Current AI Trends in Insurance and the Factors Shaping Its Future

April 28, 2025 13 min read

Current and near-future applications of Artificial Intelligence (AI) in insurance can dramatically affect the industry’s future.

Ever since AI reached the level of stability and maturity needed for real-world applications, leaders in the insurance industry have consistently ranked it as one of the most potentially influential technologies available today. Some have even made moves to incorporate AI models into their processes as a means to turn unstructured data into value.

However, the insurance industry is not necessarily known for embracing drastic changes quickly, primarily due to its heavy regulation. Therefore, much of the transformation has been focused on narrow functions rather than holistic workflows, which has left many doors open for future development. In the front office, for instance, there are still underutilized opportunities to augment human intelligence through the automated extraction of customer query context and intent, as well as to reduce the costs of customer experience (CX) operations overall. In the back office, there are expensive claims management processes that could largely benefit from automation.

Additionally, as AI becomes more versatile, new frontiers will open up where human servicing capabilities could also be enhanced. By 2030, AI in the insurance industry will reach USD $35.77 billion, according to Forbes.

Why Is It Necessary for Insurers to Make Use of AI?

The rapid rise of GenAI

GenAI long ago transcended the realm of entertainment and found its way into real-world applications. Despite being heavily regulated, the insurance industry is one of the sectors poised to be profoundly transformed by this technology. By democratizing AI capabilities, the new models can assist carriers in achieving significant efficiency gains, implementing modern business models, offering personalized services, and ultimately, delivering high-impact outcomes throughout the value chain.

Per a paper by Deloitte, the most likely near-future applications of GenAI in insurance are described, and it highlights the current and upcoming trends in GenAI’s usage. Taking a potential car insurance application scenario as an example, the paper suggests that these GenAI models possess the unique attributes necessary for automating, at least partially, key insurance processes. Specifically, GenAI can carry out or optimize customer interaction, data anonymization (to exclude personally identifiable information), personalized quote generation, underwriting, and claims processing. BCG (Boston Consulting Group) confirms the magnitude of the implications of the technology’s adoption. They note that currently, customer service agents spend up to 35% of their time retrieving information from various sources and state that by delegating data-related routine tasks to GenAI, organizations can reduce operational costs by as much as 50-60%.

Digitization and Client Expectations

Ever since COVID-19 hit, insurance carriers have practically been forced to digitize operations in order to accommodate remote workforces as well as upgrade online channels to interact with clients. As they continue to enhance their digital capabilities, they will need Machine Learning (ML) algorithms to scale operations. And, as these algorithms are being increasingly adopted, the business landscape is gradually changing, along with clients’ expectations for speedy interactions are rapidly growing.

To prepare for these shifts, executives must pay special attention to the driving factors behind them, as well as gain a firm understanding of how AI technologies of different types can reshape large chunks of insurance processes, especially underwriting and claims processing.

New Data

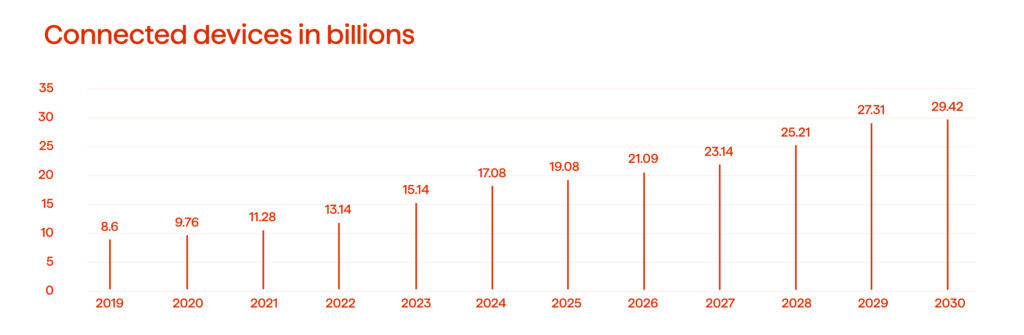

The number of connected devices in the world is expected to reach 29.42 trillion by 2030 (see Figure 1). Therefore, forward-thinking carriers should take into account the rapid growth of data that will be generated by them. These devices include a wide range of products, such as fitness trackers, connected cars, smart home assistants, smartphones, and smartwatches, as well as emerging tools like connected eyewear, IoT home appliances, and new medical devices. The data generated by these devices can potentially help insurance organizations gain deeper insights into their clients so that they can develop more personalized product offerings and pricing strategies.

