The rise of embedded financing: How brands are becoming banks

November 18, 2025 10 min read

These days, money doesn’t leave the checkout. You select the item, split the payment, insure it, apply for financing — and never lay a finger on a bank app. This is the understated evolution of embedded finance. It is not merely an additional payment button. It marks the occasion when brands begin to behave like financial platforms by offering credit, wallets, insurance, and even payouts, all built into the experience you are already in.

What enables it? It’s a mix of more intelligent, regulatory-friendly infrastructure and sophisticated financial software development. A retailer, marketplace, or logistics platform can now add lending or instant payouts in the same way they can plug in analytics. What does that equal? Fewer abandoned carts, more repeat purchases, and a tighter hold on customer loyalty.

Key Takeaways

- Embedded finance integrates payments, credit, wallets, and insurance into the product workflow, reducing checkout friction and turning transactional buyers into ongoing relationships.

- With fintech embedded finance, brands improve conversion, AOV, and retention by optimizing the right money action (pay, split, insure, cash out) at the exact moment of intent.

- Brands are not banks; they are orchestrators of embedded finance, where licensed partners implement underwriting, risk, and compliance. As a result, the brand isn’t a lender or banking service, yet it still controls the user experience and data.

- It is a technical and strategic playbook that aligns partners with risk and analytics, then ships tightly integrated experiences that keep revenue and insights on your platform.

Why companies build embedded finance into their business

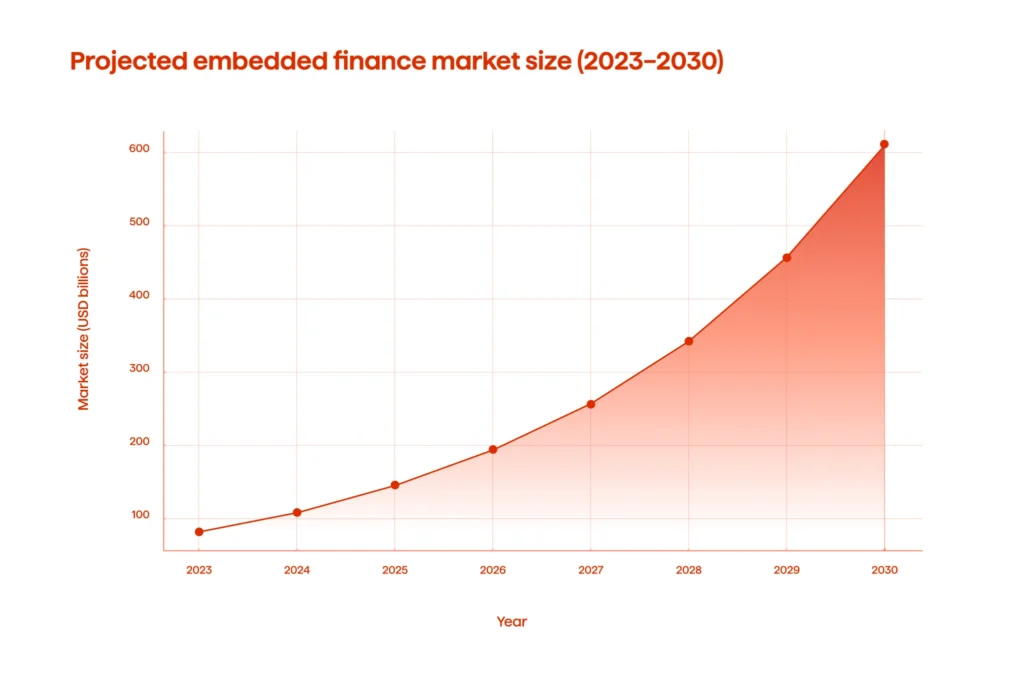

The statistics clarify the sense of urgency. The embedded finance market was estimated at around $83.32 billion in 2023 and is projected to reach $588.49 billion by 2030. At a ~32.8% CAGR, that’s not “nice growth,” but “reshape the fee culture” growth. The combination of broadband access, smartphones, and on-demand buying behavior is training customers to expect credit, insurance, and instant payouts at the moment of the transaction, not after undergoing the process of visiting a bank.

