How to Generate Value with Data Monetization in Telecom

August 21, 2025 11 min read

“Data really powers everything we do,” said Jeff Weiner, and this statement resonates clearly across today’s telecom industry. High-frequency data streams and powerful analytics are combining to create a new era of data monetization as passive data assets become dynamic sources of revenue and strategic growth.

Research by McKinsey demonstrates that, when price is removed from the equation, volume of data and speed account for almost 40% of what influences how consumers purchase. This is a clear shift: data is no longer just a feature; it’s a more primary driver of value. For telecom operators, this is not about meeting demand for faster connections, which is the nature of the market opportunity; it is about strategically monetizing data in multiple ways. From personalized plans based on usage behavior to providing anonymized insights to third parties, data itself is the product and the platform. In a market of commoditized connectivity, the value that can be obtained from data is rapidly becoming a key differentiator and a powerful growth engine.

Want to learn more about data monetization strategies and how you can obtain the most value from data as a telecom service provider? Read more in our comprehensive blog.

Understanding What Data Monetization Means in Telecom

Data monetization describes the process of creating a tangible economic benefit from your data assets. Monetization can take the form of direct revenues, such as selling data-related products, or indirect benefits, such as improved operational effectiveness, reduced churn, or better decision making. Data monetization elevates data from a passive by-product to a “Data as a Product” concept, making it a strategic business asset. In the telecom industry, data monetization assumes a more complex role. Telcos aggregate a vast volume of real-time data from the traffic on the network, which describes subscriber behavior, geolocation, device usage, content, and network performance. The real benefit of telco data comes from its granularity across very large datasets, its velocity, or how fast it updates, and the high frequency at which it derives updates in industries like retail, advertising, mobility, and financial services.

Data monetization can include use cases such as:

- Building data-as-a-service (DaaS) platforms targeted toward third parties

- Delivering precision marketing through audience segmentation and behavioral analytics

- Enabling smart city infrastructure through location intelligence

- Increasing smart infrastructure resource allocation through predictive demand modeling

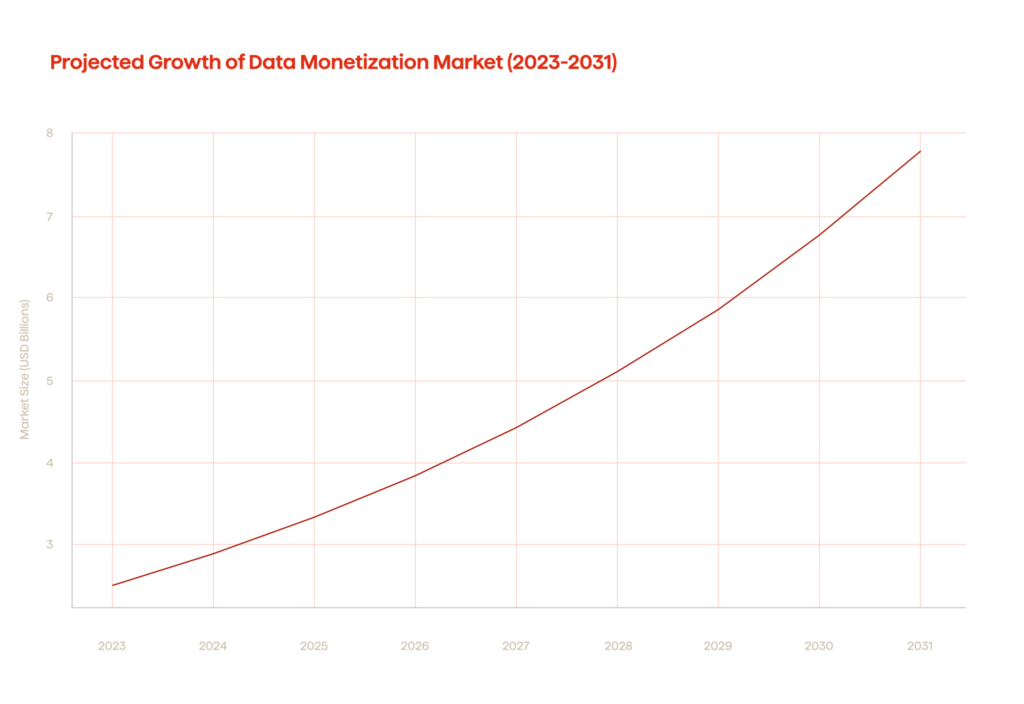

The rationale for telecom data monetization investments is gaining momentum. The Data Monetization Market size in 2023 was valued at USD 2.52 billion and is expected to grow at a CAGR of 16.70% between 2024 and 2031 and reach USD 7.8 billion by 2031.

