Future of Finance: Unveiling the Top 10 FinTech Innovations of 2024 and Beyond

May 8, 2025 23 min read

Navigating the Top Ten Trends Reshaping the FinTech Landscape in 2024.

Within 2024, the financial technology landscape is undergoing a pivotal transformation. It is marked by groundbreaking advancements and key trends, and this period signals a significant shift in finance. Factors like generative AI and the rise of decentralized systems are shaping this shift and financial services are moving towards more personalized, efficient, and secure offerings. Perhaps, that is why the FinTech market is expected to reach a staggering $882 billion with an annual growth rate of 17 percent.

However, looking at the top ten trends shaping FinTech in 2024, the industry faces both vast opportunities and significant challenges, including regulatory compliance and the need for sustainable operations. Success will belong to the financial institutions that can adeptly manage these complexities.

Keeping that in mind, let’s take a look at these trends in greater detail and understand how they will be a part of finance’s bright future.

1. Generative AI in Finance

Generative AI in finance represents a transformative shift in how financial services operate. It delivers individualized customer experiences and optimizes operational efficiency. This technology continues to revolutionize the sector by providing deep insights into spending patterns. It also customizes financial advice and streamlines processes.

The market for AI in the financial sector will grow and, more importantly, will continue to save money. According to a report by Insider Intelligence, banks managed to save $447 billion in 2023 through AI. As more institutions recognize the cost savings and enhanced capabilities offered by AI, investment in this technology is set to increase, driving further innovation and adoption.

Personalized Financial Services

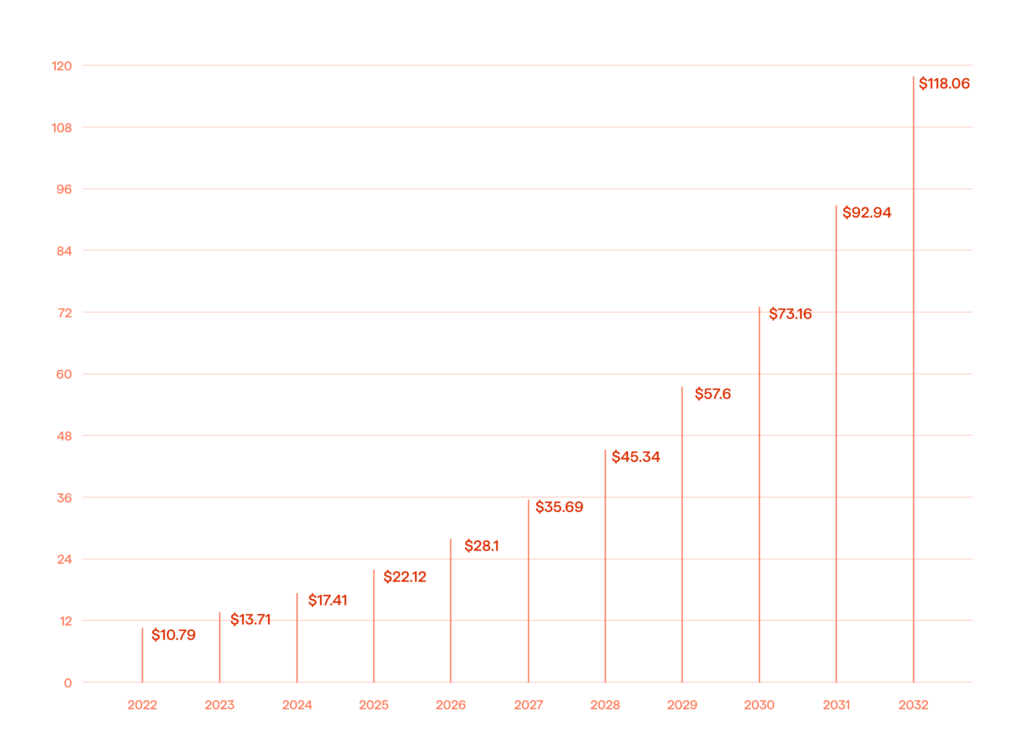

At the moment, the Generative AI market is hitting an all-time high of $17 billion. It is expected to reach $118 billion by 2032 (see Fig. 1). Generative AI will enable banks and financial institutions to analyze vast amounts of data, learning the individual customer’s preferences and behaviors. This deeper understanding will allow customized financial products and services to be created. For example, AI could suggest exclusive investment strategies, optimized saving plans, or even predict future spending to prevent overdraft fees, all of which significantly enhance the customer experience.

