Banking technology trends 2026: The future of money is here

November 19, 2025 13 min read

Modern consumers expect next-level customer experience across all sectors, including digital banking solutions. Recent trends in banking include embedded banking, ESG, open banking, conversational AI, and quantum computing. Blockchain technology, hyper-personalization, and generative AI are continuing to gain momentum as digital transformation dictates its rules. Over the next five years, the digital banking industry is expected to continue expanding, according to Statista. Net interest income from digital banks is projected to increase at a compound annual growth rate (CAGR) of 6.80% between 2025 and 2029, reaching $2.09 trillion by that time.

This article examines the most promising banking technology trends that will enable top players to stay ahead of the competition. Continue reading to learn more about the rise of digital banking technology in 2026.

Key takeaways

- Embedded finance integrates payments, credit, and protection into journeys to improve conversion, Average Order Value, and repeat purchases.

- Agentic AI will execute compliant, auditable workflows, including onboarding, servicing and fraud to reduce operating cost and time to yes.

- Open banking and hyper-personalization create data-driven real-time offers that improve satisfaction, retention, and share of wallet.

- Banks that improve cybersecurity, align with ESG, and pilot quantum modeling will future-proof risk, trust, and growth.

The rise of embedded finance in everyday transactions

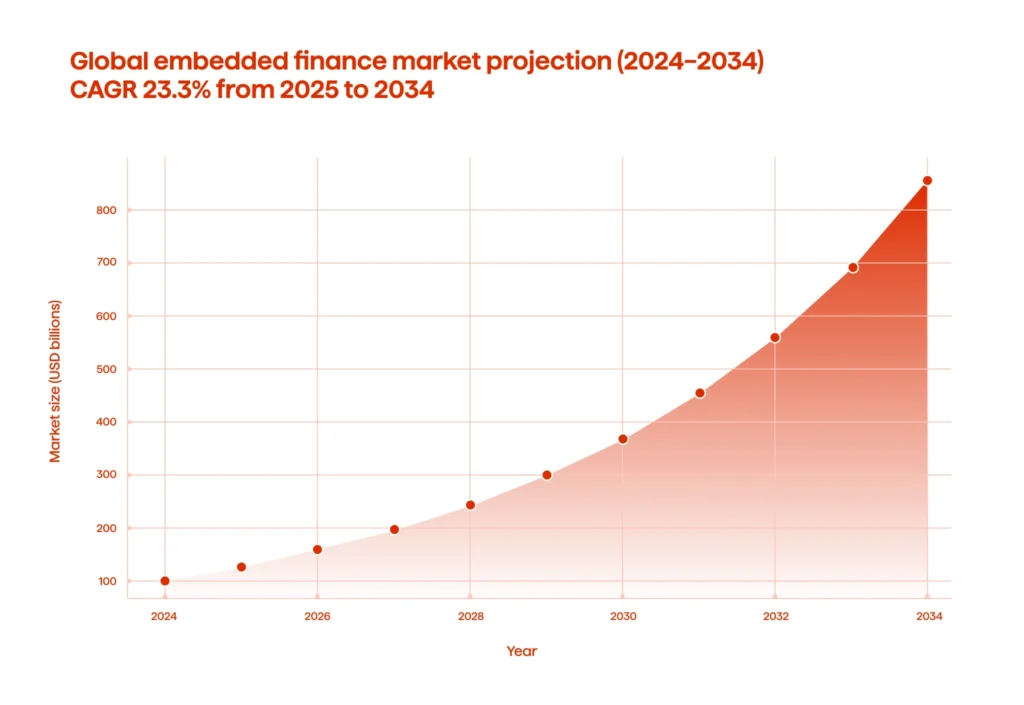

Between 2025 and 2034, the global embedded finance market is expected to expand at a compound annual growth rate (CAGR) of 23.3% from its 2024 valuation of USD 104.8 billion.

Embedded finance new technology in banking is expanding rapidly due to the swift adoption of digital payments in both consumer and commercial sectors. As consumers increasingly expect embedded payment solutions in their daily activities,among other technologies in the banking sector, companies are integrating financial services into their platforms. But how does the whole “embedded finance” concept work in practice?

