Telecom self-reported 101: adopting self-service credit reports

December 2, 2025 10 min read

Telecom payments had remained under the radar of the banking system for decades. Paying your cellphone or internet bill on time did not affect your credit score—but being late on a payment could still land you in collections. Credit bureaus did not account for the positives, only the negatives, which left millions of consumers with thin credit files and limited avenues to build credit.

That dynamic is finally changing. With self-reported data, open banking integrations, and consumer-driven tools like Experian Boost, telecom data is being reframed from a cost to a valuable asset. Experian has assisted in the real-time addition of telecom, utility, and streaming payments for more than 6 million consumers to their files, resulting in improved FICO Scores, greater financial inclusion, and providing lenders with a fuller picture of a consumer’s creditworthiness.

As telecommunication companies engage with transparency and voluntary performance reporting, they are rethinking trust in 2026.

Key takeaways

- Once “invisible” to credit agencies, telecom bills are now helping millions of people create their credit profiles with the help of services like Experian Boost.

- Transparent reporting of service quality, billing accuracy, and payment data fosters confidence, which drives customer loyalty.

- When customers have access to their own performance and payment data, the volume of support inquiries decreases, and internal efficiencies improve.

- Customer-controlled payment reporting empowers consumers, though regulatory frameworks and bureau-specific limitations shape how this data affects credit decisions.

What is self-reporting in telecom?

Customer-driven telecom payment reporting refers to consumers voluntarily adding their payment history, for mobile, broadband, TV, and bundled services, to their credit files through approved tools. This is distinctly different from traditional credit reporting, where creditors automatically furnish data to bureaus.

The goal is straightforward: enable positive telecom behaviors to affect your credit, rather than simply monitoring default and/or late payments. In the past, credit bureaus only collected negative telecom behavior once the account was in collection. This meant that a person could pay their telecom bill for five years, with not a single payment missed, and still not receive any credit score benefit, yet still have a negative impact with just one missed payment. Self-reporting is established to eliminate this imbalance.

Through tools like Experian Boost, consumers can link their bank accounts using open banking technology, verify recurring telecom payments, and potentially see a score improvement if their records demonstrate reliable patterns. This approach is particularly impactful for individuals with thin credit files or limited access to traditional credit products.

Important limitations exist. Experian Boost adds bank-verified payment data to the Experian credit file only, not to Equifax or TransUnion files. Telecommunications providers do not automatically push positive payment data to credit bureaus in real time. The reporting remains consumer-initiated and bureau-specific, meaning results vary depending on which credit file a lender reviews.

Customer-driven telecom payment reporting typically covers:

- Mobile payments

- Bills from the internet and home broadband

- TV and streaming bundles

- Utility-style telecom add-ons

What is even more significant about this is the magnitude. Experian found that 77% of consumers saw their credit scores improve, up an average of 11 points, and the share of consumers with subprime credit scores dropped from 30% to 16%.

We partner with operators to accelerate growth, unlock revenue through data monetization, and deliver exceptional customer experiences.

Why transparent performance reporting matters in telecom

For years, telecom companies held all the performance data, including network uptime, dropped calls, installation delays, and payment history. Customers could not understand how these factors impacted their service experience. That information gap caused frustration and distrust. Today, the shift toward transparency is changing that dynamic.

When a provider shares information about their performance metrics, billing accuracy, and service history, customers gain clarity about their account. Transparent reporting on service quality and account status helps customers understand what they are paying for and how their account stands. This clarity creates confidence, and confidence drives loyalty.

Transparent performance reporting, particularly when combined with self-service in telecommunications, reveals to customers how their behavior (such as on-time payments, disputes, and product changes) influences their credit data. This results in decreased churn and increased loyalty through customer empowerment rather than obscurity.

Transparency also helps telecom operators reduce support costs and increase customer lifetime value. When customers can investigate service levels, billing details, and explanations for service interruptions, they need not call support. Greater visibility means more issues are resolved independently, building trust in the process. This is a simple explanation of how transparency increases corporate value:

| Transparency Action | Customer Perception | Business Outcome |

|---|---|---|

| Sharing network uptime + performance reports | “My provider is honest with me.” | Higher loyalty, lower churn |

| Allowing customers to view their self-reported payment history | “I can manage and improve my credit profile.” | Fewer disputes, on-time payments |

| Clear explanations of outages or delays | “They communicate like a modern provider.” | Reduced call volume |

| Self-service credit data access | “I’m in control of my account.” | Increased digital engagement |

While the transparency measures may appear straightforward in nature, together they represent a fundamental shift in customer perceptions of their telecom provider. When users have easy access to service levels, self-reported payment information, or billing explanations without having to call in, customers experience a shift from a reactive stance to one of collaboration. Customers feel informed, rather than deceived, and respected, rather than taken advantage of.

Operational benefits of transparent telecom reporting

In addition to enhancing customer sentiment, transparent reporting generates quantifiable operational benefits for telecom providers. When service data, payment history, and account activity are shared, customers take on a more proactive role, reducing the support load and enhancing internal efficiencies.

1. Lower support volume through self-service in telecommunications

When customers access billing information, outage reasons, service performance, or their own telecom-recorded payment history in dashboards, they can resolve issues independently.

- Approximately 41% of telecom support calls are related to billing. Transparency removes most disputes.

- Self-service portals reduce call volumes by up to 30%.

2. Faster dispute resolution and fewer chargebacks

Clear visibility into service metrics prevents escalation. Fewer conflicts arise when consumers understand what caused an outage or how prices were calculated. Billing visibility can reduce payment disputes by up to 40%.