Operational Efficiency

By automating routine tasks and decision-making processes, generative AI can significantly reduce operating costs. A report by the Bank of England estimated that Machine Learning (ML) could reduce banks’ capital costs by up to 70%. This would be achieved through more accurate risk assessments, streamlined KYC (Know Your Customer) processes, and automated customer service interactions, which would otherwise require significant human resources.

Regulatory and Technical Constraints

Despite its potential, adopting generative AI in finance may need more support due to regulatory and technical constraints. Financial institutions operate under stringent regulations designed to protect consumer data and ensure the financial system’s stability.

Integrating AI must be done in a way that complies with these regulations, which can slow down implementation. Additionally, while advanced, the current state of AI technology still requires significant refinement in order to handle the complex needs of the financial sector reliably. Issues like data bias, model interpretability, and robustness need to be addressed to gain the complete trust of institutions and regulators.

While generative AI presents a promising future for the financial sector, its successful implementation will depend on overcoming regulatory quagmires and technical limitations. As the technology matures and regulations adapt, we can expect a more personalized, advantageous, and innovative financial environment.

2. Enhanced Open Banking

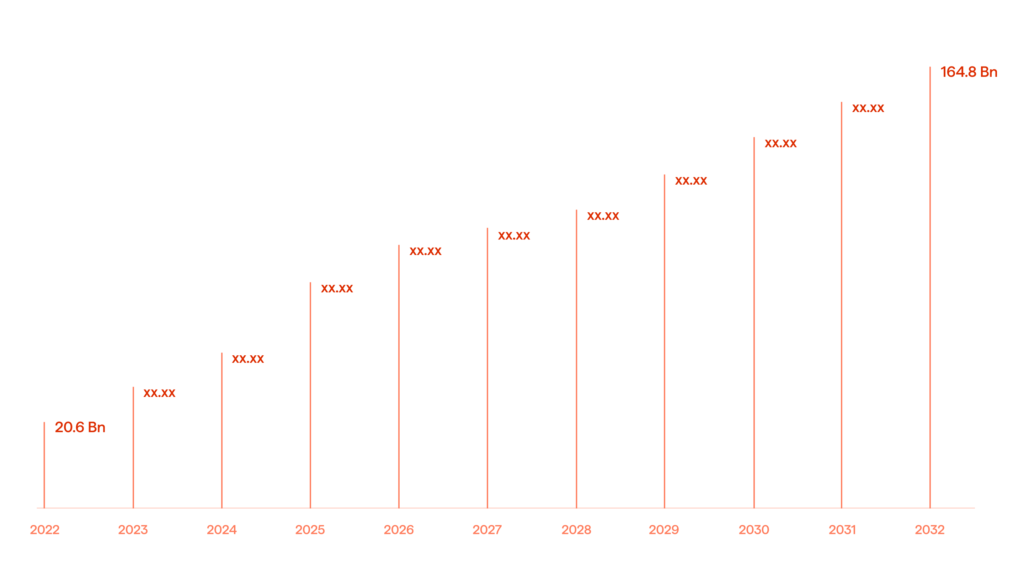

Following the latest insights, the open banking market size will soon skyrocket. There are reports suggesting the market will hit $164 billion by 2032 (see Fig. 2). Enhanced open banking is a paradigm shift in the financial services industry. It aims to revolutionize sharing and utilizing financial data. One can even say this tech is all about offering unparalleled payment experiences through API-driven financial services. Its evolution is driven by the demands for faster, more secure, and customer-centric financial solutions.

API-Driven Financial Ecosystem

Open banking relies on APIs (Application Programming Interfaces) to securely share financial data between banks and third-party providers. This technology is the linchpin of the open banking ecosystem, allowing for the creation of innovative financial services and products. According to McKinsey, banking APIs can enhance customer experience, create new revenue streams, and redefine the industry’s competitive terrain.

