Mobility industry trends and insights in 2026: Shaping the future of the sector

November 11, 2025 9 min read

Mobility is being reshaped in many intricate ways. As urban environments become increasingly dense and environmental concerns intensify, the shift towards sustainable transportation has moved from aspiration to imperative. Modern mobility technologies are redefining how people and goods move through cities, introducing environmentally friendly alternatives that challenge traditional paradigms.

From micro-mobility solutions to integrated transit systems, diverse modes of transportation are converging to create more efficient networks. This evolution reflects a broader reimagining of mobility — one where innovation serves new customer expectations and the need for sustainability. In this article, we’ll take a look at key trends that will define the industry in years to come.

AV adoption is changing urban mobility landscape

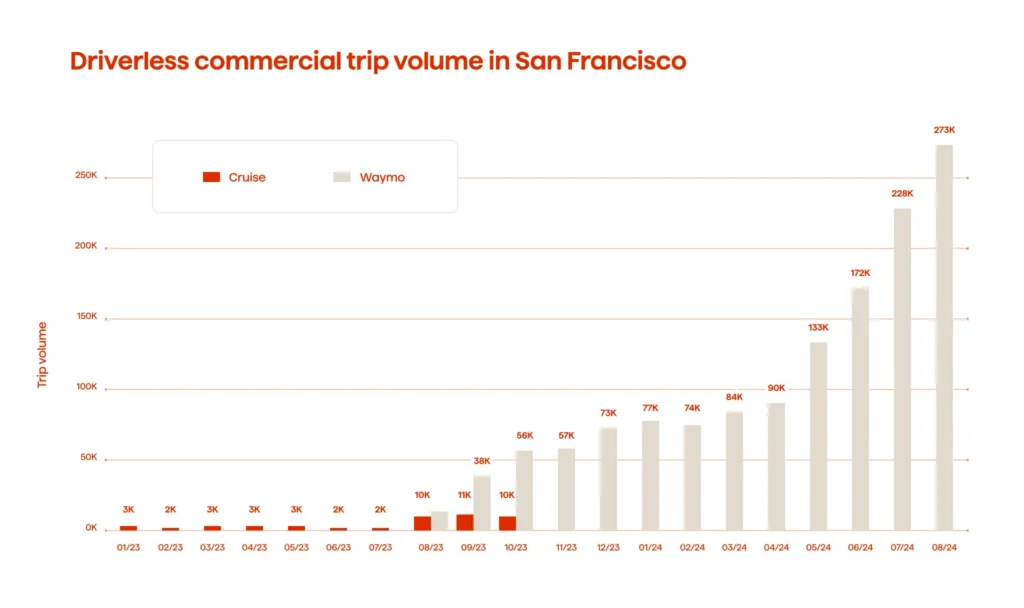

More Autonomous Vehicles (AVs) are entering the streets of big cities. In the US, Waymo now operates in San Francisco, Phoenix, Los Angeles, Austin, and Atlanta. As of August 2024, driverless commercial trip volume in San Franscisco alone reached 273,000, including shared mobility options (see Figure 1).

This adoption is supported by a strong safety record. The company’s fleet has driven over 22 million miles with 84% fewer crashes involving airbag deployment compared to human drivers. Building on this success, Waymo is planning further expansion, with London and Washington, D.C. next on their way.

But this is not the only example of the company driving this transformation. Lyft is deploying autonomous Toyota Sienna minivans in Atlanta with plans to expand to Dallas in 2026. Once the lawmakers settle the adoption frameworks, AVs will enter the market at full scale across the US.

In Asia, China has taken a proactive approach to AV infrastructure and testing. The country has issued 16,000 test licenses and opened about 20,000 miles of public roads for AV testing. Companies like Baidu Apollo, Pony.ai, and WeRide run robotaxi services in Beijing, Guangzhou, Shanghai, and Shenzhen. Pony.ai operates over 500 robotaxis and has logged more than 55 million autonomous kilometers worldwide.

Europe is primarily focusing on public transport solutions. Cities are testing roboshuttles and robovans to serve underutilized routes. Germany, France, Luxembourg, and Switzerland are leading the way, with Hamburg expecting fully driverless services in 2026.

Importantly, in October 2025, Stellantis and Pony.ai announced a partnership to develop Level 4 autonomous vehicles for the European market. Testing will begin in Luxembourg with the Peugeot e-Traveller model, followed by broader deployment across European cities starting in 2026.

