The changing face of media and entertainment: Trends to follow in 2026

December 17, 2025 15 min read

The media and entertainment (M&E) industry is at an inflection point, shaped by accelerating media and entertainment industry trends that are redefining how content is produced, distributed, and monetized. Streaming, once the disruptor of legacy TV, is now evolving into a complex ecosystem driven by technology, monetization strategy, and consumer behavior.

By 2032, the global video streaming market is projected to reach $2.49 trillion, growing at a CAGR of 17.8%, illustrating the scale and strategic importance of this sector. Yet, growth is no longer solely about producing content. What differentiates 2026 from previous cycles is that growth now hinges on efficient monetization, meaningful viewer engagement, and the intelligent application of emerging technology trends in media and entertainment industry — particularly artificial intelligence.

These shifts reflect broader entertainment industry trends where success is increasingly measured by lifetime value, personalization depth, and platform stickiness rather than raw subscriber numbers.

In 2026, four critical forces will define the market: hybrid monetization models, content monetization innovation, AI-driven personalization, and AI integration in content production. Together, they represent the most impactful trends in media and entertainment industry, intersecting with live programming, interactive commerce, deepfake detection, and platform aggregation.

Hybrid monetization models — SVOD, AVOD, FAST, and commerce integration

The subscription-only model that defined the first era of streaming is no longer sufficient. By 2026, platforms are adopting hybrid monetization strategies that combine subscription video on demand (SVOD), ad-supported video on demand (AVOD), free ad-supported streaming TV (FAST), live programming, and embedded commerce opportunities.

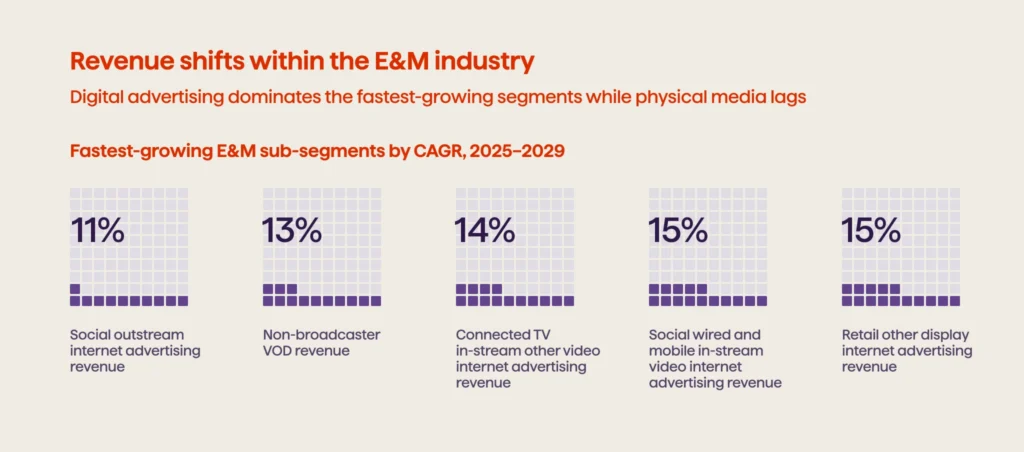

This shift aligns closely with broader media industry trends, where advertising and commerce are reclaiming center stage after years of subscription-led growth. PwC’s forecasts advertising as the fastest-growing revenue segment in M&E, and by 2029, it is projected to have US$300 billion more in revenues than consumer spending.

Within streaming, connected TV (CTV) advertising alone is expected to reach $51 billion by 2029, reflecting the shift toward monetizing viewership through sophisticated ad models.

Comscore’s 2025 State of Streaming report underscores just how quickly ad-supported platforms and FAST channels are becoming central to the streaming ecosystem. The data points to a clear momentum shift: audiences are not only adopting these services — they’re spending significantly more time with them.

According to the report, total hours viewed across major free, ad-supported streaming platforms jumped 43% year over year (August 2025 compared to August 2024), signaling a powerful surge in consumer preference for free, ad-backed options.

