Top ten technical due diligence service providers in 2026

January 29, 2026 10 min read

Technical due diligence has become a crucial component of every merger and acquisition. When evaluating an acquisition opportunity, potential buyers do not rely solely on the materials provided by the company selling the product. Potential buyers are interested in confirming that the technology has been validated by an independent, objective assessment of its performance. Technical due diligence provides buyers with the proof they need to make an informed decision about moving forward with the acquisition, and when successful, often increases the acquisition’s value.

To carefully evaluate all technical risks, you’ll need a reliable diligence team. This article will reveal a list of the top technology audit service providers to help you make more informed investment decisions in 2026.

Key takeaways on tech due diligence companies

- The technical due diligence process ensures that a company’s architecture (including coding), infrastructure, and compliance are complete before pursuing a merger, acquisition, or investment.

- A partner for technical due diligence should identify any potential problems and provide information on how an organization can increase its productivity by addressing genuine issues.

- A vendor should have a consistent record of trust and powerful technological skills. A quality vendor will possess a comprehensive understanding of engineering principles and their intersection with security, DevOps, and compliance.

- Technical due diligence protects your financial investment, helps you validate the value of the company, lowers your exposure to risks, and provides you with the ability to make more intelligent decisions through data analysis.

What is technology due diligence?

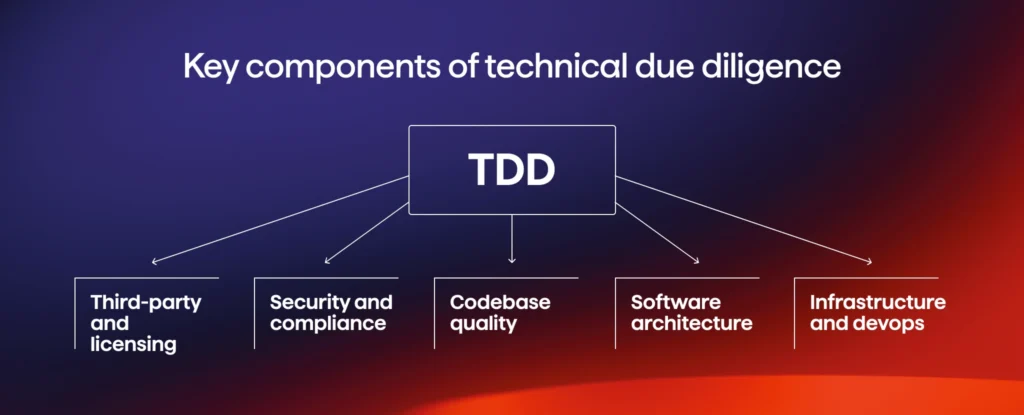

Investors, acquiring companies, or those entering into major partnership transactions often seek technology due diligence (TDD). It is a structured approach to gathering information to assess the risks and opportunities associated with investing in or acquiring a company, including the software, architecture, infrastructure, security posture, and engineering processes of the company being evaluated, among other factors. For investors or executives, TDD will help determine if the company has:

- the technical expertise,

- scalability,

- code quality,

- operational maturity, and/or

- compliance with regulatory requirements.

TDD has grown tremendously, with the market expected to increase from $8.5 billion (2024) to $16.7 billion (2034).

North America dominates the market, accounting for a 37% ($3.03 billion) share. The TDD process extends beyond identifying technological vulnerabilities to establish an organization’s long-term technology roadmap, as well as providing an assessment of whether a company’s product can sustain future growth.

Top technical due diligence companies in 2026

Before selecting from the various due diligence service companies available today, potential acquisition targets should determine which partner has the most remarkable ability to provide quality assessments of their target company’s technical platform, identify potential concerns at the outset, and offer recommendations for addressing issues. Using Avenga as an example, the following is a brief overview of the top players in the industry.

Avenga

Avenga offers a wealth of experience in its due diligence assessment services, which help investors and businesses evaluate the architecture, code quality, security posture, and long-term scalability of a business’s information technology. Avenga’s due diligence team, comprising over 500 tech experts, handles more than 4,000 security alerts each month, executes over 400 penetration tests, and identifies more than 2,500 vulnerabilities every three years.

We will help you identify potential risks and determine what is likely to become a high-cost investment, enabling you to make informed, data-driven choices about your future investments. Plus, Avenga provides clients with the necessary tools and resources to support their NIS2 compliance efforts — from initial risk assessment to ongoing monitoring programs, ensuring compliance, resilience, and a secure supply chain.

Sphere Partners

Sphere Partners has been in operation since 2005, helping individuals from startups to Fortune 100 companies navigate their technology. They’re not just tech experts; they thoroughly examine risk, data security, and the broader implications of how products and operations actually function. Most people know them for technical due diligence, but that’s just part of what they do. Investors and buyers rely on Sphere Partners to ensure post-merger integrations proceed smoothly, to plan divestitures, and to identify new ways to create value, always keeping technology choices aligned with fundamental business objectives.

AlphaSense

AlphaSense, a platform that utilizes artificial intelligence to accelerate due diligence research for the world’s major financial companies, is rated one of the best among 50 Top AI Innovators globally by the trust-rank companies Labeler and HBR. Using both outside sources of information and internal corporate memory, AlphaSense provides users with a greater context for analysis than any other information source available on the market today. Designed with a comprehensive set of explicit cybersecurity protections and state-of-the-art generative AI methodologies, AlphaSense is an advanced tool that enables business leaders to detect both risks and opportunities within months, rather than years, allowing them to make critical decisions in their organizations with high confidence.