The challenge of public trust

Despite the advances in technology and regulation, the widespread deployment of AVs ultimately hinges on public acceptance and trust. In a 2023 survey, 68% of a survey respondents reported being afraid of AVs. People worry about how AVs handle complex situations like jaywalkers, construction zones, and bad weather.

Wide acceptance clear communication about how the technology works and consistent safety records that prove AVs can be trusted as transportation partners rather than mysterious black boxes.

Improved social intelligence of AVs and trust of passengers could be key drivers to reduce this fear of self-driving cars. Trust is not solely about technical performance. It depends on how well AVs communicate their decision-making, handle unpredictable situations, and demonstrate human-like understanding.

Agentic Artificial Intelligence (AI) is just around the corner

AI is changing how we move through cities, manage logistics, and envision urban mobility and the automotive industry. The next big thing in this area is AI agents — systems that can perceive their environment, analyze sensor information, and make autonomous decisions. They can ultimately become the intelligence layer that connects vehicles, infrastructure, and passengers into modern mobility ecosystems.

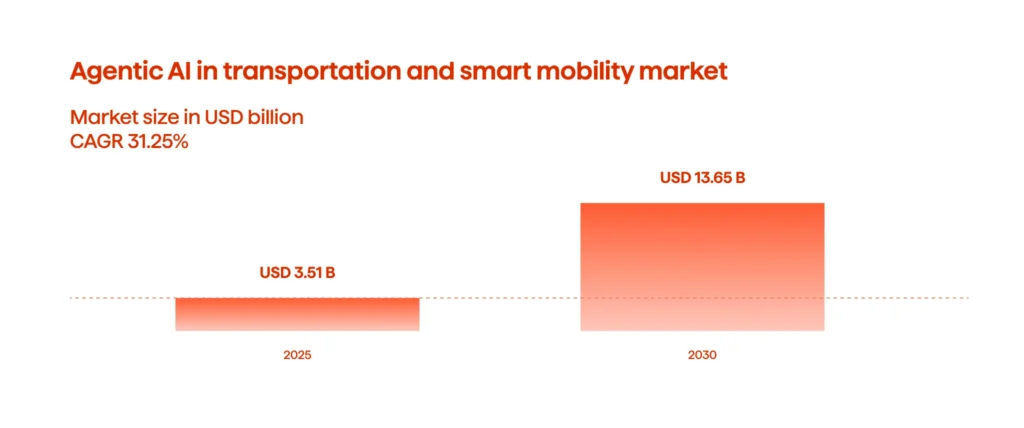

Market opportunities are growing. The agentic AI market in smart mobility and transportation is expected to surge from $3.51 billion in 2025 to $13.65 billion by 2030, with a 31.25% annual growth (see Figure 2 for details).

The next significant shift will come when agents work together, creating a “system of systems.”

- Coordinated movement. In the future, your car agent will talk to the city’s traffic agent and a parking agent. This allows for a smooth, end-to-end trip: The car knows the best speed to hit all green lights, and a parking spot is held for it when it gets close.

- Personal mobility managers. A personal agent will act for the user. It will be able to analyze the price and speed of all options (bus, train, scooter, or taxi), and book the whole trip without you having to open an app. It will also handle the payment.

- Adaptive urban planning. City agents will be used to run complex tests on how new roads or rail lines will work before they are built.

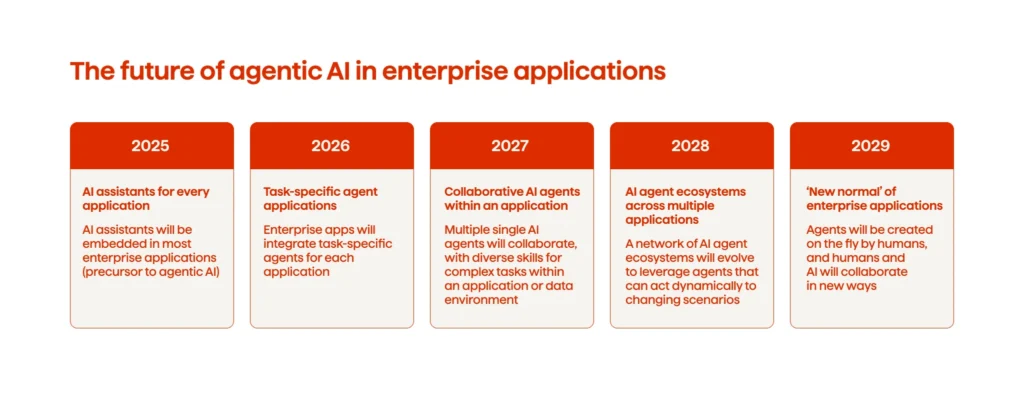

Meanwhile, Gartner predicts that 40% of enterprise applications will use task-specific AI agents by the end of 2026, a massive jump from less than 5% in 2025. This rapid integration confirms that agents are quickly becoming a core part of all business software, including those that power mobility operators (see Figure 3).