Regulatory Landscape

As open banking gains traction, regulatory frameworks globally are evolving to accommodate and promote this change while ensuring consumer protection and data security. The European Union’s PSD2 (Payment Services Directive 2) and the UK’s Open Banking Standard are pioneering examples of this. Deloitte notes that these regulations not only mandate data sharing, but ensure that it’s done securely and with the customer’s consent, thereby setting a standard for other regions to follow.

Consumer Protection and Data Security

With the increase in data sharing, there’s a heightened focus on ensuring consumer protection and data security. Forbes highlights that the future of open banking depends significantly upon building and maintaining consumer trust. This involves powerful encryption methods, secure data storage solutions, and transparent privacy policies. It also means ensuring compliance with regulations like the GDPR (General Data Protection Regulation) to protect personal data.

Innovation and Customer Demand

Customer expectations are driving innovations in open banking. Consumers are looking for faster, more convenient, and personalized banking experiences. According to a report by PwC, 71% of SMEs (small and medium-sized enterprises) are expected to adopt open banking by 2024 in order to improve their services. This could manifest in various ways, from real-time payments and enhanced financial management tools to more competitive lending rates and made-to-order insurance products.

As open banking advances, it promises to redefine the financial services geography. Its success will hinge on a robust regulatory framework. It will also depend upon steadfastly pursuing security and consumer protection. Additionally, the industry’s ability to innovate and meet customer demands will be crucial.

