Key manufacturing trends that will shape the industry in 2026

December 2, 2025 11 min read

The manufacturing industry is continuously evolving. The linear “take-make-waste” models are dissolving into data-driven, circular ecosystems. Moving away from mere digitalization of analog processes, businesses are looking into new use cases of next-gen technologies. Countered by current geopolitical pressures and climate imperatives, they seek innovative strategies to stay adaptive and resilient for whatever comes next.

In this article, we’ll explore key developments that will alter manufacturing in the year ahead. Some of the concepts we’re discussing have been with us for a long time, while others are just coming into play.

Key takeaways

- Manufacturing’s competitive advantage in 2026 stems from converging technologies (agentic AI, private 5G, digital twins, and nano-engineering) rather than any single innovation.

- The shift to agentic AI represents one of the most profound transformations in manufacturing.

- Cybersecurity has evolved from an IT concern to an existential business imperative. Manufacturing has become the most targeted industry for cyberattacks.

1. Advancements in clean tech manufacturing

Clean technology manufacturing is way more than just environmental compliance. It now drives competitive advantage and market positioning for manufacturers worldwide.

Global investment in renewables reached $386 billion in H1 2025 and is set for further expansion. The scale is unmatched. Chinese firms alone have committed over $227 billion across green manufacturing projects, with 387 projects launched since 2022.

The dominant trend is a pivot from centralized mega projects to distributed energy assets. Manufacturers are increasingly integrating “behind-the-meter” energy storage and generation directly into facility designs to insulate operations from grid volatility and price fluctuations.

American manufacturers are pursuing a dual strategy: vertical integration of supply chains and strategic reshoring of critical component production. Currently, the country has approximately 34 battery factories that are either operational, under construction, or in the planning phase. The competitive gap with Chinese production costs remains significant, but US manufacturers are betting on automation, process innovation, and premium market positioning to offset higher labor and land costs.

2. Smart manufacturing and adoption of Artificial Intelligence (AI)

The most profound shift in industrial artificial intelligence for 2026 is the transition from predictive to agentic. While traditional AI provides can provide dashboards and alerts (the “Human-in-the-Loop” model), Agentic AI possesses the autonomy to reason, plan, and execute complex workflows with minimal human intervention.

To name one innovative use case, an autonomous procurement agents will be able to autonomously find alternative suppliers, verify compliance, negotiate pricing based on pre-set parameters, and execute the purchase order, alerting the human manager only if parameters are exceeded.

And there is another essential consideration — the growing integration of physical AI. According to Deloitte, approximately 22% of manufacturers plan to deploy physical AI (autonomous mobile robots and humanoids) within the next two years. In this scenario, robots succeed at tasks like transportation or installation of equipment parts. Advancements in quantum computing, coupled with the leaps in AI, could result in further evolution of intelligent robotic machines.