Agentic AI is moving fast from a nice-to-have to a core business tool. For mobility, this means that having agents that run things on their own will become the new normal in just a few years.

BEVs become front-runners in HGV decarbonization

Battery Electric Vehicles (BEVs) are the designated zero-emission pathway for heavy-duty commercial transport in the EU. The European Commission’s report confirms BEVs as front-runners. The development is especially necessary for businesses to achieve the EU target: a 90% reduction in tailpipe emissions for new trucks by 2040. Interim CO2 reduction targets (45% by 2030 and 65% by 2035) reinforce this mandate for Heavy Goods Vehicles (HGVs). Furthermore, the commitment to making urban buses 90% zero-emission by 2030 accelerates the entire sector’s transition toward climate neutrality.

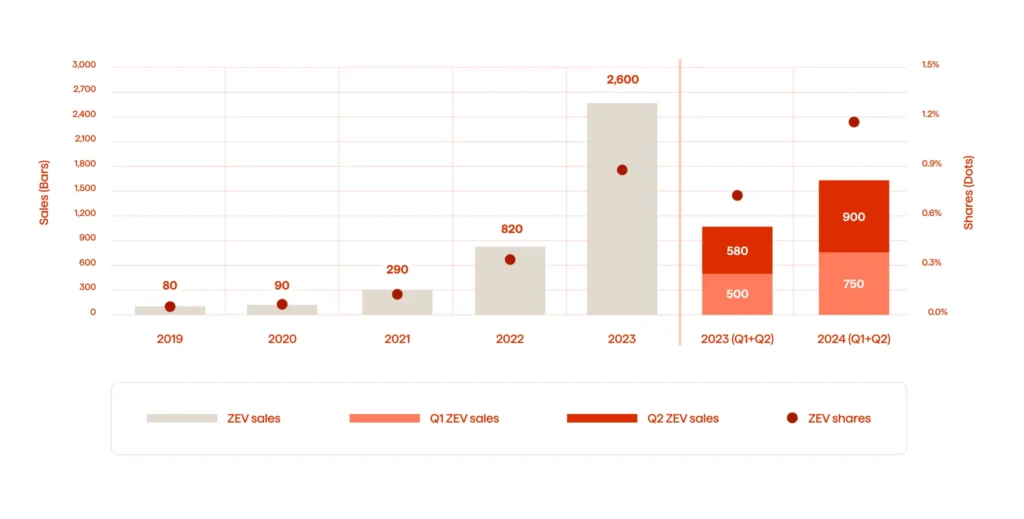

Despite sales growth, the market transformation for heavy, long-haul electric trucks is only in its nascent stage. But progress is evident. There is a 53 percent increase in Zero-Emission Truck (ZET) sales during the first half of 2024 compared to the same period in 2023 (see more in Figure 4). However, this growth begins from a low baseline; ZETs still account for 1.2% of total heavy truck sales, illustrating the substantial journey ahead to meet 2040 goals.

The Total Cost of Ownership (TCO) is expected to flip in favor of BEVs by 2030, though barriers persist in capital and infrastructure. EV trucks are projected to become the most cost-effective decarbonization solution for most truck categories in Europe by the end of the decade. This shift will occur as their lower maintenance and energy costs surpass the hurdle of higher upfront purchase prices.

Nevertheless, high initial costs and an insufficient high-power charging capacity remain critical constraints on adoption. They are particularly challenging for smaller businesses, which often face limited access to financing and lower credit ratings.

Digital end-to-end experiences are key to the future growth

End-to-end digital experiences are moving from a competitive advantage to baseline expectations. There is a demand for effective integrated platforms that handle every aspect of the journey, from planning and booking to real-time updates and payment, within a single interface. Consumer fatigue with fragmented, single-purpose apps is driving this mobility trend.