This growth trajectory indicates a strategic shift in the industry: telecoms are transitioning away from their role as connectivity providers and evolving towards platform players and cross-industry innovation enablers. This evolution is fueled by growing urgency for revenue diversification. Traditional growth in ARPU (average revenue per user) is limited due to market saturation, regulatory pressures, and competition from OTT services. To stay in the game, telecom operators are accelerating the monetization efforts on their data to extract value in adjacent revenue streams, such as developing B2B data ecosystems, enabling APIs to allow data interactions, and entering partnerships with enterprises that require scalable and compliant access to their data. Additionally, telcos are increasingly putting investment into data privacy and security frameworks and customer consent management to safeguard trust and comply with regulatory obligations (GDPR, etc.) at a regional data level.

How Data Analytics Enables Monetization in Telecom

Data analytics is the technical enabler for telecom operators to extract monetizable insights from volumes of high-frequency data. While data is valuable by itself, advanced analytics capabilities—descriptive, predictive, and prescriptive models—can produce real economic value. Modern telecom networks generate petabytes of data from various systems, including Call Detail Records (CDRs), OSS/BSS systems, Deep Packet Inspection (DPI) solutions, location systems, and subscriber management systems.

These streams are complex and often siloed, and thus, require a comprehensive data ingestion, transformation, and storage pipeline for effective analytics. After data has been ingested and transformed, big data systems (Apache Hadoop, Apache Spark, or cloud-native alternatives such as AWS Glue, Google BigQuery, Snowflake, etc.) are used to analyze it. From there, machine learning and AI algorithms are on the lookout for patterns and behavior prediction to assist or perform decision-making in real time.

Key ways data analytics enables monetization:

- Customer micro-segmentation and targeting. Sophisticated clustering algorithms (such as k-means, DBSCAN) process behavioral, demographic, and location data to discover high-value cohorts. Direct monetization improvements include next-best-action or targeted marketing, up-selling with personalized bundles, or retail and media partnerships for audience extension monetization.

- Churn prediction, retention optimization. Models trained on data such as usage frequency, complaints, payment patterns, renewals and external metrics from social sentiment parameters can predict customer churn (disengagement) at a high accuracy level. This data can build triggers into real-time automated decision engines, facilitating retention marketing campaigns primarily to preserve the customer’s value to the organization and reduce the cost of attracting new customers.

- Dynamic pricing and real-time offer management. By overlaying usage analytics, network loading, and external parameters (such as events or location), telcos can begin to take advantage of AI-based tariff creation. This means real-time offers within certain frameworks, or day-optimized plans that offer flexible data volumes based on typical weekday or weekend usage.

- Network optimization and cost reduction. Predictive analytics plays a role in forecasting demand spikes, thereby providing a basis for optimizing the allocation of spectrum, bandwidth, and energy consumption. ML models are illustrative of predictive maintenance that can detect incipient congestion or hardware outages before impacting performance to inform network management. Therefore, cost efficiencies become indirect monetization opportunities.

By operationalizing these use cases through scalable data pipelines and integrating them into decision engines and orchestration layers, telecom operators can move from reactive to proactive monetization strategies. The key lies in aligning analytics outputs with real-time systems – such as campaign management, charging platforms, and network orchestration – to enable closed-loop automation and measurable revenue impact.

Real-World Examples of How Telecoms Are Monetizing Data

Vodafone has developed an analytics platform based on anonymized, aggregated location data from its subscribers to gain insights on footfall patterns, crowd movements, and consumer segments. Known as Vodafone Analytics, the solution is accessible to retailers, event organizers, and city planners who want to optimize store locations, manage transport flows, and enhance public safety. By packaging and selling the insights, Vodafone has created a proven new revenue stream while offering stringent privacy protections.

Another exceptional effort is the partnership with Google Cloud and Quantexa to build a single data system, allowing for a complete, 360-degree view of its customers. Quantexa’s contextual decision intelligence platform collects and analyzes distinct data sources, including billing systems, network usage logs, and CRM database records, while Google Cloud provides the scalable infrastructure for meaningful real-time processing of large data sets. The single system supports advanced analytics like customer segmentation, churn prediction, and fraud detection, which enables Vodafone to deliver hyper-personalized offers and more reliably identify anomalies. Additionally, Vodafone has the option to monetize these new data products by packaging them as anonymized data solutions with partners, extending its role much beyond a mobile service operator.

