Biometrics, OCR, and AI: the technology powering modern identity verification

October 29, 2025 11 min read

Identitas probanda est — identity must be proven.

That proof must be fast, transparent, and ironclad in fintech. Those first few seconds of verifying identities for digital onboarding set the expectations for trust, conversion, and compliance. If done right, you keep the fraud out without denying access to good users. This is where the customer onboarding best practices—OCR for documents, biometrics for presence, and AI for risk—work in a single flow rather than three hurdles. This article explains how the stack fits together and common field patterns to watch for.

Key Takeaways

- AI, biometrics, and OCR create a single coordinated workflow that enables fast, auditable identity verification for digital onboarding and is highly secure.

- Following the best practices in banking customer onboarding—lightweight by default, step-up on risk—increases conversions while decreasing manual reviews and fraud losses.

- Biometrics (face match + liveness) create the user-to-document bind intrinsic to identity verification for remote onboarding, and NFC or active checks are reserved for high-risk sessions.

- Plan for verifiable credentials, on-device checks, and explainable AI to future-proof onboarding as regulations, threats, and user expectations evolve.

OCR: data capture and extraction (document-to-digital)

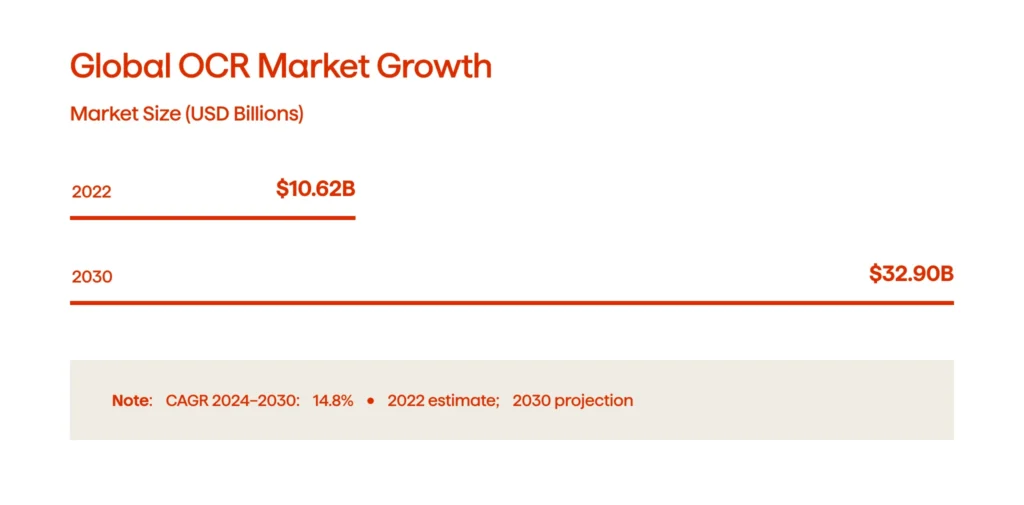

Optical Character Recognition (OCR) is the entry point of modern KYC. It takes photos of identity documents (e.g., ID cards, passports, utility bills, bank statements) and converts them into structured fields that the system can trust. With the market size estimated at $10.62 billion (2022) and projected to grow to $32.90 billion by 2030 (14.8% CAGR, 2024–2030), OCR is a cornerstone of ID verification for digital onboarding.

In reality, contemporary OCR does a lot more than just read characters. It stabilizes images (de-skew, de-blur, glare removal), detects layouts without burdening the layout with rigidity, and parses the MRZ/barcode/QR to cross-reference name, DOB, document number, and expiry. It even provides a confidence score with each field, allowing downstream systems to determine whether to auto-approve, request a retake, or route to assisted review for a single field, keeping the journey fast while maintaining KYC/AML expectations.

Fintech teams also use document intelligence technology to detect tampering, such as font discrepancies, differences in metadata, or mismatched checksums in “edited” PDFs. It is essential that these checks are unobtrusive and can detect forged statements and recycled IDs quietly before entering the queue. Privacy has become a non-negotiable; leading implementations process in-region or on-device, redact sensitive areas, and hash evidence for audits.

A few digital onboarding best practices tighten the loop:

- Bind person to document. Leverage OCR technology alongside facial recognition and liveness detection for authentication, facilitating verification.

- Act on confidence. Implement clear thresholds that automatically pass reliable fields and only prompt questions for uncertain items.

- Normalize and validate. Standardization of names/addresses is required, and expiration/age must be verified before creating the account.

When OCR is optimized with biometrics and AI risk scoring, teams observe shorter manual reviews, faster decision-making time, and lower fraud loss without friction.