In the UK, the OTT (over-the-top) market is on track to hit £9 billion by 2029, and ad-supported services are becoming a bigger piece of the pie — expected to make up about 35% of all OTT revenue. This growth outpaces the global average, demonstrating how regional collaboration among broadcasters is reshaping competitive dynamics — a clear example of localized media and entertainment industry trends in action.

Platforms that:

- Offer tiered subscription levels

- Integrate interactive ad formats

- Bundle content with telecommunications or commerce services

will create multiple revenue streams while reducing churn.

Advertisers benefit from contextually relevant ad placement that reaches highly engaged audiences through contextual placements, while consumers retain the flexibility — a win-win dynamic increasingly central to entertainment marketing trends.

Content monetization and creator-led revenue streams

Content monetization is moving beyond traditional subscription or ad revenue to embrace creator-led ecosystems, direct-to-consumer commerce, and interactive revenue models. According to Goldman Sachs Research, by 2027, the global creator economy is projected to exceed $480 billion, with platforms actively providing creators tools to monetize across multiple channels.

Prime Video and Twitch have demonstrated that live engagement drives both retention and revenue. Cooking shows, fashion streams, and concert events now incorporate:

- Real-time shopping options

- Merchandise integration

- Sponsored polls and interactive experiences

This convergence of live content, commerce, and creator monetization transforms passive viewership into active participation — a defining shift within current media industry trends.

Creators are no longer only content producers but strategic partners. Platform-native monetization tools increase content volume, diversify programming, and strengthen long-term platform loyalty. For advertisers, this unlocks highly contextual, influencer-driven campaigns that outperform traditional ad formats and align directly with evolving entertainment marketing trends.

AI-driven personalization and recommendation systems

The explosion of streaming choices has created an unexpected problem for consumers: too much freedom. With thousands of titles at their fingertips, viewers often spend more time browsing than watching.

In 2026, personalization has emerged as the antidote. Artificial intelligence is evolving from a recommendation engine into a predictive system that understands not only what users watch, but why, when, and how they prefer to engage. This evolution sits at the heart of current technology trends in media and entertainment industry.

The AI market within media and entertainment is on track to reach $85.36 billion by 2026, growing at nearly 26,5% CAGR through 2034. But behind those numbers lies a deeper shift: platforms are no longer using AI simply to sort content. They are using it to interpret mood, intent, attention span, and even social context. Recommendations are becoming less about similarity and more about emotional resonance.

Instead of relying on “because you watched X,” platforms now analyze viewing behavior down to the micro-moment — scene-level pauses, rewinds, session time of day, patterns across genres, and behavioral signals that indicate whether a viewer wants comfort, stimulation, background noise, or a fresh discovery. This allows services to predict what a viewer is in the mood before the viewer realizes it themselves. This shift is rapidly becoming one of the most decisive media and entertainment industry trends.

Consumer-facing features reflect this evolution.

- Netflix’s Play Somethinghas grown from a novelty to a highly sophisticated intent engine that learns session behavior and reduces browsing friction. Scene-level previews help users decide faster by surfacing snippets they are most likely to respond to.

- Prime Video’s advanced recommendation system goes a step further by guiding viewers across different subscription channels within the same ecosystem, a subtle retention strategy that keeps users inside a single environment.

The business impact is substantial. Personalized experiences can increase time on platform by as much as 35 percent, significantly improving engagement metrics. Better discovery reduces churn by reinforcing habitual viewing. And with higher engagement comes more effective ad delivery, multiplying monetization opportunities.

By 2026, platforms that invest in predictive algorithms, interoperable identity layers, and cross-platform behavioral analytics will define the competitive benchmark across the media industry trends landscape. Those that fail to evolve risk being pushed into the “infinite scroll” dead zone — present, but rarely chosen. Hyper-personalization is no longer an enhancement. It is table stakes for survival.

