Top banking software development companies of 2026

October 20, 2025 13 min read

The banking industry has experienced unprecedented growth since the early 2010s, driven by the adoption of digital banking and regulatory shifts. Consumer expectations have played a significant role in this shift, with instant transactions, AI-powered personal finance assistants, BaaS, seamless biometric authentication, gamified savings & rewards, and many more online banking features becoming the new norm.

A truly outstanding core banking solution requires unmatched expertise in financial technology. The question that naturally follows is: how to find a banking software development company that not just meets, but exceeds expectations? Don’t worry, you’re in safe hands. In this article, we’ll uncover the top banking software development companies of 2026, mention all their strengths, and provide the latest insights into the banking industry.

Key takeaways

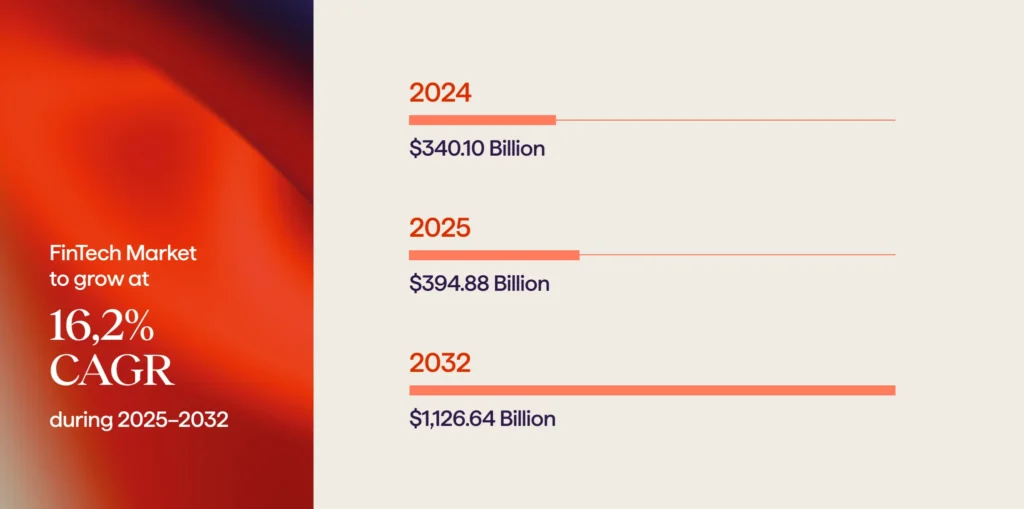

- By 2032, the fintech software market is expected to reach a value of over $1 trillion USD.

- To enhance services for both corporate and retail banking, core banking systems integrate with wealth management platforms, digital wallets, and lending software.

- When it comes to identifying the ‘right’ software development partner, there are several factors to consider, including technical expertise, development methodology, compliance knowledge, and ability to build scalable custom solutions.

- The companies featured in this article exemplify the type of innovation and adaptability that will enable financial institutions to stay competitive in a core banking software market.

The role of banking and financial services today

In 2024, the global fintech software market was estimated at USD 340.10 billion. The market is expected to grow at a CAGR of 16.2% from its estimated USD 394.88 billion in 2025 to USD 1,126.64 billion by 2032. In 2024, North America held a 34.05% market share, accounting for the largest share of the global market.

Several strong drivers are propelling the rapid growth of the financial software market. Customers’ expectations have shifted: more people expect to engage with businesses digitally. Furthermore, new paradigms for creating and delivering banking technology have become possible by advancements in AI, blockchain, and cloud computing. Regulatory opportunities, such as open banking, enable banking software development companies to build custom solutions that enhance transparency, disseminate transactional data, and provide clients with greater control.

This landscape is composed primarily of a few key segments. The banking providers are what wrap it all up; they provide the infrastructure for taking deposits, lending, and carrying out everyday transactions. Digital wallets and payment systems are driving this adoption, while lending platforms and wealth management applications provide retail and corporate clients with flexibility. Insurtech products are beginning to diversify the space of acceptability, demonstrating how flexible banking technology has become. Taken together, all of these financial products deliver the operational backbone of today’s banking system.

According to industry research, core banking software alonewas valued at USD 16.79 billion in 2024. The market is projected to grow from USD 19.67 billion in 2025. Additionally, it is expected that the mobile payment market will reach USD 587.52 billion by 2030, growing at a CAGR of 38.0% from 2025 to 2030; therefore, the momentum behind banking software development companies is not expected to slow down anytime soon.

Unlock the potential of digital transformation in banking and finance.

The top 10 banking software development companies

Numbers tell one side of the story — now let’s meet the top banking software development companies building custom solutions that shape the industry.

Avenga

Avenga is a leading fintech software development company with a rightful claim to any core banking software list. With over 6,000 people, 610 customers, three decades of experience, and 44 locations worldwide, it provides robust software solutions engineered to meet the needs of any financial institution. It possesses industry knowledge that encompasses AI-enabled tools, data-driven financial processes, and managed services designed to optimize banking experiences.

Avenga provides a full suite of services, including:

- Fintech powered by AI — utilizing artificial intelligence to offer smarter choices and customer experiences.