APIs are essential for embedded finance because they allow financial services to be directly integrated into a company’s platform or product. As an example:

- The retail platform may integrate a fintech-powered payment gateway to enable consumers to pay without leaving and being transferred to another third-party application.

- A taxi service may offer financing options to drivers via a partner financial institution.

Embedded finance allows financial services to be smoothly integrated into non-financial platforms or products. Services such as payments, lending, and insurance are offered directly through these ecosystems, saving users the effort of contacting traditional banks.

Numerous sectors employ embedded finance to enhance the client experience. For example,

- eCommerce platforms. Buy-Now-Pay-Later (BNPL) solutions and other integrated payment options are available on Amazon and Shopify, ensuring a smooth transaction experience.

- Ridesharing services. Apps such as Uber and Lyft use digital wallets, facilitating easy transactions between drivers and passengers.

- Healthtech. To make things easier for patients, telehealth systems incorporate payment gateways and insurance verification.

Banking industry trends are no longer confined to traditional institutions. While customers’ expectations are evolving, so is the very concept of banking — invisible yet essential to modern life.

Hyper-personalization in banking: meet customer expectations

Across all industries, hyper-personalization has emerged as one of the latest trends in banking, drawing attention and transforming the way companies deliver top-notch customer experiences. Banking is certainly not an exception. Customers have raised the bar, expecting nothing less than tailor-made experiences at every turn and across all digital channels. Generic messages are now viewed as spam, while one-size-fits-all solutions are no longer sufficient.

Although an increasing number of banks recognize hyper-personalization as a key growth factor, many still struggle to implement it efficiently. While nearly 71% of banks are using personalized campaigns and communications, less than 50% are leveraging enterprise customer data management, proactive advice and recommendations, data-driven micro-segmentation, human-augmented sales, and AI and ML-driven recommendations, according to the report “Maximizing Digital Engagement,” co-produced by Infosys Finacle and Qorus. However, banks are making progress in bridging the gap. So, what does it truly mean to offer highly personalized banking services?

In this digital age, hyper-personalization encompasses much more than just meeting all the requirements for knowing your customer (KYC). It involves creating a comprehensive profile of each client by analyzing interactions across various touchpoints, such as purchases, support requests, social media, and spending trends. For instance, if a bank identifies that a customer frequently travels abroad, it can proactively offer international credit card options or travel insurance before the customer even considers these needs.

However, understanding your client base is only half the fight. Utilizing data and drawing insightful conclusions is the next stage. This implies leveraging:

- descriptive insights, such as determining that a consumer frequently purchases electronics online,

- diagnostic insights like realizing that their spending has increased, aligning with significant sales or life events,

- predictive insights, such as identifying when your customer might need to take out a loan for a major purchase, like a house or car.

Having said that, hyper-personalization is the skill of making each client feel appreciated, understood, and ahead of the curve in their financial path.