3. Improved on-time payments and reduced churn

Account dashboards help customers track due dates and understand the impact of late payments. When customers monitor their own payment patterns, compliance improves.

4. Greater operational efficiency for telecom teams

When support agents, field, and billing teams rely on the same shared data, internal coordination improves. Suppose everyone sees the exact source of truth. As a result, the incentive for the team to make contradicting statements is reduced, and the requirement for gathering data across different areas of the business is lessened. If a technician serves a customer, they are aware of what support has said, and the support teams have the necessary context to provide help reasonably. Billing teams can confirm charges without needing to chase additional information.

5. Better data quality and fewer internal inconsistencies

Transparency requires more disciplined data hygiene, like cleaner billing records, aligned network performance logs, and more consistent customer data. Better data hygiene improves the quality of the service organization. Telecom companies that feature good data governance report a reduction in quote fallout of as much as 30% when they use transparent serviceability and data reporting systems.

The technical foundation for accurate, self-reported telecom data

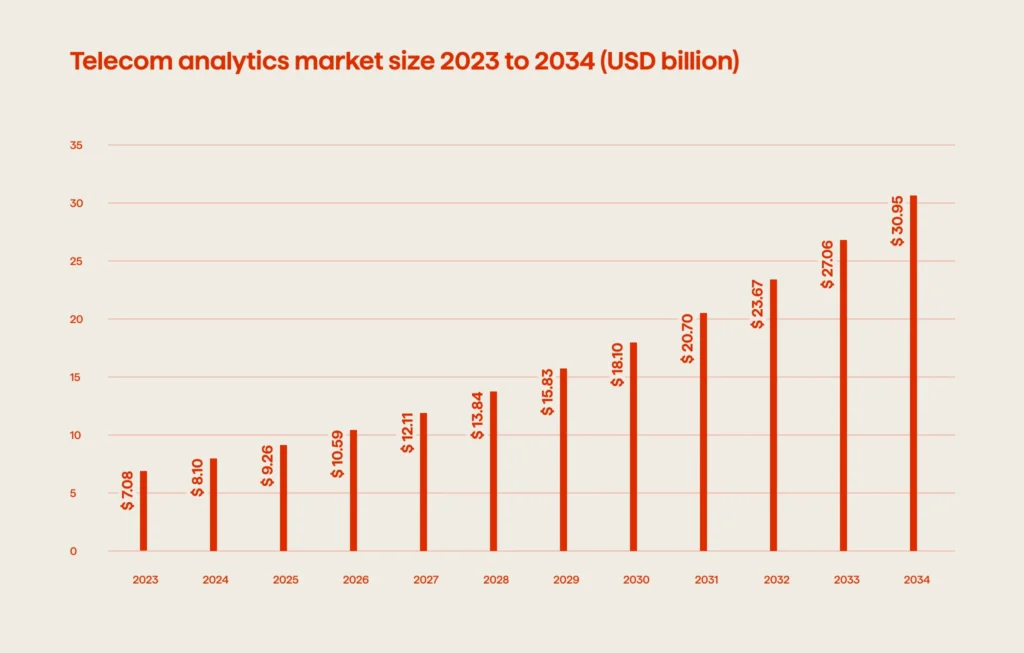

Telecommunications providers are investing heavily in analytics capabilities to improve service delivery and customer experience. The global telecom analytics industry, valued at USD 8.1 billion in 2024, is projected to grow to USD 9.26 billion by 2025 and reach over USD 30.95 billion by 2034, growing at a healthy 14.35% CAGR.

This growth reflects operator investment in network optimization, churn prediction, revenue assurance, and customer behavior analysis. Telecom analytics platforms process vast amounts of data from mobile networks, broadband infrastructure, and customer interactions to improve service quality and operational efficiency.

These analytics capabilities also support customer transparency initiatives. The same data systems that track network performance and service quality can power customer-facing dashboards, self-service portals, and account management tools. When providers build robust data infrastructure for internal operations, they create the foundation to share relevant information with customers.

From a payment perspective, these systems track payment history alongside service metrics. However, telecommunications providers face regulatory limitations on how they report payment data to credit bureaus. In many jurisdictions, telecoms cannot freely furnish positive payment data to credit bureaus because telecom accounts are not classified as credit obligations. Instead, most positive payment reporting happens through consumer-initiated tools like Experian Boost, where customers link their bank accounts and verify payments themselves.

Regulatory considerations shape this landscape significantly. Credit reporting regulations like the Fair Credit Reporting Act (FCRA) in the United States establish strict requirements for who can furnish data, what data can be reported, and how accuracy must be maintained. Telecommunications providers generally report negative payment information (accounts in collections) but lack the regulatory framework or furnisher agreements to routinely report positive payment data across all three major credit bureaus.

This is why customer-driven reporting tools have emerged as the primary mechanism for adding telecom payments to credit files. The consumer, rather than the provider, initiates the reporting through secure bank account verification.

FAQ

Final words

Customer-driven telecom payment reporting is proving to be an effective bridge between routine bill payments and credit-building opportunities. While regulatory frameworks limit how telecommunications providers can report payment data, consumer-initiated tools have created pathways for millions to strengthen their credit profiles.

Businesses that adopt transparent approaches to customer data and account management are building trust and improving customer experiences. As the industry evolves, the combination of better data infrastructure, self-service tools, and regulatory clarity will continue shaping how telecom payments factor into financial assessments.

Interested to learn more about telecom software development? Contact Avenga, your trusted technology partner.