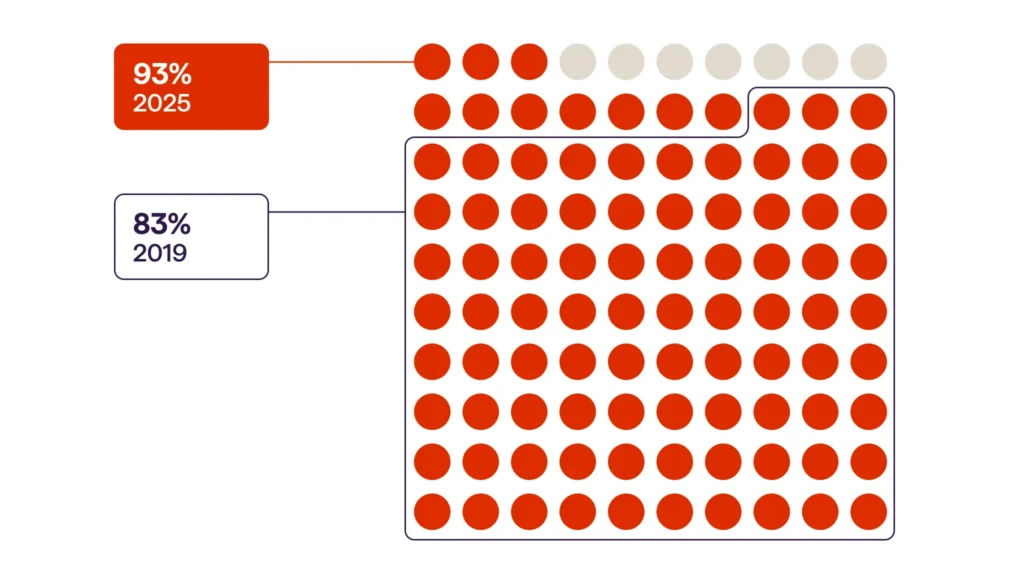

In general, 80% of manufacturing executives plan to allocate 20% or more of their improvement budgets specifically to smart manufacturing initiatives that will rely on agentic AI, automation hardware, data analytics, sensors, and cloud computing among others. The lion share believes smart manufacturing will redefine the way products are created (see Graph 1).

3. Intelligent supply chain on rise

Supply chain disruption has been massively present in the industry. Consider pandemic shocks, trade uncertainties, and geopolitical tensions all across the globe. Businesses just can’t afford reactive approaches anymore. That’s why intelligence is now being embedded in every step of the supply chain.

The competitive edge lies in connected execution. The traditional silos of Order Management (OMS), Warehouse Management (WMS), and Transportation Management (TMS) are translated into unified, intelligent layers.

The definition of supply chain resilience is evolving from redundancy (holding excess safety stock) to adaptability (the ability to reconfigure flows in real-time).

This shift is happening largely due to AI, which is moving from an “analyst” role (e.g., predicting an ETA) to an “operator” role. For example, if a port strike is predicted, the system reroutes shipments and updates production schedules without waiting for a planning meeting.

At the end of the day, top-performing supply chains are characterized by high-frequency planning cycles. Rather than monthly or weekly planning, leaders are moving toward continuous, event-driven planning where digital twins simulate millions of scenarios to optimize margin and service levels simultaneously.

4. Generative design in the spotlight

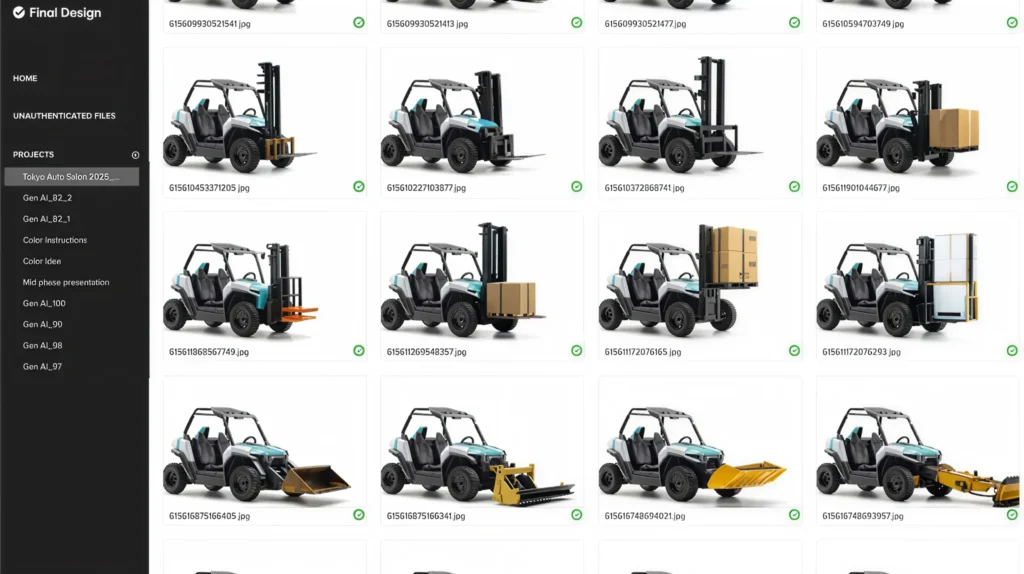

Generative design changes how engineers approach problem-solving in manufacturing. They can now define requirements and let AI explore thousands of possibilities instead of iterating on existing concepts. This greatly contributes to the speed of the engineering process.

The generative design process consists of six key stages, as per Nvidia: generate, analyze, rank, evolve, explore, and integrate. This approach allows mass customization, faster timelines, and more options than traditional methods allow (see Graph 2).

The technology optimizes both design and manufacturing methods simultaneously. This guarantees feasibility and efficiency in production. Parts can be CNC-machined or additively manufactured depending on complexity and volume requirements.