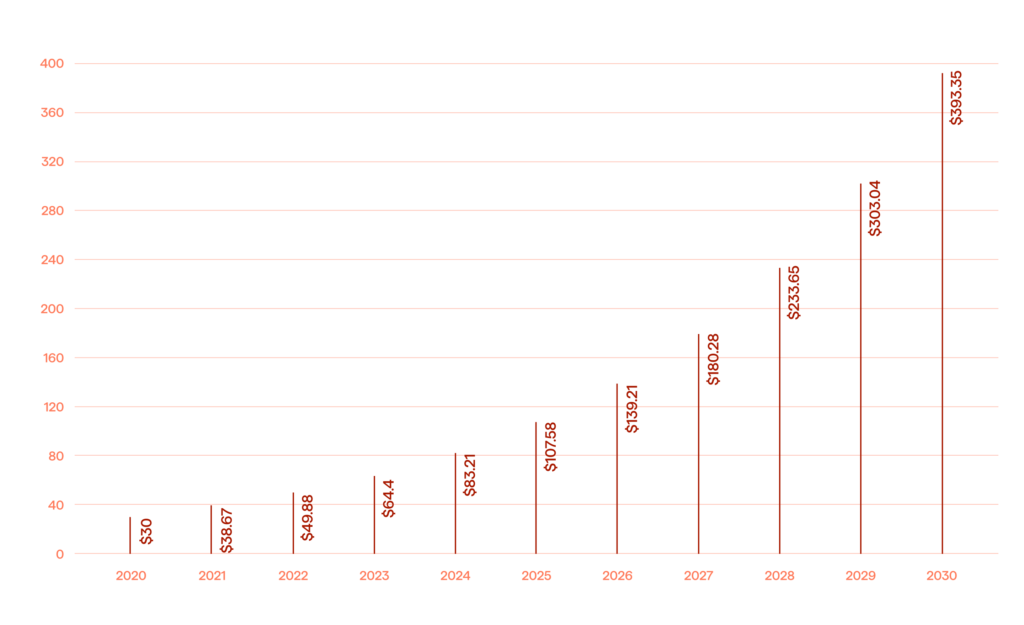

3. Decentralized Finance (DeFi) and DLT

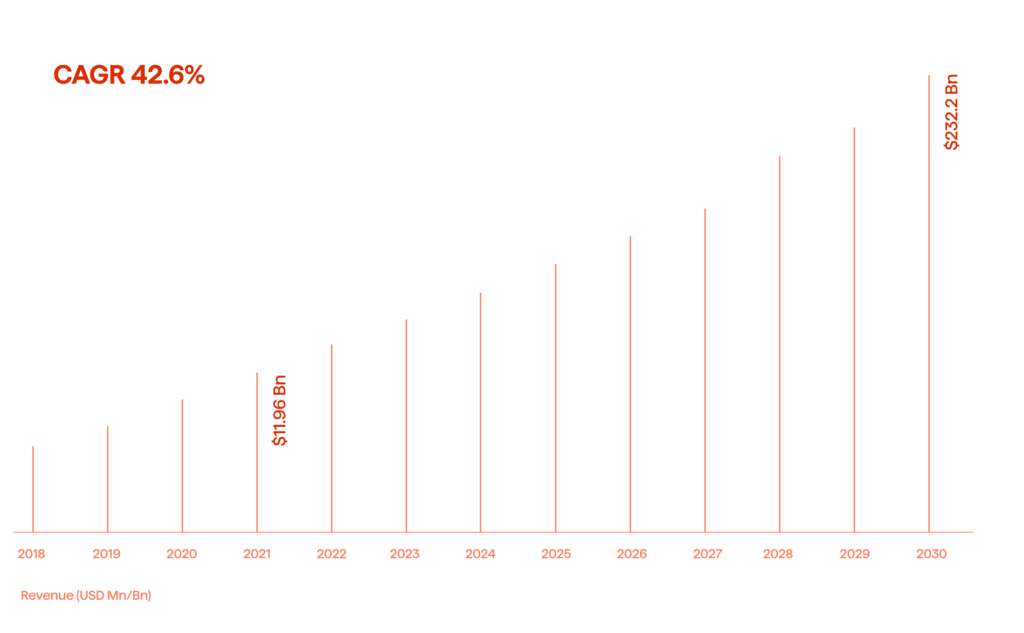

Decentralized Finance (DeFi) and Distributed Ledger Technology (DLT) are at the forefront of the financial revolution, seeking to decentralize and reshape the global financial markets. At the moment, the evidence shows DeFi experiencing an unprecedented CAGR of 42.6 percent, which is far higher than any other industry (see Fig. 3). In turn, according to Statista, the DLT market is also experiencing a major growth rate and is expected to reach $140 billion by 2030.

DeFi leverages DLT, such as blockchain, to operate financial applications and services without centralized intermediaries. This integration will expand by offering various financial services from lending and borrowing to asset trading and risk management, and it will be executed on a decentralized network. According to a report from Deloitte, DeFi has the potential to create more open, inclusive, and fair financial markets that are accessible to anyone with an internet connection.

Regulatory Developments

DeFi and DLT’s growth is increasingly catching regulators’ attention worldwide. Initiatives like the European Union’s DLT Pilot Regime aim to establish a safe environment for trading and settling transactions in financial instruments within DLT. By providing legal certainty and regulatory clarity, such frameworks are significant for the wider adoption and growth of DeFi and DLT. Similarly, the UK’s Digital Securities Sandbox allows firms to experiment and innovate with digital securities trading in a controlled environment, while ensuring compliance and consumer protection.

Need for Interoperability

As the DeFi ecosystem grows, so does the need for interoperability among different blockchains and DLT platforms. This interoperability is crucial for creating a seamless and efficient DeFi ecosystem where assets and data can quickly move across other platforms. According to a Binance Research report, interoperability solutions are pivotal to unlocking the full potential of DeFi, and thus enabling a more connected and accessible financial system.

Challenges and Risks

While the promise of DeFi and DLT is vast, it comes with concerns and hazards. Issues like scalability, security, and regulatory compliance need to be addressed for DeFi to achieve mainstream adoption. Furthermore, as noted by the World Economic Forum, the anonymous and borderless nature of DeFi could pose challenges in ensuring compliance with international financial regulations.

The integration of DeFi and DLT will significantly impact global financial markets as they offer a more decentralized, transparent, and optimized system. Continuous developments in technology, regulation, and interoperability are essentialAnd, all this will help to fully realize DeFi and DLT’s potential.