At Avenga, we enable financial organizations to unlock unprecedented growth by integrating AI and ML into digital frameworks.

Biometrics: personal confirmation (user-to-document)

Biometrics represents the point in onboarding that moves past pixel integrity and trusts the actual person. It ties a “real” live user to the document OCR just extracted—confirming presence and preventing identity theft. The biometrics market was valued at $34.27 billion in 2022 and projected to reach $150.58 billion by 2030 (20.4% CAGR, 2023—2030). Biometrics has already become the de facto second step in the predominantly digital customer onboarding process.

In fintech, face matching (1:1) with liveness is the workhorse. A passive liveness approach looks for micro-signals—such as depth cues, texture, moiré—that don’t require users to perform some awkward gesture. An active liveness approach adds a quick prompt (turn your head, blink) for even stronger spoof resistance in high-risk flows. The outcome is a clean “user-to-document” bind: the face in the selfie matches the face on the ID, and the capture is live, not a replay. That one claim reduces manual review, shuts down recycled-ID rings, and keeps conversion healthy.

A well-executed implementation will optimize both speed and security. When a low-risk card top-up accepts passive liveness, they set confidence thresholds that increase only when necessary.. In contrast, high-limit lending requires an additional challenge or a second modality.

Inclusivity is also essential. Models trained on wide variations in age, skin tone, and lighting should create lower rates of false rejections. At the same time, thoughtful UI copy and retry logic will help an honest user get back on board without making a loophole. Regarding identity verification for remote onboarding, on-device checks will minimize latency and help with data residency. In contrast, server checks will add deeper spoof defenses for higher-risk segments.

| Option | When to use | Why it works |

|---|---|---|

| Face + passive liveness | Default for identity verification for digital onboarding | Lowest friction; strong replay/print spoof defense |

| Face + active liveness | Step up on risk (limits, new device, flagged session) | Extra challenge boosts spoof resistance with minimal added effort |

| NFC ePassport/eID tap | Markets with NFC-enabled IDs; identity verification for remote onboarding | Cryptographically signed chip data; high trust with quick tap |

| Device biometrics (Face ID/Touch ID) | Re-auth after digital customer onboarding | Instant, familiar; great for ongoing protection (not a doc match) |

AI/ML: the intelligence layer (fraud detection and analysis)

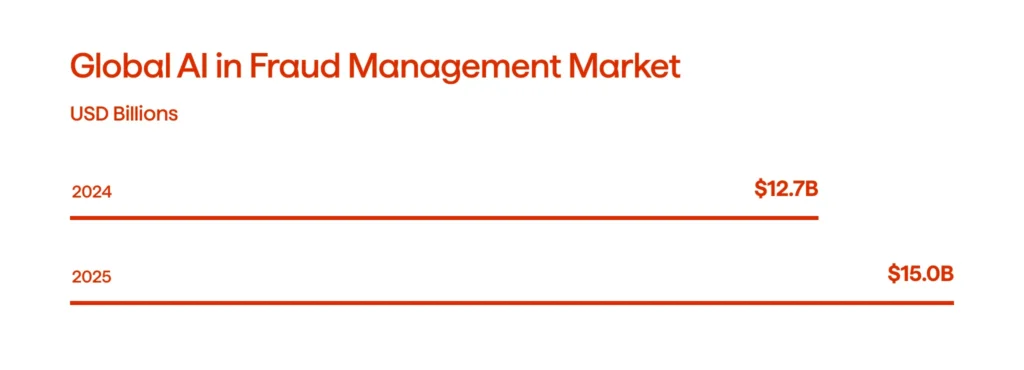

AI makes onboarding decisions faster and smarter. The fraud management industry alone is expected to grow from $12.7 billion (2024) to $15.0 billion (2025) — signaling that models are advancing from piloting to production. In cases where onboarding verification is required, AI/ML combines document-based signals (utilizing OCR), biometric outcomes, and device and behavioral data into a single risk-based decision score. Low risk? Auto-approve. Unclear? Step up with liveness or NFC. High risk? Deny and submit a case without losing trusted users in the process.

Operationally, it boils down to: gradient-boosted trees or tabular deep nets for scoring, unsupervised anomaly detection to catch new patterns, and rules as policy guardrails. A feature store can keep signals consistent across batch and real-time scoring, and explainability will highlight some of the “why” behind a decision, proper for audits and appeals. The best programs include model monitoring (drift, false accept/reject), then rapid retraining, so fraud rings do not get months of free runway.