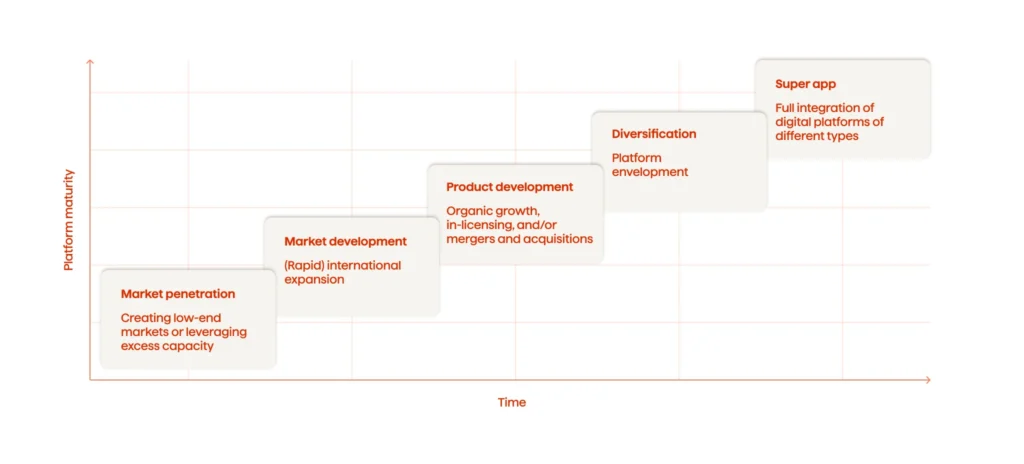

Super apps can partly address this need as they consolidate an ecosystem of services into a single platform. These apps integrate services like public transit ticketing, micromobility (scooters and bikes), and parking reservations. They also include non-transport services, such as payments, food delivery, and social functions. Uber, Bolt, Grab, and Gojek are super apps that have originated in or focused on the mobility sector.

The operating model of super apps is unique primarily because they create a single ecosystem that captures a share of users’ daily lives. This is usually achieved through rapid global expansion and subsequent market diversification (see Figure 5).

Many successful super apps, especially in Asia (such as WeChat), use an open platform approach, which allows third-party partners to develop and integrate their own “mini applications” directly within the super app interface. This enables the super app company to quickly grow its services without the constraints of in-house software development.

A critical feature is the integration of a digital payment system (e.g., GrabPay, GoPay, WeChat Pay). It enables transactions across all services within the ecosystem and can generate additional revenue streams from transaction fees.

In the long term, these end-to-end ecosystems (whether super apps or fully integrated Mobility as a Service (MaaS) platforms) will become the essential digital infrastructure of urban life.

Last-mile connection requires new mobility solutions

The final leg of any journey continues to present disproportionate difficulties, particularly in remote or underserved locations. The last-mile problem affects both passenger transportation and logistics.

Remote destinations often lack the density to support on-demand transportation services economically. Travelers arriving at regional airports or train stations frequently face limited options: expensive taxi services, infrequent shuttle buses, or long walks with luggage. The problem intensifies in areas with seasonal tourism, where demand fluctuates and providers struggle to maintain year-round service.

Traditional solutions show their limitations. Fixed-route shuttles serve only major hotels or attractions. Rental cars require infrastructure. Ride-hailing services either don’t operate in these areas or charge premium rates that offset their convenience. The result is a gap between digital sophistication in booking and the analog reality of actual arrival.

Partnerships between municipalities and private operators could fill these gaps. In rural towns, partnerships with local businesses are more frequent and essential to optimize the rural last mile, as they have a better understanding of distribution areas and can offer logistical support such as temporary storage areas or delivery points. Electric bikes and scooters extend the practical walking distance from transit hubs. Yet these solutions often lack integration with main transportation systems that would make them truly seamless.

The challenge extends beyond passenger movement. Travelers increasingly expect luggage delivery services, rental equipment at destinations, and provision of deliveries to remote accommodations. Meeting these expectations requires logistics networks that can operate profitably on a small scale — a difficult proposition that will likely require continued innovation in routing algorithms, vehicle types, and business models throughout 2026 and further in the future.

Mobility is at a crossroads

The future of mobility stands at a pivotal moment. Electrification, autonomous driving, and connectivity are major trends that are reshaping the industry. As cities grapple with congestion and environmental pressures, emerging technologies offer new solutions toward sustainable transportation.

But success lies not in adopting innovation for its own sake. Forward-thinking mobility businesses approach these disruptive technologies as a means to an end — tools that serve broader objectives of accessibility, efficiency, and environmental responsibility. The companies that thrive will be those that tap into these forces to create genuine value.

Scalable, future-ready technology for your mobility business: talk to Avenga’s experts.