Areas of applications encompass aerospace, automotive components, medical devices, consumer products, and industrial equipment. Items that require optimized structures and have unique engineering constraints can all benefit from generative design.

5. Next generation of biomanufacturing

Biomanufacturing offers a way to rethink manufacturing. Instead of relying on petrochemicals, manufacturing companies can program living cells to produce desired molecules.

Market opportunities are immense. The biomanufacturing market achieved $22.98 billion in 2025 and is forecast to reach $44.37 billion by 2035. Predicted growth rate is at 6.8% CAGR. That said, the biopharmaceutical market could double in the next decade. This involves the expansion of biomanufacturing into industrial-scale operations.

AI-powered biofoundries (e.g., NSF iBioFoundry and Agile BioFoundry) use robotics, automation, and machine learning to accelerate the Design-Build-Test-Learn (DBTL) cycle. Due to tech advancements, development timelines have compressed dramatically. What took months now takes weeks.

At the same time, sustainability drives adoption. Biomanufacturing lowers greenhouse gas emissions by 30-80% if we compare it to conventional manufacturing processes. Some applications achieve carbon neutrality or carbon negativity. Mild operating conditions lessen energy consumption.

But the shift towards new biomanufacturing progress requires new skills from the manufacturing professionals. It implies an interdisciplinary expertise that has biology, automation, data science, and process engineering at its core.

Organizations invest in training programs and partnerships with educational institutions to guarantee a competitive edge for their employees. Technical skills are crucial, but adaptability and creative problem-solving are equally important in this field.

6. Steady growth in additive manufacturing

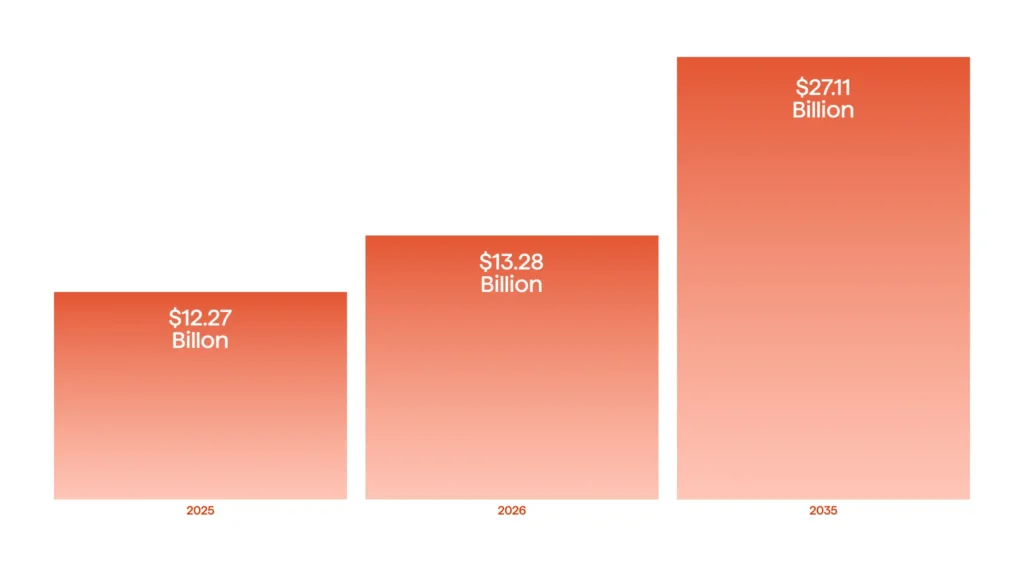

Additive manufacturing (AM) has firmly moved past the “prototyping” phase into full-scale production for high-value parts. The global polymer additive manufacturing market alone is projected to reach $13.28 billion in 2026 and grow with an 8.25% CAGR up to 2035 (see Graph 3).

What’s changed is the maturation of the technology itself. Newer industrial systems offer improved speed, larger build volumes, and better material properties that approach those of traditionally manufactured parts. The expanded palette of printable materials now includes high-performance polymers, titanium alloys, and even composite materials.

Perhaps most significantly, manufacturers are rethinking their approach. Rather than trying to replicate conventionally designed parts, engineers are learning to design specifically for additive manufacturing, creating structures with internal lattices, integrated cooling channels, and consolidated assemblies that reduce part counts. This design-for-AM philosophy unlocks the technology’s true potential.