4. Behavioral Biometric Authentication Advances

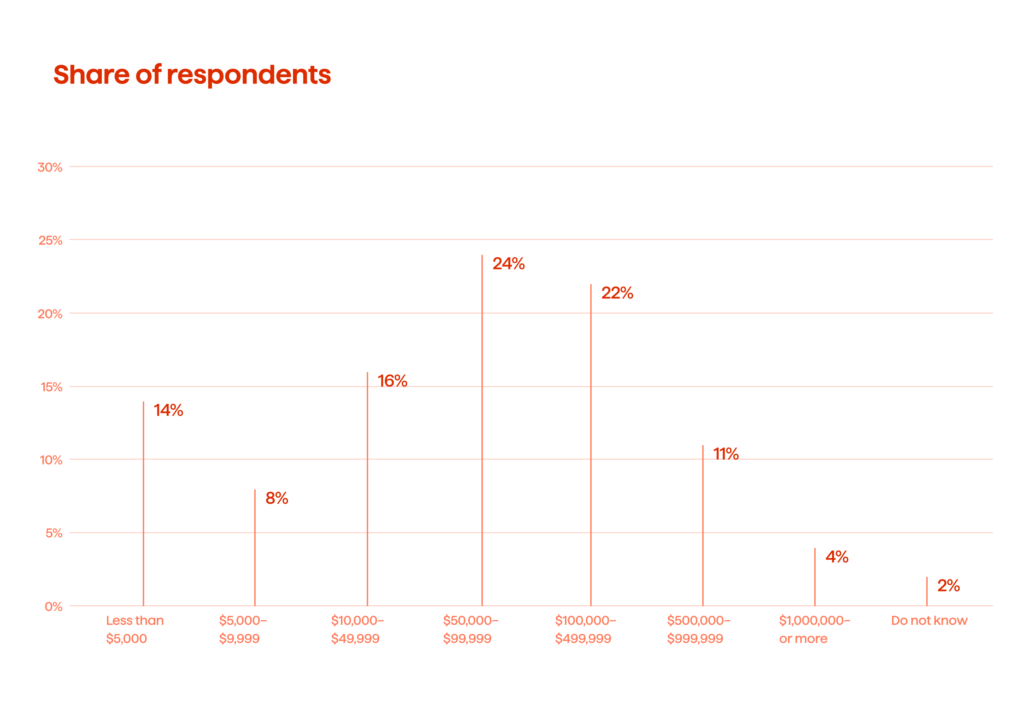

With cyber threats rising, biometric authentication will become more prevalent in fintech for securing access to apps and sensitive information. According to the latest surveys, almost every company operating in the financial sector has experienced financial losses due to cyber threats (see Fig. 4). This biometric trend includes the adoption of fingerprints, facial recognition, and other unique identifiers for user verification.

Behavioral biometric authentication is quickly becoming a cornerstone in the financial industry’s defense arsenal against cyber threats. Fintech is continuing to evolve in this area and the adoption of biometric technologies is on the rise. These technologies are used to secure access to applications and sensitive information. The need for more robust security measures is driving this trend, especially since cyber-attacks are becoming increasingly sophisticated.

Types of Biometric Authentication

The most common forms of biometric authentication include fingerprint scanning, facial recognition, voice recognition, iris scanning, and behavioral biometrics. Each method offers a unique way of verifying an individual’s identity by using their physical or behavioral characteristics. According to a report by Grand View Research, the global biometrics technology market size is expected to reach $59.31 billion by 2025, indicating the rapidly growing adoption and trust in these technologies.

Fingerprint Scanning and Facial Recognition

Fingerprint scanning is one of the most widely adopted biometric methods due to its ease of use and high accuracy. Facial recognition technology has also seen significant advancements and is increasingly used in mobile banking apps to provide quick and secure access to financial services. According to a study by Juniper Research, facial recognition hardware is expected to be installed in over 800 million mobile devices by 2024, showing its growing prevalence.

Behavioral Biometrics

Beyond physical biometrics, behavioral biometrics is surfacing as a powerful tool for continuous authentication. It analyzes user behavior patterns such as typing rhythm, mouse movements, and device interaction to create a constant authentication process that can detect anomalies indicative of fraudulent activity. A report by Mastercard indicates that integrating behavioral biometrics with physical biometrics significantly enhances security.

Security and Privacy Concerns

While biometric authentication provides enhanced security, it also raises privacy concerns. The storage and handling of biometric data are critical issues that must be addressed. Regulations like the European Union’s GDPR (General Data Protection Regulation) have set standards for biometric data protection, ensuring that individuals’ privacy rights are respected and secured.