AuditBoard

AuditBoard’s platform includes features and functions that support third-party oversight through the integration of internal audit, control management, and vendor risk factors. The automated assessments, intake workflows, and live dashboards provided by the vendor offer users a comprehensive overview of the entire risk lifecycle.

Additionally, this vendor has established a robust technical foundation that facilitates seamless connections between vendor risks and enterprise controls, as well as an integrated link to SOX/Audit processes. Furthermore, it provides a straightforward approach to implementing these processes quickly through APIs, templates, and connectors. This feature assures all users within the enterprise.

OneTrust

OneTrust pulls together everything you need to handle third-party risk, privacy compliance, and data governance, plus it keeps an eye on your ESG standards—all in one place. For private equity firms, this means you can finally get a clear picture of your entire vendor network without having to juggle a multitude of different tools. So, if you want real visibility into your software and tech supply chain, OneTrust makes it happen.

ProcessUnity

ProcessUnity’s third-party risk platform protects companies from cybersecurity threats and operational interruptions or breaches resulting from issues related to an organization’s vendor/customer relationships. In addition, ProcessUnity enables companies to conduct comprehensive audits of multiple vendors simultaneously, utilizing the most extensive collection of third-party risk-related data worldwide, as well as through AI-driven automation. As a result, businesses are better equipped to protect their intellectual property and customer data while allowing for continued efficiency within their vendor ecosystem, providing uninterrupted and secure solutions.

Forbytes

Forbytes is an end-to-end software development provider that collaborates with customers across various sectors in both North America and Europe, including e-commerce, fintech, real estate, logistics, and others. We offer technology due diligence services ranging from strategic and operational audits to technical strategy evaluations, infrastructure reliability reviews, SDLC assessments, process evaluations, and comprehensive security audits. Their objective is to identify potential risk areas and ensure that your company’s technology architecture aligns with your long-term growth strategy by providing organizations with specific, actionable recommendations for improved performance and sustainability.

Boston Consulting Group (BCG)

BCG is a global consulting company with offices in over 80 locations worldwide and more than 33,000 employees. The company provides various types of consulting services throughout the M&A and strategy process, including tech diligence consulting, to world-class companies such as Coca-Cola and Microsoft, as well as numerous private equity firms (e.g., KKR) and government agencies. BCG teams examine technological environments, operational processes, and future growth opportunities to enable clients to make informed and risk-aware investment and acquisition decisions.

Django Stars

Django Stars is a software and consulting agency that assists companies in developing, upgrading, and growing their online products. The company’s technical due diligence solution helps organizations validate their system architecture, coding standards, infrastructure, and security, enabling them to be audited successfully. The company has over 250 specialists offering legacy modernization services, cloud/DevOps solutions, and comprehensive product development for clients such as MoneyPark, BillionTwoOne, and PADI Travel.

Alacrita

Alacrita brings over 20 years of hands-on experience in both the pharmaceutical and biotechnology industries. They help startups with due diligence, leveraging their technical, scientific, and commercial expertise to deliver thorough assessments. With teams in Cambridge, London, San Diego, and Tel Aviv, they offer real support—whether it’s due diligence, product development, business growth, or figuring out the next strategic move.

Build a resilient business with Avenga. We combine advanced defense technologies with compliance expertise to protect your organization.

How to choose the right technical due diligence partner

Picking the right technical due diligence partner can make or break an acquisition, merger, or investment. You want someone who truly understands their field, someone who delves deeply into everything from software architecture and the codebase to infrastructure, DevOps, security, compliance, and third-party or licensing risks. When you’ve got a partner who gets all that, you end up with a clear picture of how the company can grow, what it’ll actually cost you in the long run, and where things might go wrong operationally. That kind of insight is what helps you move forward with absolute confidence.

When evaluating a potential partner, start by assessing their technical expertise. For example, a partner with experience in reviewing microservices architecture and cloud-native systems would be able to identify scaling risks that a generalist would not have the knowledge to recognize. Seasoned organizations will also be able to locate misconfigured systems, outdated libraries, or potential regulatory gaps, all of which are critical to companies within the fintech and healthcare industries.

A good TDD provider also brings tooling and methodology. TDD providers should incorporate static code analysis tools (such as SonarQube), dependency scanners, threat modelling frameworks, and automated DevOps audits into their process. A good partner will also verify the licensing status of any third-party software that may lead to a significant legal issue for your company later on.

In addition to these basic features, many TDD partners offer actionable insights, rather than just providing a list of items to check off. Quality teams will provide you with specific flags for concern, prioritised remediating schedules, and an execution roadmap for after closing your investment. For example, informing you that 40% of your codebase needs to be refactored or that your CI/CD pipelines lack any type of gating will enable you to make informed and timely decisions as an investor.

FAQ

Avenga: your trusted due diligence expert

For companies, conducting a thorough technical due diligence process assures their investors that the company’s valuation is sound, identifies potential issues before they become significant problems, and protects their investors’ interests. For end users, conducting a thorough technical due diligence will confirm their belief that the technology they are purchasing meets the security, performance, and regulatory requirements they expect from their vendor.

Want to learn more about regulatory compliance and adopt a holistic approach to your risk analysis? Contact Avenga, your trusted technical expert.