Agentic AI in banking

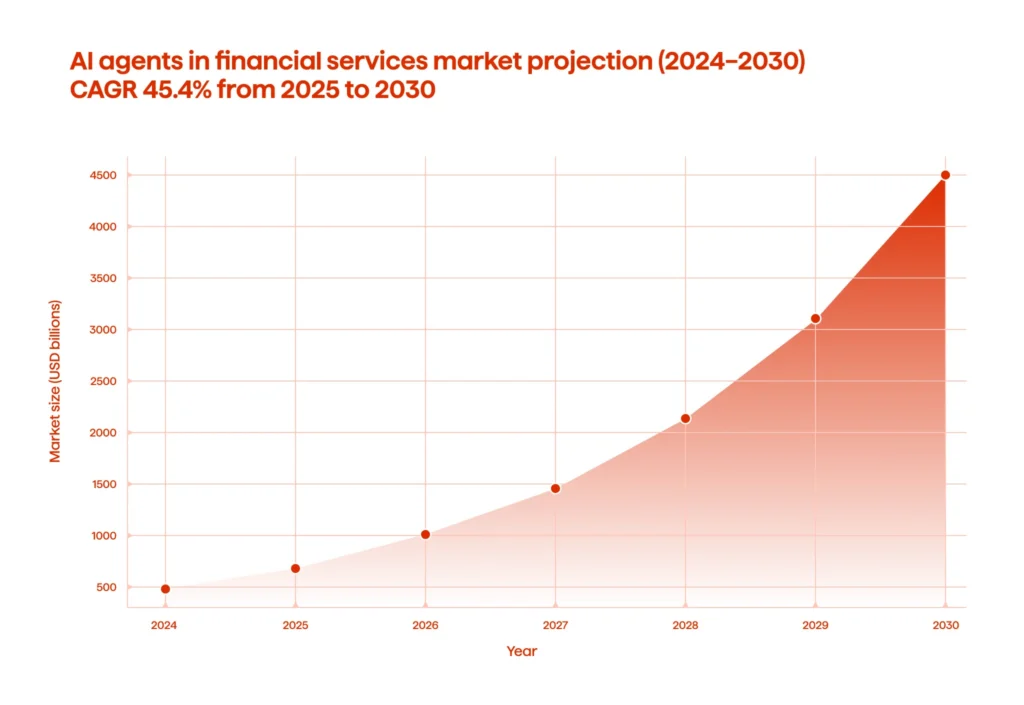

The market for AI agents in financial services was anticipated to be worth USD 490.2 million in 2024 and is expected to expand at a compound annual growth rate (CAGR) of 45.4% from 2025 to 2030, reaching USD 4,485.5 million.

Agentic AI takes banks from “assistive chat” to autonomous, goal-oriented workflows that plan, act, and learn within policy guardrails. Instead of just handing bankers a summary, an agent will verify KYC data, draft and file case notes, request missing documents, simulate risk impact, trigger payments, and schedule follow-ups – all hands-free and fully auditable. In retail banking, agents drive proactive offers (e.g., pre-approved limits, savings nudges), triage fraud in real-time, and provide personalized service that continues across all touchpoints. In commercial banking, agents reconcile invoices, orchestrate treasury operations, and monitor covenants, culminating in an escalation path to a human.

What makes this applicable at scale is a control stack:

- role-based permissions;

- fine-grained data masking;

- tools restricted to approved APIs;

- in-line human check for high-risk actions, and

- end-to-end observability (reasoning traces, immutable logs, and policy alerts).

For banks that are creating embedded financial services or partnering on embedded financing, agentic systems can coordinate lending, payouts, and compliance behind the scenes, connecting lending decisions to identity, risk, and transaction context. The outcome is faster time-to-yes, lower servicing cost, and higher NPS without the need for increasing headcount.

Technologies enabling the ESG movement in banking

The ESG movement is all about reframing banking’s role in promoting sustainability and social responsibility, not just about compliance. Here’s the list of emerging technologies in banking that enable the ESG:

Blockchain for trust and transparency

In terms of ESG advancements, blockchain is recognized as one of those leading technologies. It enhances the transparency of trading carbon credits, issuing green bonds, and other sustainability-focused financial operations.

Machine learning and AI for ESG analytics

With the use of this technology, banks can now evaluate vast amounts of data to find ESG possibilities and risks. Artificial intelligence-powered advanced tools can predict the environmental impacts of lending practices, measure the carbon footprint of investments, and even examine social and governance factors, such as business diversity and labor practices.

IoT for real-time monitoring

Thanks to the Internet of Things, banks can now track the environmental impact of projects they fund in real-time. Sensors will measure water use, emissions, energy use, and other key parameters to provide valuable information for informed decisions that can help achieve sustainability objectives.

Platforms for inclusive finance online

On the social front, digital banking platforms promote financial inclusion by providing fundamental financial services to marginalized groups. By filling gaps in financial accessibility, technology—from mobile wallets to microfinance apps—is helping banks meet the “S” in ESG.