If banking institutions are adhering to customer onboarding best practices, orchestration should be just as important when onboarding customers as the accuracy of data: step up, only when risk is high; log evidence for regulators; and track your business KPIs (auto-pass rate, manual review rate, time to decision, and loss avoided). Our digital banking development services can link the dots—data, models, and policy—if you’re modernizing your stack. This will ensure that fraud is prevented before it begins and that good clients receive approvals instantly.

Key applications and impact

In financial technology, the greatest value occurs at account opening and the issuance of card products. OCR does a good job at grabbing information from the document, biometrics tie the person to the document, and AI risk scores happen in milliseconds; therefore, good customers pass on the first try, while high-risk customers are bumping up against identity verification or are denied. That is how you demonstrate customer onboarding best practices in banking: fast when it can be, strict when it absolutely has to be, and always with auditability.

Payments, wallets, and remittance flows take advantage of the same orchestration. The everyday top-ups slide through with passive liveness, while uncommon corridors, new devices, or large amounts trigger an NFC or active liveness. You see it in real metrics: fewer false declines, fewer manual reviews, and less abandonment—all without letting mule accounts or account takeovers slip through.

Lending involves additional complexity. OCR is used to validate proof of income and identity, biometrics verify that the user is present, and AI pulls together bureau information, device reputation, and behavior to reduce risk. Approvals for low-risk bands happen quickly, fewer synthetic identities exist, and underwriters are free to spend time where they matter. After onboarding, the stack is still working—device biometrics for normal re-authentication, a facial recognition + liveness check for sensitive changes—fewer support tickets and less abuse of account recovery.

The numbers do the talking:

- greater conversion (more legitimate customers verified in a few seconds),

- reduced cost (shorter queues, fewer manual checks),

- fraud loss reduction, and

- cleaner audits, supported by evidence artifacts, and reproducible decisions.

Long story short, pulling together OCR, biometrics, and AI will help you transform onboarding from a compliance burden to a growth lever.

Future perspectives: decentralized identity and adaptive systems

The concept of identity is shifting from ‘prove everything up front’ to ‘prove only what is needed when it is needed.’ Decentralized identity (DI) adds verifiable credentials (VCs) and digital wallets into the onboarding and re-auth process. Instead of re-uploading documents, customers simply present cryptographically signed proofs from trusted issuers such as banks, governments, and employers.

Through selective disclosure and zero-knowledge proofs, they can check facts like ‘over 18,’ ‘current address,’ or ‘salary over X’ without revealing sensitive underlying information. For fintechs, this translates to higher pass rates, increased efficiency and accuracy, and less sensitive data moving through their systems (and lower breach liability).

Two realities will shape adoption. One is interoperability. Wallets and verifiers need to be able to speak common standards and recognize revocation lists, or VCs become a new silo. The other is governance – who is issuing what credentials, how the trust framework is audited, and the process for fraud and compromised credentials. Begin with hybrid flows – always create the fallback (OCR/biometrics) while embracing high-trust credentials where they exist (for instance, national eIDs or Payroll VCs). Then measure the conversion and risk deltas before broadening coverage.

At the same time, identity is becoming adaptive. Always-on, risk-based journeys assess behavior signals, device posture, and transaction context to determine if it should be ‘stepped up’ (liveness, NFC tap) or simplified (passwordless experience). Models run closer to the edge—on-device inference and federated learning to reduce latency and protect user privacy. Policy engines will orchestrate decisions across channels so the same user is not challenged twice for the same risk.

| Capability | Why it matters | First step |

|---|---|---|

| Standards-compliant wallet support | Avoid vendor lock-in; interop across issuers/verifiers | Support W3C VCs + OIDC4VC, test with major wallets |

| Verifiable credential verification | Trust signed claims without raw data | Implement signature/issuer checks and selective disclosure |

| Revocation handling | Kill compromised/expired credentials fast | Poll/status-list checks; cache with short TTLs |

| On-device checks (liveness/inference) | Lower latency; better privacy | Add on-device liveness; fall back to the server on risk |

| Clear consent and disclosure UX | Reduce drop-off; meet compliance | Plain-language prompts; granular consent + receipts |

Onboarding stays quick, accounts are safe, and compliance can be proven if these capabilities are implemented. Consumers get what they truly care about: sharing less, proving more, and adapting in real time.

FAQ

Conclusion

When the three pillars of OCR, biometrics, and artificial intelligence work seamlessly within the user experience, the onboarding process stops becoming a roadblock to conversion. Instead, it acts as a trust builder—fast for good customers, unforgiving for fraudulent ones, all easily audited. The value is clear: higher conversions, less manual review, less loss, and easier compliance.

If you need a hands-on partner, Avenga, a seasoned fintech software development company, can help you design, integrate, and scale your solutions.