As cyber threats continue to emerge, so does the need for more advanced security measures. Biometric authentication is at the forefront of this evolution. It offers a more secure, convenient, and personalized way of protecting sensitive financial information.

5. Quantum Computing in Financial Modeling

Quantum computing is expected to provide finance and other industries with unprecedented computational power. Even though the niche is still germinating, it has already found massive investment opportunities and it is expected to grow rapidly (see Fig. 5). This emerging technology can process vast amounts of data. It can perform complex calculations at speeds far beyond traditional computing, which is particularly important for risk modeling and fraud detection.

Risk Modeling and Analysis

In finance, risk modeling is crucial for investment strategies, portfolio management, and decision-making processes. Quantum computing allows for analyzing vast and complex financial systems in real-time. According to a report by McKinsey, quantum computing could provide more accurate and detailed models of financial markets, leading to better risk assessment and investment decisions. It can simulate market scenarios with a complexity and speed that is unattainable by classical computers.

Fraud Detection and Prevention

The financial industry is being increasingly targeted by sophisticated cyberattacks and deceitful schemes. Quantum computing’s ability to rapidly analyze patterns and anomalies within large datasets makes it an ideal tool for detecting fraud. A study by Deloitte suggests that quantum computing could significantly enhance the ability to identify dishonest activities and unusual transaction patterns, thereby reducing losses due to fraud.

Algorithmic Trading

Quantum computing can process and analyze large datasets almost instantaneously, which can be a game-changer for algorithmic trading. It allows financial institutions to react swiftly to market changes and make more informed trading decisions. This rapid processing capability could lead to the development of more advanced trading algorithms, potentially increasing profitability.

Economic Impacts

Integrating quantum computing into finance is expected to have broad economic implications. By enabling more efficient risk modeling, enhancing fraud detection, and improving algorithmic trading, quantum computing could potentially add significant value to the financial industry and the broader economy. A Boston Consulting Group study estimates that applying quantum computing in finance could generate billions in value over the coming decades.

Quantum computing represents a transformative opportunity for the finance sector. The technology is evolving and becoming more accessible. Its integration into various financial applications will likely drive significant advancements and innovations across the industry.