Generative AI: revolutionizing customer service and operations

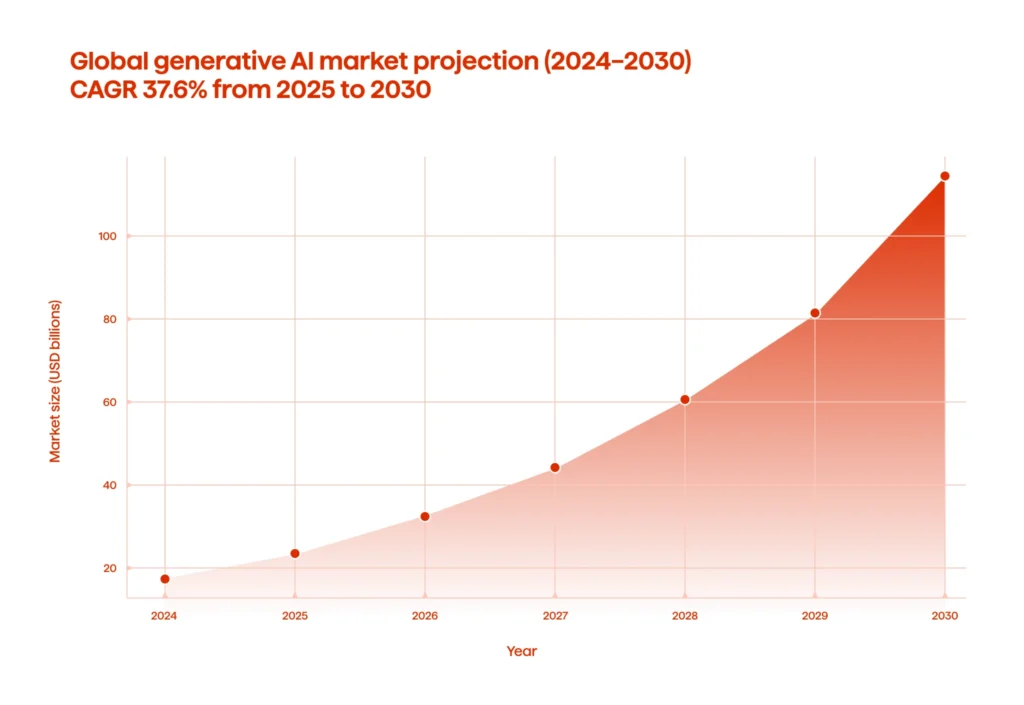

Generative AI in banking is a technology that no modern bank can afford to avoid: the efficiency and multifunctionality it provides are unprecedented. The global generative AI market size was estimated at USD 16.87 billion in 2024 and is expected to expand at a compound annual growth rate (CAGR) of 37.6% from 2025 to 2030, reaching USD 109.37 billion by 2030.

But why exactly is Gen AI one of the most promising banking tech trends? The primary reason is that it is multifunctional: from automating processes to detecting and preventing fraud, this tool is reshaping traditional banking to a record-breaking extent. Take, for example, Morgan Stanley. Earlier in the summer of 2024, the banking industry giant reported that it had completed deploying its second-generation artificial intelligence application to financial advisors, prioritizing in-house solutions over off-the-shelf tools. Developed in collaboration with OpenAI, Morgan Stanley has unveiled AI @ Morgan Stanley Debrief, a tool that summarizes video sessions and creates follow-up emails. It was developed after the release of the bank’s first generative AI tool, an AI knowledge assistant.

Blockchain beyond cryptocurrencies: the backbone of trust

Beyond its origins in Bitcoin, blockchain technology is transforming banking; one of its most significant applications is fraud prevention. Blockchain makes it nearly impossible for fraudulent activity to go unnoticed. It establishes an immutable ledger that guarantees every transaction is safely recorded and validated. By helping banks identify irregularities in real-time, this degree of transparency promotes security and trust.

Facilitating the KYC process is another compelling use case. Blockchain enables banks to store and exchange client-identifying information with other institutions safely. KYC data may be accessible and validated on a shared, impenetrable blockchain, eliminating the need to repeat the process each time a consumer interacts with a different bank. This lowers the chance of data breaches, saves money, and shortens onboarding periods.

