ahead to fintech in 2026, crypto agility is the name of the game. Start by identifying what you rely on now, test PQC in areas where a mistake won’t cause harm, and develop a migration plan that ensures a smooth transition for both customers and regulators.

Trend 4: Crypto regulation tightens and shapes compliant innovation

There has been a spike in regulatory requirements and enforcement against digital assets which are changing the definition of “safe” innovation in the financial industry. The largest trend we are seeing in FinTech in 2026 is the shift from regulators giving vague guidelines to providing clear regulations regarding stablecoins, custody, and how cryptocurrency will interact with traditional banks. This increased clarity allows legitimate players to create their FinTech projects with less risk of running afoul of the law; however, it has also raised standards relating to governance, disclosure, and reserve management.

Bank regulators across the United States have begun to relax restrictions on crypto-assets and other forms of cryptocurrency, paving the way for increased opportunities to develop compliant solutions for holding and transferring value using regulated private payment systems.

The UK Financial Conduct Authority (FCA) is currently consulting on the establishment of a formalised framework for regulating cryptocurrencies, focusing mainly on consumer protection and behavior, while the Bank of England has begun to define the regulatory framework for how to supervise systemic stablecoins.

The Hong Kong Special Administrative Region is positioning itself to be the global leader in stable coin issuance through its innovative licensing scheme aimed at providing clear rules and guidelines for Stelfrum’s issuer’s operations and providing them greater access to the Asian market.

| Jurisdiction | Primary focus | Direction of travel | Practical impact |

|---|---|---|---|

| United States | Bank participation + market structure | Guidance easing + legislative clarity efforts | More regulated “bank-grade” crypto services |

| United Kingdom | Licensing + consumer protection | FCA regime build-out + stablecoin oversight | Higher compliance workload, fewer grey areas |

| Hong Kong | Stablecoin issuer licensing | Reserve + redemption rules | Faster pathways for regulated stablecoin models |

Regulators dragged their feet for years, but now they’re clamping down because crypto isn’t just hype anymore—it’s bumping up against real financial services. Stablecoins are acting like payment tools. Crypto custody is starting to look like the pipes that keep markets running. And when things blow up, it’s not just crypto that gets rattled; trust in banks and the whole financial system takes a hit.

There’s another thing stirring the pot: DeFi doesn’t care about borders, but every country has its own rules for protecting people. When something goes sideways, it’s still the local government that has to answer the phone.

So, what does all this mean for fintech in 2026? It’s pretty straightforward. Innovation that plays by the rules comes out on top. If you build in licensing, transparency, proper reserves, and audits right from the start, you’ll beat the folks trying to slap on compliance at the last minute. You’ll launch faster, and banks will actually want to work with you.

Trend 5: Open banking expands to open finance for broader data access

Open banking is at an inflection point, and the UK has provided the strongest indication of what to expect next in the evolution of open banking. Open banking’s rapid growth has resulted in more than 10 million active users and the processing of over 14 billion API calls annually. Open Banking has quickly transitioned from the “pilot” phase to being an essential everyday service for the processing of payments, for performing affordability assessments, and for tracking individuals’ total assets using multiple fintechs via “account-to-account” journeys. A larger superstructure that encompasses many new products (within finance as a whole), often referred to as open finance, will soon emerge, and the UK’s Financial Conduct Authority (FCA) has stated it will release an open finance roadmap in 2026.

In the fintech sector, this shift is particularly notable. It combines all those separate products into a single, connected experience. Now, you get things like “whole-of-life” dashboards that show your savings, debts, and insurance in one place. Smarter switching and underwriting use real, verified data—no more drowning in paperwork. And outside the banks, fintechs can mix bank data with other systems. They’re even integrating blockchain technology, allowing tokenized assets or digital IDs to seamlessly fit into workflows that keep regulators satisfied.

Trend 6: AI-powered hyper-personalisation reshapes customer experience in financial technology

Artificial intelligence developments are transforming “one size fits all” banking into personalized service assistants. Hyper-personalization in the financial sector uses AI and real-time analytics (spending patterns, life events, channel behavior) to enhance and personalize fintech’s product offerings without requiring clients to browse menus to locate what they’re looking for. Customers receive a proactive notice about their cash flow, permitted limit changes are made, and fraud checks are carried out based on how the client regularly makes payments, thanks to the ability to develop a better next-best action strategy.

The greatest revolution in the field of banking services and systems has been through orchestration. Orchestration enables AI to integrate CRM with risk management and product engines, ensuring a seamless customer journey across apps, web/contact centers, and branches alike. Furthermore, since 75% of firms currently utilize AI and 74% have recently invested in AI/GenAI technologies, demand for personalization has surged to the point where customers now expect their financial interactions to be seamless, rather than purely transactional in nature.

FAQ

Final words: Key fintech trends 2026

The fintech stories with the most executional clarity will be recognized in 2026 rather than the loudest ones. Consolidation, open finance, AI-based personalization, CBDCs, and stricter rules for cryptocurrency are some of the latest fintech trends. Financial services companies will be able to function more quickly, safely, and intelligently if they stick to the latest fintech trends transforming the industry. Want to learn more about financial products and services in 2026? Contact Avenga, your trusted financial experience partner.