AI in content production and workflow automation

Artificial intelligence has woven itself into nearly every stage of the modern content pipeline. What began as experimental tooling for niche creative tasks has become a foundational layer supporting the entire production lifecycle — and now became one of the most transformative technology trends in media and entertainment industry.

Writers, directors, editors, localization teams, and marketers increasingly rely on AI to accelerate processes, reduce costs, and improve consistency. Script ideation can now begin with AI-assisted narrative drafts that shorten the earliest phases of production by 20 to 30%. Storyboards can be automatically generated from text prompts, giving creators more time to refine creative concepts rather than wrestle with initial scaffolding.

Localization has been one of the biggest beneficiaries. Automated dubbing, subtitling, and translation allow studios to distribute globally without re-creating costly workflows for every region. AI voices, now significantly more natural than their early iterations, let global rollouts happen in weeks rather than months.

In post-production, AI tools now optimize color grading, refine VFX layers, detect continuity issues, and clean audio with remarkable precision. Editors are learning that routine tasks can be automated while they focus on artistic and strategic decision-making. Predictive analytics, meanwhile, inform executives which genres, themes, or story arcs are likely to resonate in specific markets, helping shape investment decisions before money is committed. It’s a clear example of data-led media and entertainment industry trends shaping creative risk management.

Large studios are already operating this way:

- Netflix’s scene-level metadata system, for example, does more than help with recommendations. It powers a cycle of production intelligence that informs everything from casting to marketing.

- Amazon Studios uses Runway, AI-assisted editing to compress post-production timelines without sacrificing cinematic quality.

The democratization effect is equally important. Independent creators now have access to tools that used to require entire teams. Generative AI enables small studios, YouTubers, and social content producers to achieve professional-grade outputs, challenging long-standing assumptions about budget requirements.

Companies that fully integrate AI into their pipelines will enjoy lower costs, faster time to market, and data-driven decision-making. Those who do not will struggle to compete with a new generation of agile, AI-powered creators.

Live programming resurgence

Streaming was built on the promise of watching anything, at any time. Yet, in 2026 entertainment industry trends show that audiences are gravitating back toward something more familiar: watching together. Live programming is experiencing a renewed surge as platforms rediscover the magnetic pull of shared, real-time experiences.

The live entertainment market is projected to grow from USD 202.90 billion in 2025 to USD 270.29 billion by 2030, at a CAGR of 5.9%. Live sports alone account for about $94.7 billion by 2033, growing at a robust CAGR of 17.2% during the forecast period, reinforcing their unmatched value within the broader media industry trends ecosystem.

But what should be different in 2026, is how platforms will blend traditional broadcast sensibilities with interactive digital layers that turn viewership into participation.

YouTube’s partnership with NFL Sunday Ticket shows how major platforms (think Netflix) are reshaping live sports streaming. Fans can watch multiple games at once with multiview and access features like real-time stats and player-focused insights — all without leaving the stream. Prime Video’s Thursday Night Football has also expanded the live experience with alternative commentary feeds, enhanced analytics powered by Next Gen Stats, and interactive ad formats that allow viewers to explore or shop related products while watching.

Twitch continues to redefine what “live” means. Music artists and event creators use co-streaming, chat, tipping tools, and interactive extensions to let audiences influence performances or participate in real time. These events aren’t just streamed — they’re shaped by the community around them.

Live programming consistently drives deeper engagement than typical on-demand video. Viewers tend to stay longer during real-time events, and scheduled broadcasts help rebuild weekly viewing habits that support retention. Because attention is higher, advertisers value live inventory more, especially when it includes interactive, integrated, or shoppable formats.

As more platforms incorporate live and interactive programming, the strategic stakes become clear. Live content strengthens retention, enables new monetization paths, and creates competitive differentiation in a streaming landscape saturated with static catalogs. To fully capitalize on this momentum, services will need to continue investing in low-latency streaming, real-time overlays, and interactive frameworks that elevate live experiences beyond passive viewing.