In addition to these benefits, blockchain enhances operational efficiency by eliminating intermediaries, facilitating faster settlements, and increasing transparency in international transactions. It is transforming traditional banking systems, proving its value as more than just the foundation for cryptocurrencies.

Achieve unparalleled growth with Avenga’s tailored digital banking solutions.

The promise of open banking and API-driven innovation

Better customer experiences are one of open banking’s main promises. APIs facilitate simple interfaces between banks and fintechs, providing consumers with access to cutting-edge services such as aggregated account views, tailored financial advice, and budgeting tools—all on a single platform. Tink, for example, is a banking app that uses open banking APIs to provide individualized financial data.

Customers who use open banking have greater autonomy and control over their financial data. The advantages of APIs and open banking are numerous:

- Convenient and customized financial experiences: APIs simplify the management of multiple applications by enabling tailored features like account aggregation, investment analysis, and budgeting, all within a single platform.

- Faster, seamless services with innovation: Real-time data sharing boosts efficiency and fosters innovation, enabling instant credit approvals, simplified payments, and smooth integration with fintech and e-commerce services.

- Inclusive financing: Open banking facilitates better access to financial services for underserved groups while ensuring the safety and transparency of shared customer data, all in compliance with relevant regulations.

- APIs for competitiveness and new opportunities: APIs enable banking and financial services companies to gain market access, drive innovation, enhance financial products, and generate new revenue streams for banks and businesses.

Leveraging quantum computing for advanced financial modeling

With an estimated $2 trillion in potential economic benefits by 2035, quantum computing is sure to transform the financial services, pharmaceutical, chemical, and transportation industries. Financial services are poised to gain early advantages by applying quantum technology to problems of risk management, fraud detection, and portfolio optimization.

Quantum systems can process multiple variables simultaneously, dramatically reducing computing time compared to classical computers, which analyze data sequentially. This makes quantum technology particularly valuable for financial modeling, where billions of data points need to be examined to price complex derivatives or develop effective investment strategies. For example, quantum algorithms can generate actionable insights in seconds and compute high-dimensional risk models that would take traditional systems days to complete.

Financial services companies and banks are exploring the potential of quantum computing to enhance process accuracy and efficiency. As emerging technologies in banking advance, they could significantly improve decision-making, reduce costs, and revolutionize how financial institutions tackle complex challenges — all essential for the future of global banking.

Cybersecurity innovations to combat evolving threats

As cyber-attacks become more sophisticated, the banking sector is using cutting-edge technologies to safeguard financial systems and consumer data. The following is how banks are addressing these issues:

- Passwordless authentication. To enhance security and consumer convenience, banks are increasingly utilizing biometric fingerprinting, facial recognition, and hardware security keys in place of conventional passwords. These technology solutions provide a smooth login experience while removing threats such as phishing and password reuse.

- Behavioral authentication: AI-powered systems monitor user activity, such as typing speed, navigation patterns, and device usage, to detect irregularities. This dynamic security layer identifies suspicious activity in real time, enhancing security without disrupting the user experience.

- PSD3 setup: With the impending Payment Services Directive 3 (PSD3), banks are being required to implement advanced cybersecurity measures, including multi-factor authentication and secure API architecture. These initiatives help build trust in open banking systems while ensuring compliance with more stringent regulations.

- Addressing social engineering threats. Banks utilize AI systems to identify suspicious activity and implement comprehensive training programs to mitigate human error, a significant vulnerability in cybersecurity.

- Biometric authentication. The latest innovations in the banking industry, such as fingerprint verification, iris scanning, and voice recognition, significantly enhance security. Biometrics make it easier for users to access their accounts and complete transactions because they are more secure than passwords.

FAQ

Embracing innovation to shape the future of banking

The banking landscape has adopted technology investments primarily focused on delivering the best possible customer experience. Whether it’s providing top-notch security, open banking, or embedded finance, all the emerging trends will keep the user as the focal point.

Contact Avenga, your trusted fintech software development services partner to learn more about banking technology trends for 2026 and beyond.