Orange, one of Europe’s foremost telecommunications providers, has enlarged and diversified its service offerings from basic connectivity to a suite of data-driven services that provide new sources of revenue. The company anonymizes location and uses data from its large subscriber base and offers location-based analytics services to municipal authorities, retailers, and other organizations to help improve footfall analytics and traffic management, as well as inventory auditing. For instance, local governments may use the data to optimize public transport routes, while retailers may improve store locations or staff scheduling during peak periods.

Data-centric services are further enhanced through Orange Business, a subsidiary that offers big data consulting and AI-based solutions to customers in finance, health care, logistics, and other industries. Orange Business pulls together large-scale data ingestion, predictive modeling, and machine learning solutions to help organizations operationalize improvements, forecast demand, and improve customer experience. Collectively, these initiatives position Orange as an all-in digital solutions provider, extending its reach much beyond a traditional telecom operator.

Exploring New Revenue Streams Through Different Business Models

Orange’s journey toward becoming a complete digital solutions business highlights a common trend across the sector: telecom operators around the globe are looking beyond standard connectivity to take advantage of their data assets. Using some of the vast amount of data generated each day, operators are finding creative ways to create new business models and monetization opportunities. One major strategy is a Data-as-a-Service (DaaS) model, where the operators package insights that have been anonymized and aggregated–everything from location insights to patterns of behavior, and sell or license that data to third parties in advertising, retail, and transportation. This data as a service strategy allows telecoms to generate revenue from data that would otherwise sit unused and enables contribution to revenue growth.

Also, many telecoms are using a platform strategy. By exposing their data for use by secure APIs, they allow developers and other external businesses to create applications that leverage existing network and customer data. In those engagements, revenue-sharing arrangements can provide ongoing value. Every time the new service generates revenue from a data service, a share comes back to the telecom. This drives an ecosystem effect that extends the telecoms’ reach far beyond their customer base.

An emerging model involves insight-driven consulting and solutions. Similar to Orange Business Services, telecommunications companies with capabilities for advanced analytics can establish themselves as trusted advisors to other organizations aiming to improve either their operations or user experience. These consulting engagements involve combinations of AI products and managed services, providing a differentiating factor for operators in a competitive environment. Lastly, partnerships and joint ventures with technology suppliers, OTT platforms, and content developers are another important consideration. By leveraging subscriber analytics with specific digital tools or proprietary content, telcos can create shared branded services – whether these services be dynamic pricing schemes or AI-generated bundles of content – that drive subscriber engagement and incremental revenue.

Balancing Data Value with Privacy and Compliance

For telecom operators, balancing the monetization potential of subscriber data while following strict confidentiality protocols is important and, at times, difficult. Since telcos come into contact with sensitive data (e.g., call detail records (CDRs), locations, and billing transaction history), this can sometimes trigger regulatory scrutiny. Regulatory frameworks, such as GDPR (General Data Protection Regulation) in the EU, CCPA (California Consumer Privacy Act) in the U.S, and other regionally-defined mandated programs regarding the use of communications data substantiate the messaging of using augmented protections for individuals and transparency in data practices.

A leading practice for mitigation of risk is anonymization of the data, through which valuable data (e.g. phone number, IP address) can either be removed or pseudonymized before being used for analytics or share with third party providers; however, some telecom datasets are so pervasive, so the risk of reidentification remains, unless additional methods, such as differential privacy, which adds statistical ‘noise’ to data to prevent identification of individuals, or advanced encryption techniques are employed. As a matter of habit, many operators practice and employ privacy-by-design principles throughout the data life cycle, applying privacy controls and monitoring practices at every step in the data life cycle from ingestion to reporting.

Data governance, which is a framework that dictates how data is gathered, processed, stored, and accessed, is also vital. Telecoms use technologies like metadata management, managing data lineage, and role-based access controls (RBAC) to establish an auditable trail of data usage. Audits, along with risk assessments, including DPIAs, are regularly conducted to identify vulnerabilities and validate compliance across global operations. In addition to technology protections, operators are tasked with building customer trust as well. They often adopt granular consent management systems that allow subscribers the choice to opt in or out of certain data uses, like targeted advertising and data sharing with third parties. Understandable privacy rules and consent processes lower legal risk and promote goodwill.

Final Thoughts on Turning Data into Long-Term Value

Telecom operators hold one of the most precious assets of the digital age—real-time, high-frequency, deeply contextual data. But raw data alone is not the endgame. The real opportunity is in building the infrastructure, partnerships, and governance models that can convert that data into sustainable value, over and over again. Telco data monetization is not a one-off special project or a short-lived revenue initiative. It is a long-term strategic repositioning of telcos’ role in the digital economy. The winners will not simply collect the most data, but understand how to activate data responsibly, enrich data with analytics, and embed it into ecosystems where data does not merely inform the business—it is the business.