Shoppable and interactive streaming

In 2026, streaming is no longer a one-dimensional entertainment medium — it has become a dynamic commerce environment where viewers transition seamlessly from watching content to purchasing products without breaking immersion. The rise of interactive and shoppable video represents one of the clearest intersections of media and retail, transforming viewership into an integrated commercial journey.

The global video streaming market is expected to reach $149.34 billion by 2026, fueled especially by shoppable video, i.e., fashion, beauty, home, and lifestyle categories. This shift reflects broader entertainment marketing trends, where seamless UX and contextual commerce outperform disruptive advertising.

Viewers prefer shopping options embedded directly into the viewing experience rather than disruptive pop-ups or external redirects. This preference has led platforms to rethink UX entirely, focusing on subtle, context-aware commerce that enhances rather than interrupts the narrative.

TikTok and Instagram Live have demonstrated the scale of this opportunity. Their interactive shopping events often produce conversion rates three to five times higher than standard e-commerce, driven by the immediacy of creator endorsements and the social dynamics of live participation.

Roku and Prime Video have likewise built sophisticated shoppable ecosystems. Roku’s commerce features allow viewers to purchase products showcased during cooking shows or lifestyle programs using on-screen prompts or QR codes synced with mobile carts. Prime Video integrates shopping prompts directly into select series, enabling users to pause and purchase items ranging from wardrobe pieces to household products, backed by Amazon’s retail infrastructure — which makes completion frictionless.

In this model, commerce becomes a natural extension of content rather than an add-on. It deepens engagement, increases session value, and opens new revenue channels for both platforms and creators. Data collected through these interactions offers rich insight into consumer preferences, informing both ad targeting and future content production.

By 2026, interactive streaming is emerging as a core monetization strategy rather than an experiment — and a defining feature of modern media and entertainment industry trends. Platforms that master seamless commerce integration will capture a competitive edge, while those that fail to adapt may find themselves reliant on traditional revenue streams that no longer keep pace with audience expectations or market dynamics.

Deepfakes, synthetic media, and content trust infrastructure

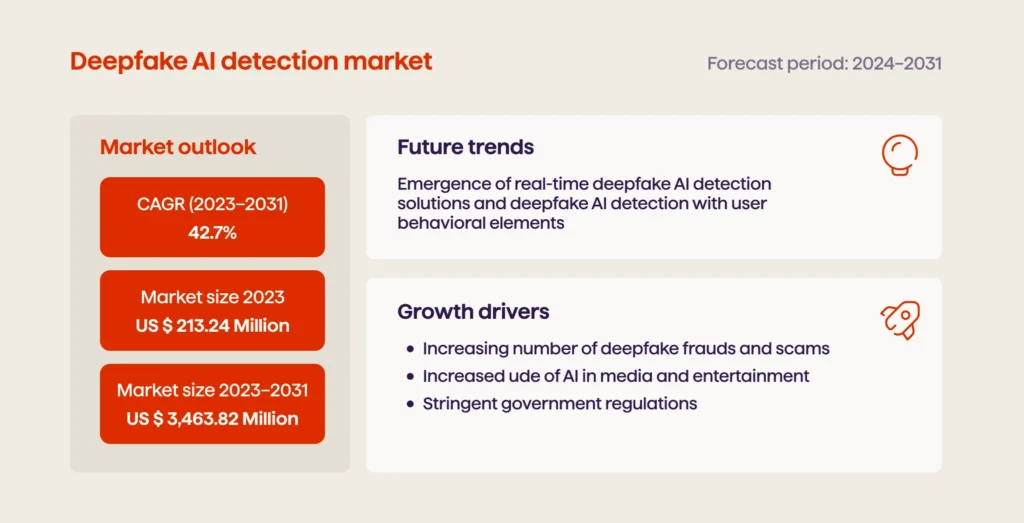

The rise of generative AI has transformed media creation, enabling unprecedented speed and creativity — but also introducing profound risks. Deepfakes, synthetic video, AI-generated actors, and machine-crafted narratives are increasingly common, blurring the line between authentic and artificial content. As adoption accelerates, trust infrastructure has become one of the most urgent media industry trends.