- Data-driven financial processes — providing more innovative lending, payment, and risk management.

- Managed services — ensuring banking products run smoothly, efficiently, and with ongoing monitoring services.

- Custom software development — building the right solution for the institution’s unique needs.

- End-to-end financial operations — providing improved, comprehensive workflows across the entire banking system.

- Blockchain and mobile security — securing trust with advanced encryption and mobile banking environments.

Avenga allows you to experience a unique blend of global perspective and local insights in the delivery of financial software development services.

Software Mind

Software Mind is an international digital transformation partner with strong expertise in the banking sector. Since 1999, the organization has supported retail and commercial banks, payments platforms, WealthTech companies, investment managers, and insurance providers with innovative strategies and scalable banking applications. Software Mind has more than 2000 experts and operates from 14 global hubs. Having successfully delivered over 1,000 projects to 350+ clients, it has demonstrated its capacity to deliver complex, large-scale projects.

They offer a comprehensive range of products and services encompassing the entire development cycle, from idea generation and design through to engineering, integration, deployment, and ongoing maintenance. With Software Mind, financial institutions can easily build strong, compliant, and user-friendly platforms.

ScienceSoft

Since 1989, ScienceSoft has been focused on IT innovation and has been dedicated to the banking, financial services, and insurance (BFSI) sector since 2005. ScienceSoft delivers comprehensive IT consulting and software engineering services to help financial institutions optimize processes, enhance customer engagement, and maintain compliance. The company has extensive knowledge of digital transformation projects, creating custom banking software, and using low-code platforms to enable faster and more reliable delivery.

ScienceSoft develops software for treasury and debt collection, as well as systems for automating lending and mortgages, managing insurance claims and policies, creating secure payment gateways, and building sophisticated investment management platforms. Additionally, it develops unique mobile and online applications, including investment portals, banking, payment, and loan apps, as well as cryptocurrency wallets.

DashDevs

DashDevs is a fintech software development and consulting firm that creates modern banking products and transforms the global financial ecosystem. With over 80 successful fintech solutions delivered to clients, DashDevs has established itself as a trusted partner in digital finance, serving both startups and enterprises.

DashDevs has experience across essential categories of modern banking technology. They offer core banking and infrastructure solutions, ranging from KYC automation to card services. They have also developed payment gateway services to support in-person, online, and in-app transactions, as well as custom general ledger systems that provide real-time, accurate accounting. DashDevs connects financial institutions via open banking stacks to real-time data, offering account consolidation and payment initiation services.

One of the highlights of their portfolio is Fintech Core. This white-label, modular digital banking solution enables businesses to quickly launch digital banks or expand their services with the right banking software. DashDev is focused on speed, scalability, and flexibility to help global financial innovation, supplementing Fintech Core with integrations to over 100 fintech vendors.

Geniusee

Geniusee is a cutting-edge software development company with engineering hubs in both Ukraine and Poland. They offer secure and comprehensive development to help financial institutions modernize their operations and create innovative customer experiences.

They are subject matter experts who provide a variety of financial products and services with a specialty in mortgage lending establishments and commercial finance lenders. The company creates digital banking portals and mobile banking apps that enhance client engagement, and its AI banking solutions implement automation, fraud detection, and personalization. Geniusee also creates and upgrades core banking systems, trading platforms, and lending apparatuses to ensure banks and fintechs can scale.

As one of the top core banking software companies, Geniusee delivers reliable software platforms that incorporate cloud-native designs, advanced analytics, and AWS-driven infrastructures. From MVPs for start-ups to enterprise-grade reengineering, Geniusee supports customers and clients through every phase of digital transformation in the financial services sector.

Pragmatic Coders

Pragmatic Coders brings over a decade of experience in developing fintech software and aims to provide innovative solutions for challenger banks, trading platforms, and cryptocurrency exchanges. The company offers a comprehensive range of custom-built and compliant products to drive revenue growth for both startup fintech companies and established global organizations.

Their expertise encompasses the development of custom banking software, advanced mobile banking applications, and dedicated trading platforms. Pragmatic Coders also develops custom wealth and investment management applications to facilitate portfolio management and client engagement. As a trusted software developer, security, encryption, and regulatory compliance are core to all projects. They develop compliant software products for the highly regulated financial services industry.

Pragmatic Coders builds and delivers software systems that maximize front-, mid-, and back-office processes ranging from neobank platforms to online banking software. The company empowers financial institutions’ transformation agendas by focusing intensely on user experience, quality integrations, and AI-based enhancements.

Itexus

Itexus is a software development company that has focused on providing fintech solutions since 2013, specializing in financial technology for startups, mid-sized companies, and enterprises by implementing secure, scalable digital solutions to modernize their financial operations. Itexus is recognized for its clean code, sound security, and user-centric design, providing viable solutions for today’s rapidly changing banking environment through new digital alternatives to traditional banking technology.