New Ecosystems

As the adoption of IoT technologies becomes increasingly prevalent, it is anticipated that new open-source protocols will appear to ensure secure and efficient data exchange across various industries. To facilitate this, private and public organizations are likely to come together and establish protected ecosystems that enable information sharing while adhering to common regulatory frameworks.

Also, incorporating AI into their operational strategies for the next few years is becoming paramount for insurance organizations, because it can enable improved business models and lead to massive customer service enhancements. Therefore, staying updated with the latest developments in IoT and AI, and their related regulations is essential for businesses and organizations in this ever-evolving landscape.

Current State of Underwriting

Underwriting is the side of insurance that appears to be most ripe for change with AI. Currently, there is a notably high rate of churn in placement and insurance shopping behaviors, both in personal and commercial lines, as well as in group insurance. There is significantly more shopping happening in the industry compared to in the past. However, despite people comparing prices for new and renewable policies, this often does not result in them switching insurers. Consequently, underwriting teams are now grappling with significantly increased workloads for roughly the same level of profitability. They are dedicating substantial amounts of time to preparing files, making a bid, and providing quotes for opportunities that often do not yield profit.

Furthermore, they are spending approximately 70% of their time on non-core underwriting activities. This issue is exacerbated due to brokers submitting ever increasing numbers of applications. In such cases, wasting time while underperforming on key underwriting metrics, like quote-to-bind ratios and yield ratios, contributes to a carrier’s overall inefficiency.

Issues That Could Be Resolved with AI

Traditionally, insurance operates as an intermediary business, where distribution is facilitated through trusted third parties. Currently, these intermediary channels are undergoing significant changes. Some companies have opted for complete digitization of their processes, while others have adjusted only their submission procedures. And, all of these modifications must be handled by underwriters.

Disruptions are also a significant concern, particularly in areas related to accurate risk selection and assessment. This can be attributed to the impact of COVID-19 on the medical and automotive industries, pandemic-related business process interruptions, and supply chain challenges.

Learn more about how we enhanced the customer experience to increase conversion rates for Trov. Success story

Another consideration is the aforementioned abundance of data sources, and the numerous new ways to integrate insights and enhance existing data sources, which underwriting staff must familiarize themselves with and find effective ways to incorporate them into their workflows.

AI is the technology poised to help address these challenges in the various aspects of file-level activities, including:

- Document extraction

- Third-party analytics

- Prioritization and triage

- Decision accuracy

How Do You Approach the AI-Enabled Underwriting Transformation?

If your company is considering utilizing AI, the first area to focus on is the leveraging of ML in order to harness multiple external data sources and to facilitate a broader comparison of claims and submissions, allowing for the quick identification of similarities. It’s often the case that a submission falls outside the expertise of a particular underwriter, but the carrier, in general, has encountered many similar submissions. An AI tool can empower each individual employee to expand their search parameters and effectively identify patterns, even if the submission is beyond the specific segment they typically handle.

Regarding the issue of discontinuity, it can also be mitigated when employees are capable of handling submissions that are unlike those found in their usual workload. Thus, AI can help an organization’s staff to operate as a hive mind, always thinking and handling tasks from the perspective of the carrier at large and mitigating the gaps in an individual’s knowledge.

In our experience working with insurance carriers, many of them already have AI tool proof-of-concepts (PoCs), run experiments, and have tried various out-of-the-box solutions for data, propensity models, renewals, etc. However, for these organizations to operate effectively, connectivity and orchestration across the entire process must be established rather than integrating several point or third-party solutions into the existing workflow.

So, What Exactly Can a Connected AI System Do?

Currently, brokers’ requests typically arrive in the form of emails, which then need to be inspected, analyzed, and structured in a specific way for the underwriters to determine if the submission is of interest. Advanced models, when applied properly, can:

- Read the emails and accurately categorize their contents.

- Route the emails to the necessary groups.

- Extract content from both the email and attached documents and evaluate if there’s enough information for the submission to proceed or if additional data is required (in which case it would be sent back to the broker).

- Enrich them with existing internal comparative data and external data.

- Determine, based on predefined rules, the feasibility of underwriting a particular request. AI can assess the likelihood of success based on past similar deals and the carrier’s expertise within that niche.