The chart above shows what that curve actually looks like: steady in the early years and then going vertical. Invigorating change doesn’t take long to surprise, as an entire sector of payments, lending, and protection emerges when every retailer, marketplace, and platform offers its own payments, lending, and protection offerings, respectively. It becomes embedded financing in action, with a financial touchpoint built into the product experience, rather than an additional layer bolted onto the outside.

At a high level, companies don’t build embedded finance because it is trendy. They make it because it allows them to control the money relationship as opposed to giving it away. And that creates two massive clusters of value:

Revenue, margin, and conversion gains

Embedded finance directly impacts four keys that determine if you close the sale(s), and how much you close for:

- Conversion. Most people don’t walk away because they don’t want it – they walk away because they can’t justify it today. Instantly approved payments/installments eliminate the need to go through a bank.

- Order value. “$49/month” sells upgrades; “$1,200 upfront” does not.

- Margin. You’re not just selling the item anymore – you’re monetizing payments, protection, credit, and fees.

- Speed. A 10-second “yes” via your app closes sales that would have died weeks waiting for external financing.

Loyalty, data ownership, and defensibility

Embedded finance transitions your role from that of “a vendor” to that of an infrastructure service — and once this happens, it is complicated to walk away.

- Retention. Wallets, stored balance, lines of credit, rapid payouts — now money lives inside of your product. Much more painful to leave.

- Behavioral insight. When you manage payments, payouts, and financing, you also manage actual spending behaviors, the full cycle of timing, and associated risks. You know exactly when to offer an upgrade, a refill, or a new service, and it feels relevant, rather than prescriptive.

- Defensibility. If you are advancing capital to sellers, insuring transactions, and managing their cash flow, they are not just using your platform; they are also relying on you for these essential services. They are structuring their business around it. This level of dependency is almost impossible to break on discounting alone.

Deliver exceptional customer experience with Avenga’s digital banking solutions.

How embedded financial services show up in real products

Embedded finance in fintech is a design decision that removes friction and maintains all the money movement within your product. Rather than sending customers to a bank or third-party portal, brands present the exact financial action at precisely the time it is needed, as in the case when Shopify Capital provides funds inside the merchant dashboard, when an Uber driver taps “cash out now” for immediate earnings, or when Amazon offers installments using a partner such as Affirm at checkout. In each case, it is easier for the customer, which matters because it leads to more completed conversions and clearer unit economics while building an open-loop feedback loop of behavioral data for smarter offers. This is where fintech embedded finance can stop being a buzzword and start becoming a measurable lift in conversion, retention, and lifecycle value.

Payments, wallets, and credit at the point of need

Use payment methods that don’t disrupt the purchase intention, such as one-tap cards, account-to-account rails, and geo-limited payments (like iDEAL on European travel sites, like Booking). Add a wallet for your customers to preload funds, hold refunds, and apply loyalty credits without re-entering card & billing details— a standard industry practice in gaming, super-apps, and more. Add in credit moments for pending decisions: split pay or revolving lines of credit at checkout (Amazon + Affirm, PayPal Pay in 4), or revenue-based working capital for sellers based on POS/sales history (Square/Toast Capital, Shopify Capital).

From a supply perspective, immediate profits (like Uber/Lyft) or advances on pending earnings (which enable our partners, like you, to receive orders and grow) benefit the partners’ experience. All of these methods reduce the time-to-yes, increase the average order value (AOV), and ensure the money relationship stays with your brand, not your bank app.

Protection, insurance, and bundled financial add-ons

Protection converts risk into peace of mind. Travel websites include trip insurance from Allianz as a simple toggle; marketplaces like Airbnb bundle protected host/guest coverage (AirCover) into the experience; DTC and electronics merchants add contextual warranties through providers such as Extend at checkout. Shipping protection (e.g., Route), often added post-purchase, cuts “Where is my order?” (WISMO) tickets and the churn they cause.

B2B flows can similarly have embedded trade credit or invoice protection, allowing deal flow to continue without spending time on offline underwriting loops. When these are context-aware and part of the experience (added based on basket size, category, buyer profile, etc.), they feel valuable rather than pushy and create an entirely new layer of margin discovery: premiums, fee share, and fewer disputes. In summary: buy, finance, and protect—without leaving the experience.

Who’s winning with embedded finance?