7. Digital twins and virtual simulation

Virtual replicas of physical manufacturing systems aren’t experimental technology anymore, they have become essential operational infrastructure. The global digital twin market is set to grow from $24.48 billion in 2025 to $259.32 billion by 2032. Manufacturing accounts for the fastest-growing sector in this expansion.

Digital twins create dynamic virtual representations of production lines, equipment, processes, and entire factories that continuously update with real-time data from Internet of Things (IoT) sensors. Companies can run thousands of production scenarios virtually, testing new layouts, equipment configurations, and process changes without the risk and cost of physical experimentation.

The technical foundation continues to strengthen in this area. Advances in IoT sensor technology provide rich data streams, and edge computing enables real-time processing close to physical assets. AI integration allows digital twins to recognize patterns and continuously learn from operational data. Cloud platforms provide computational power to simulate complex scenarios at scale and make the technology accessible to mid-sized manufacturers.

8. Cybersecurity imperative

Manufacturing has become the most targeted industry for cyberattacks for 4 years in a row. The message is straightforward: manufacturers can no longer treat security as an afterthought.

This IT-OT convergence stands as both opportunity and peril. Connecting factory floor machinery to enterprise networks enables real-time monitoring and predictive maintenance. But it also exposes operational technology (which could have been designed decades ago without security considerations) to profound cyber threats.

Industrial control systems, programmable logic controllers, and SCADA systems that manage production lines were built for reliability and availability, not cybersecurity. Many run on legacy software that can’t be easily patched without a risk of production downtime.

To make things even more complicated, manufacturers operate within intricate ecosystems of suppliers, distributors, and service providers, any of which can serve as an entry point for attackers. Third-party vendors with more vulnerable security postures become the weak links that can compromise entire networks.

Effective defense requires a fundamental shift in approach. Network segmentation to isolate critical production systems, a zero-trust architecture that assumes no user or device is trustworthy by default, and industrial zones that buffer OT from IT networks are becoming essential. Real-time asset visibility, knowing exactly what devices exist on networks, forms the foundation, yet many manufacturers lack comprehensive inventories of their connected systems. It is high time businesses started deepening their cybersecurity to avoid risks that are growing every year.

9. Nano-engineering and composites

Material science is experiencing a fundamental shift as engineers manipulate matter at atomic and molecular scales to create composites with previously unattainable properties. The addition of nanomaterials to composite structures enhances thermal stability, electrical conductivity, and strength-to-weight ratios, transforming what’s possible in manufacturing.

Applications are proliferating across industries. Aerospace manufacturers achieve lighter, stronger components that directly improve fuel efficiency. The energy sector, including batteries, supercapacitors, and solar cells, has the largest end-use application.

The trajectory points toward mainstream integration. Machine learning optimizes synthesis processes, and additive manufacturing techniques enable precise placement of nanocomposites in complex geometry. As production expertise deepens and costs continue falling, nano-engineered composites are transitioning from specialty materials to building blocks for next-generation manufacturing across transportation, energy, and electronics.

10. Private 5G and decentralized compute

Manufacturers are taking control of their connectivity infrastructure. They are deploying dedicated wireless networks and moving computing power directly onto factory floors.

Private 5G delivers what conventional networks cannot: guaranteed bandwidth on dedicated spectrum, latency under 10 milliseconds, and capacity for thousands of simultaneous device connections without degradation. The performance gap translates directly into operational gains.

Sensitive production data and proprietary algorithms remain within factory boundaries rather than traversing public internet connections. Systems continue functioning during internet outages since critical processing happens locally. Bandwidth costs drop when only processed insights travel to central systems instead of raw data floods.

The combination of private 5G’s reliable, low-latency connectivity with edge computing’s local processing power creates infrastructure capable of supporting autonomous systems, real-time quality control, and adaptive production that weren’t previously possible.

Final thoughts

The manufacturing sector of 2026 isn’t shaped by any single breakthrough technology but by their convergence. What separates tomorrow’s manufacturing leaders won’t be access to advanced technologies. The differentiator will be strategic integration: knowing which innovations solve actual operational challenges and moving decisively while competitors deliberate.

The manufacturers watching these trends are preparing. The ones acting on them are already pulling ahead. Beat the competition with state-of-the-art technology: contact Avenga.