AI can consolidate all of these insights into comprehensible widgets within an underwriting portal. This isn’t about fully automating underwriting, but providing staff with the information needed to expedite the pricing and submission process. Experiments show that a holistic solution like this can help carriers achieve a 20%-40% reduction in speed-to-quote and cut cycle time by 50%.

When considering GenAI specifically, these models excel in rapidly analyzing extensive sets of structured and unstructured data. They can deliver timely insights that empower underwriters to enhance their assessment of potential risks, better calculate claim probabilities, make well-informed underwriting decisions efficiently, and establish appropriate pricing for individual customers.

Issues in Claims Processing

On the claims processing side, implementation of profound changes is required as, currently, one in three claimants have expressed dissatisfaction with how their requests are handled. This dissatisfaction is typically not primarily related to the settlement amount, but rather to the cycle time (the time it takes to settle the claim) and the complexity of the settlement process from the client’s perspective. To address this issue, it is imperative to reshape the entire process of client interaction, including decision accuracy.

As far as contact and call centers go, a substantial portion of the requests revolve around basic claim status checks, address changes and other tasks that could easily be handled through the introduction of AI intelligence or even “smart” rule-based systems.

In terms of challenges, indemnity accuracy remains one of the key concerns for every adjuster. But, maintaining it becomes increasingly harder due to rising inflation, chip shortages, supply chain interruptions, and other current factors.

Another issue is the persistence of many manual processes in the claim adjuster’s workflows, resulting in a fragmented experience for clients. While many carriers have digitized some portions of their claims processing, comprehensive end-to-end transformation is still hard to come by.

All these issues result in insurance carriers being unable to meet their clients’ expectations. With the rapid adoption and emergence of technologies, coupled with the often-exaggerated advertising of tech advancements by companies, clients expect the processes to become significantly easier and quicker, but unfortunately that’s rarely the case.

Using AI to Gain Efficiency

AI, at its current state, would serve carriers best if aimed at expediting the flow of claims through the pipeline. Currently, each step in the processing of claims is rife with delays due to different teams being involved. This disjointedness leads to additional friction, calls, and miscommunications, significantly slowing down the process. This holds true for both simple claims and complex ones, where adjudication and claim filing naturally take longer; but despite this huge efficiency gains can still be achieved through automation.

AI can accelerate several simple claims processes:

- Eligibility checks based on policy possession matching the claim, which can be handled at the start of filing the claim

- Facilitating seamless intake for simple high-volume claims through mobile or web portals

- Assisting with automated verifications of covered events and coverage determination with the proper infrastructure on the back end

- Fraud detection and decision support

- Automating and simplifying payment verification, extracting insights, and obtaining feedback

While a multitude of point and third-party solutions are readily available to claim adjusters, coupled with diverse packages catering to both personal and commercial insurance lines, it is still crucial to ensure connectivity and a seamless flow of operations. Furthermore, despite low-complexity claims being well-suited for partial or complete automation, there is a category of claims that will not be involved in the AI-enabled procedures because they encompass high-emotion and high-complexity claims, exemplified by scenarios such as DNO and ENO in the commercial sector, as well as death claims and long-term disability in life insurance. In these intricate cases, the adjuster works closely with the claimant and the employee’s EQ, which is far beyond the capability of any AI system despite being the carrier’s most valuable asset.

GenAI chatbots, which are increasingly being explored for integration into claim processing, excel at gathering user information during the initial notice of loss and responding to fundamental inquiries. Furthermore, claimants can then utilize the chatbot channel to obtain real-time updates on matters such as triage, pertinent policy clauses, and repair services. This technology offers the potential to substantially alleviate the call center workload and accelerate turnaround times, thus elevating the overall user experience.

Summing Up

Insurance is a complex and heavily regulated industry that revolves around people and data. AI, in its various forms, holds the potential to profoundly reshape insurance by transforming this data into value, unlocking new levels of productivity, and helping firms build a lasting advantage.

The current trends are mostly tied to the emergence of new data sources and the need for insurance professionals to incorporate them efficiently into their workflows. Claims processing and underwriting are the first two sectors that are being significantly modified in the current landscape. Leaders who can meaningfully change these processes and build holistic and automated flows with AI will gain a competitive edge and be in a better position to meet the ever-growing expectations of the clients.

If you would like to learn more about how AI can help you streamline and enhance insurance processes, and future-proof your business, please reach out to our experts right now for a free consultation.