The greatest beneficiaries are those brands that can convert transactions into lasting relationships by incorporating embedded financial services into their experiences. Retailers, marketplaces, and B2B platforms with savvy UX design and financial software development experience can offer faster checkouts, improved average order value (AOV), and greater customer loyalty—all because money movement now exists within their products.

Retail and eCommerce

Retailers utilize embedded financing to eliminate friction precisely at the moment of purchase decision. Payment solutions that include one-tap pay, local A2A methods, in-app wallets, and BNPL convert at the instant of the cart, and again reduce cart abandonment for the retailer. For higher-ticket items, installment plans or revolving credit transform the math from “$1,200 upfront” to “$49/month”, which encourages customers to go with premium bundles.

After the purchase, extended warranties, shipping protection, and easy returns are embedded as no-brainer toggles, adding margin without adding frustration and hassle. The composite effect is fewer drop-offs in conversion, higher average order value, and repeat purchases fueled by stored balance, loyalty credits, and personalized offers informed by real spending behavior.

B2B platforms and marketplaces

B2B platforms achieve success by integrating financial services throughout a transaction. Sellers can access immediate payouts, revenue-based advances, and invoice factoring based on their platform history—enabling them to finance their restock and growth without the time-consuming cycles of underwriting in an offline mode. Buyers derive benefits from trade credit at checkout, predictable terms, and insurance (e.g., cargo, performance, or invoice protection) that de-risks the buying process. Because the rails are native to the workflow, orders close faster, cash cycles shorten, and dependency on the platform deepens. Over time, the platform will be a financial rails—having owned the data, capital flow, and trust that competitors are unlikely to replicate.

Are brands actually becoming banks?

In short, the answer is no, but they are becoming financial entry points. The majority of brands do not have banking charters; however, for money movement, they orchestrate embedded financial services within their products. Simply put, the brand owns the user experience, signals data, and determines the “when/where” of the offer. In contrast, licensed partners (banks, EMIs, and insurers) own regulated activities such as safeguarding funds, underwriting, and compliance monitoring. This is why embedded finance fintech looks and feels like banking without the bank app — the financial infrastructure is abstracted, the client relationship remains the brand, and the substantial regulatory burden remains with the license holder.

This approach also modifies defensibility and economics. Brands obtain conversion and AOV by linking payments, credit, and protection to context. They also learn about client spending patterns, risk levels, and other factors. However, the “moat” does not require becoming a bank; instead, it calls for the right collaboration and end-to-end instrumentation of the customer journey.

Partnering for compliance and control

The effective formula is: “control the experience, contract the compliance.” You create a service mesh that includes sponsor banks/BaaS, EMIs, lenders, and insurers, with your own policy layer unifying KYC/KYB, AML, fraud, and dispute workflows in accordance with your risk appetite. You make the rules; partners do the work, under license.

| Capability | Brand owns (experience & control) | Partner/license owns (compliance) | Notes |

|---|---|---|---|

| Payments & wallets | UI, routing, pricing, refunds | Money transmission/EMI, safeguarding | Use multiple APMs and reconcile them to the partner ledger. |

| Credit/BNPL | Offer timing, limits UX, collections comms | Underwriting, capital, adverse action | Start with partner models; add risk overlays. |

| Payouts & accounts | When/how funds are released; APIs | KYC/KYB, sanctions, AML monitoring | Instant/earned wage access needs clear rules. |

| Insurance/protection | Offer design, claims touchpoints | Policy issuance, reserves, licensure | Embed only where the value is obvious. |

| Fraud, disputes | Risk rules, step-ups (3DS, docs) | Network chargebacks, SAR filings | Share features for model performance. |

| Reporting | Revenue, cohorts, LTV | Reg filings, trust/accounting | Map product metrics to compliance data. |

FAQ

Final words

Embedded finance shifts checkout into a relationship: payments, credit, wallets, and protection activate where intent occurs. With the right partners, stacks, and governance, you can accelerate time-to-yes, increase AOV, and lock in loyalty without being a bank. The momentum is building. By 2030, embedded finance is expected to reach €100 billion and account for 10-15% of banking revenue pools.

Are you ready to surface opportunities onto your roadmap? Contact Avenga, your trusted partner in embedded financial services technology.