Their portfolio comprises a range of custom fintech solutions. In digital banking and payments, they build mobile apps, eWallets, and digital lending systems. In wealth management, they make trading platforms, robo-advisors, and portfolio analysis tools. In InsurTech, they develop on-demand insurance platforms and automated claims management systems. In the blockchain area, they develop crypto wallets, exchanges, NFT marketplaces, and DeFi protocol frameworks. All in all, the company builds personal finance management tools that use AI-based insights.

Oxagile

Oxagile is a software development company founded in 2005, specializing in custom solutions for financial services, fintech, and banking. With over 400 engineers and offices in the US and Europe, Oxagile helps banks, payment processors, and fintech startups to build secure, scalable digital products. The company has delivered over 800 projects across various industries, with a strong focus on financial technology.

Oxagile’s banking expertise includes developing mobile banking applications, payment processing systems, lending platforms, and wealth management tools. They work with both traditional financial institutions looking to modernize legacy systems and fintech startups building products from scratch. Their development approach emphasizes security, regulatory compliance, and seamless integration with existing banking infrastructure.

The company uses modern technology stacks including cloud-native architectures, AI/ML capabilities, and blockchain solutions to help clients stay competitive. From digital wallet development to KYC/AML automation, Oxagile provides end-to-end software engineering services tailored to the financial sector.

10Clouds

10Clouds is a product development company based in Poland with strong expertise in fintech and banking software. Since 2009, the company has been building custom digital products for financial institutions, payment providers, and fintech startups. With a team of over 150 specialists, 10Clouds focuses on creating user-centric banking applications that combine modern design with robust engineering.

Their banking portfolio includes digital banking platforms, payment solutions, personal finance management apps, and investment tools. 10Clouds works closely with clients throughout the entire development lifecycle — from product discovery and UX design to development, testing, and post-launch support. The company has particular strength in mobile-first banking experiences and progressive web applications.

10Clouds emphasizes agile development methodologies and maintains ISO 27001 certification, ensuring high standards for information security in financial projects. They’ve worked with both challenger banks building new platforms and established institutions modernizing their digital channels.

Exadel

Exadel is a Polish software development company founded in 2010, specializing in AI-powered solutions for the financial services industry. With over 100 software engineers, Exadel builds custom banking software, fintech platforms, and data-driven financial applications. The company has delivered projects for banks, insurance companies, investment firms, and payment providers across Europe and North America.

Exadel’s fintech expertise centers on machine learning applications for banking—including fraud detection systems, credit scoring algorithms, personalized financial recommendations, and automated risk assessment tools. They develop modern banking backends, API-first architectures, and cloud-based financial platforms that integrate with existing core banking systems.

The company works with technologies like Python, Java, React, and cloud platforms (AWS, Azure, GCP) to build scalable, secure banking solutions. Exadel’s development process emphasizes code quality, security best practices, and compliance with financial regulations. From robo-advisory platforms to open banking integrations, Exadel helps financial institutions leverage AI and modern software engineering to improve their services.

Banking service software development company FAQ

What should I look for when selecting a banking software development company?

When evaluating a software development parter, focus on development capabilities, technical stack, development processes, and team expertise. You’ll want to review their prior experience working with financial institutions, including their history of successful implementation and their expertise in compliance. A dependable partner will integrate its banking platform with your retail and corporate banking strategy to tailor your offerings.

What technical expertise should a banking software development company have?

A reliable banking software development partner should have expertise in building scalable, cloud-native, and API-first architectures. Ensure they have proven experience in developing real-time processing systems, understand regulatory compliance requirements, and can create seamless integrations throughout the fintech ecosystem. In addition to evaluating technical capabilities, consider their security practices, development efficiency, and adaptability, especially if your institution plans to expand into universal banking or cross-border digital services.

Why is specialization important when selecting a development partner?

Different software development companies specialize in various areas of banking technology. Some excel in building digital wallet solutions, others in corporate banking systems, and others in payment processing platforms. By selecting a development partner with specialized expertise in your domain, you’re more likely to receive custom software solutions tailored to your specific banking needs, whether you require mobile-first applications, wealth management tools, or systems with strong compliance requirements.

How can leading development companies help future-proof banking operations?

Leading software development companies are not just code builders; they provide strategic technical partnerships. By working with developers who understand emerging technologies like AI, blockchain, and open banking architectures, institutions can build systems that adapt to technologies and regulations that have not yet fully materialized. Top development partners offer technical expertise to help you evolve into a universal bank, modernize legacy systems, and build flexible architectures designed for sustainable future operations.

Final thoughts on the leading fintech companies

As of 2025, the number of digital banking users worldwide has reached approximately 3.6 billion, which is almost half of the world’s population. These numbers demonstrate that global banking solutions have never been so widely adopted. Nearly every technology company is attempting to expand its offerings by incorporating online banking solutions.

As more software development companies enter the spotlight, the challenge becomes choosing the company that best fits your needs—the first step is to take the time to evaluate your options carefully. This article presented the top companies that can help you find the right banking platform, address complex core banking challenges, and deliver secure, scalable solutions.

If you’re interested to learn more about digital banking development services, contact Avenga — an absolute leader among financial software companies. We provide a wide range of banking technology solutions to support your digital transformation journey today, paving the way for a more promising tomorrow.