The size of synthetic media market was USD 563.6 million in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 42.79% to reach $13,889.8 million by 2032, illustrating both the scale of adoption and the magnitude of the challenge.

Viewers struggle to distinguish AI-generated content from real footage. Companies must embed authentication tools earlier in the production process, using watermarking, metadata tracking, and secure version control to prevent unauthorized manipulation of post-production assets. These safeguards protect both creative integrity and contractual rights.

Platforms are investing heavily in trust infrastructure. YouTube and TikTok have begun rolling out AI-powered detection systems capable of identifying synthetic footage with increasing accuracy. Both platforms require creators to label AI-generated content, positioning disclosure as a fundamental part of transparency and user safety.

Synthetic media carries several forms of risk:

- Misinformation becomes more potent when AI can generate photorealistic videos of public figures saying or doing things they never said or did.

- Brands face the danger of unauthorized synthetic replication that can damage reputation or violate intellectual property.

- Content owners worry that generative models trained on copyrighted material may inadvertently reproduce protected assets.

On the other hand, it brings a creative opportunity:

- Enables faster production and new forms of storytelling

- Creates a field for improvement by demanding investments in safety systems that protect audiences, advertisers, and brands.

Companies that build robust verification pipelines will position themselves as trusted environments — a decisive advantage as authenticity becomes a competitive differentiator across trends in media and entertainment industry.

Multi-CDN and low-latency

While content and personalization often capture headlines, the foundation of viewer satisfaction continues to rest on something far simpler: the quality of the streaming experience. In 2026, as global demand surges and interactive formats grow more sophisticated, the industry is making aggressive investments in the technologies that enable speed, stability, and scalability.

Multi-CDN orchestration has become standard practice among major platforms. Instead of relying on a single content delivery network (CDN), services distribute traffic across multiple CDN providers, dynamically rerouting streams to maintain low latency even during peak events. Media and entertainment companies deploy multi-CDN strategies that ensure viewers experience minimal buffering, reliable resolution shifts, and consistent playback regardless of geographic spikes in demand. This redundancy is now seen as essential for reducing performance volatility.

Ultra-low-latency streaming represents the next frontier. As live sports, esports, auctions, betting integrations, and interactive content gain importance, platforms aim for end-to-end latency under three seconds. This is not simply a technical milestone; it is a business driver. Low latency enables real-time polling, synchronized viewing across households, and seamless shoppable overlays. The platforms that master it are best positioned to capitalize on the booming live and interactive content markets.

Infrastructure investments have clear strategic implications. Superior delivery quality directly correlates with engagement and retention, while any degradation — buffering, pixelation, latency spikes — quickly drives churn. Infrastructure investments have clear strategic implications. Superior delivery quality directly correlates with engagement and retention, while any degradation — buffering, pixelation, latency spikes — quickly drives churn. In an environment where audiences have endless alternatives at their fingertips, technical performance becomes a silent differentiator. It shapes user perception, influences brand loyalty, and determines whether viewers stay through an entire session or shift to a competing service. In an environment defined by choice, technical excellence underpins every other media and entertainment industry trends discussed above. It shapes user perception, influences brand loyalty, and determines whether viewers stay through an entire session or shift to a competing service.

Conclusion

The media and entertainment industry of 2026 is defined by convergence: technology and content, monetization and engagement, innovation and trust. Platforms that successfully integrate hybrid monetization models, AI-driven personalization, interactive and live content, robust infrastructure, and trust mechanisms will capture the largest share of audience attention and revenue.

2026 will be a year when incremental revenue shifts become structural. Advertising will continue to assert itself as the dominant monetization engine, AI will move from tactical efficiency to product innovation, gaming and hybrid streaming will cement themselves as primary channels for reach and revenue, and live/local experiences will remain a crucial differentiator. Executives who treat these as integrated elements of a single growth playbook — with governance, partnerships and tech to match — will be the ones who capture the most value as the industry evolves.