6. Sustainable Technology and Green FinTech

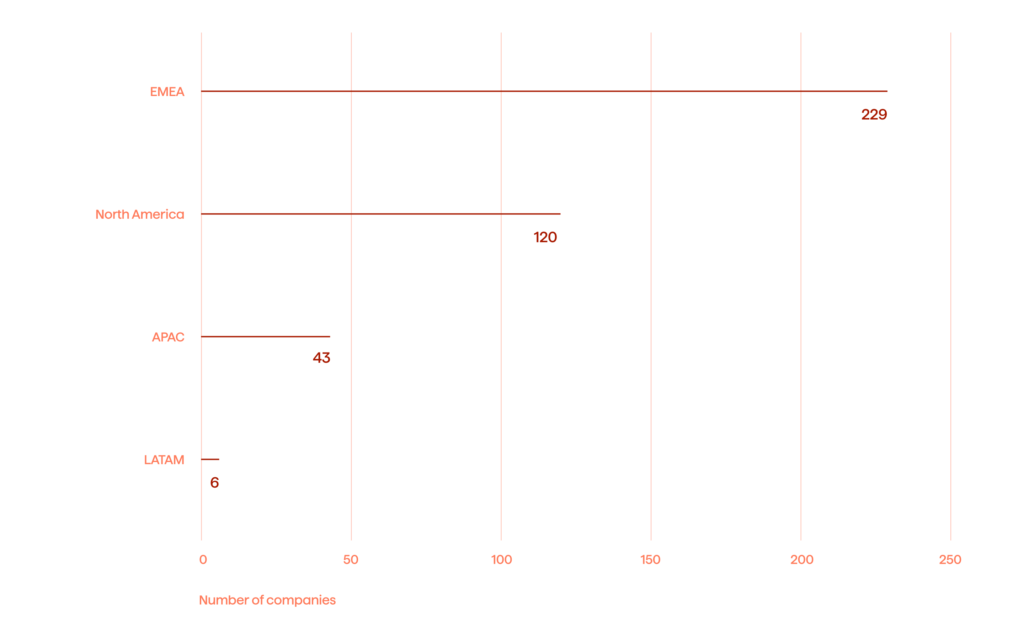

As environmental concerns take center stage globally, sustainability is emerging as a critical driver of innovation in fintech. There is a growing number of companies all over the globe investing more and more into green fintech (see Fig. 6). This trend is characterized by efforts to reduce carbon footprints, enhance energy efficiency, and promote responsible consumption, thereby aligning with the growing emphasis on environmental, social, and governance (ESG) initiatives.

Reduction of Carbon Footprints

Fintechs are focusing on developing solutions that help financial institutions and their customers track and reduce their carbon footprints. According to a report by PwC, green fintech solutions enable consumers and businesses to monitor and manage their environmental impact by providing insights into carbon-intensive activities and suggesting more sustainable alternatives. This includes investment in green bonds, carbon offsetting programs, and financing for renewable energy projects.

Energy Efficiency in Operations

There is a growing trend toward optimizing energy usage within financial operations. Deloitte highlights that fintech companies are leveraging cloud computing, AI, and other technologies to enhance the energy efficiency of their operations and services. By doing so, they not only reduce their environmental impact, but also improve operational efficiency and reduce costs.

Promoting Responsible Consumption

Green fintech is also crucial in promoting responsible consumption patterns. Financial products and services are being designed to incentivize sustainable behaviors among consumers. For instance, eco-friendly spending rewards, sustainable investment portfolios, and green loans are some of the innovative products that encourage consumers to make more environmentally conscious decisions.

Alignment With ESG Initiatives

The rise of sustainable technology in fintech aligns with the broader corporate and consumer concentration on ESG initiatives. A Global Sustainable Investment Alliance (GSIA) study shows that sustainable investment is climbing, with investors increasingly considering ESG factors in their investment decisions. Fintechs are responding to this demand by integrating ESG criteria into their platforms, allowing investors to screen investments based on environmental and social factors.

Sustainable technology and green fintech represent a transformative shift in the financial industry. The world is increasingly prioritizing sustainability. These technologies could significantly contribute to a more sustainable and environmentally responsible financial ecosystem.

7. Personalization Through Data Analytics

Personalization through data analytics is becoming a central theme in the financial industry. Banks and institutions are increasingly using advanced data analytics and AI-powered tools, with the aim of enhancing customer engagement.

This trend involves using sophisticated algorithms and Machine Learning (ML) techniques that analyze vast customer data which enable more tailored banking experiences. Perhaps, service being a crossroads for all different kinds of tech is what makes the data analytics market so prosperous (see Fig. 7).

Comprehensive Customer Profiling

Financial institutions are using data analytics to create detailed customer profiles. These profiles encompass various aspects of customer behavior, preferences, and financial histories. According to a report by McKinsey, this allows banks to offer highly personalized services, such as customized investment advice, tailored loan offers, and individualized banking experiences, significantly enhancing customer satisfaction and loyalty.

Credit Risk Evaluation

One of the critical applications of data analytics in finance is credit risk evaluation. Financial institutions can gain a more nuanced understanding of credit risk by analyzing customers’ transaction histories, spending patterns, and even social media activity. Deloitte notes that this improves the accuracy of credit assessments and enables the development of more sophisticated risk models that can identify potential pitfalls and opportunities.

User Behavior Analysis

AI and machine learning tools are used to analyze user behavior to detect anomalies that could indicate deception, assess customer satisfaction, and predict future financial needs. For example, AI can see unusual transaction patterns that may indicate fraudulent activity, enhancing security and improving trust.

Challenges and Ethical Considerations

While the benefits of personalization through data analytics are clear, it raises issues, particularly regarding data privacy and the ethical use of customer information. Regulations, such as the GDPR in Europe, have set data protection and privacy standards, requiring financial institutions to handle customer data responsibly.

Personalization through data analytics is transforming the banking and financial services industry as it enables more tailored customer experiences. It also improves risk management and marketing strategies. As technology advances, we can expect even more sophisticated data analytics applications to be used in the financial sector.

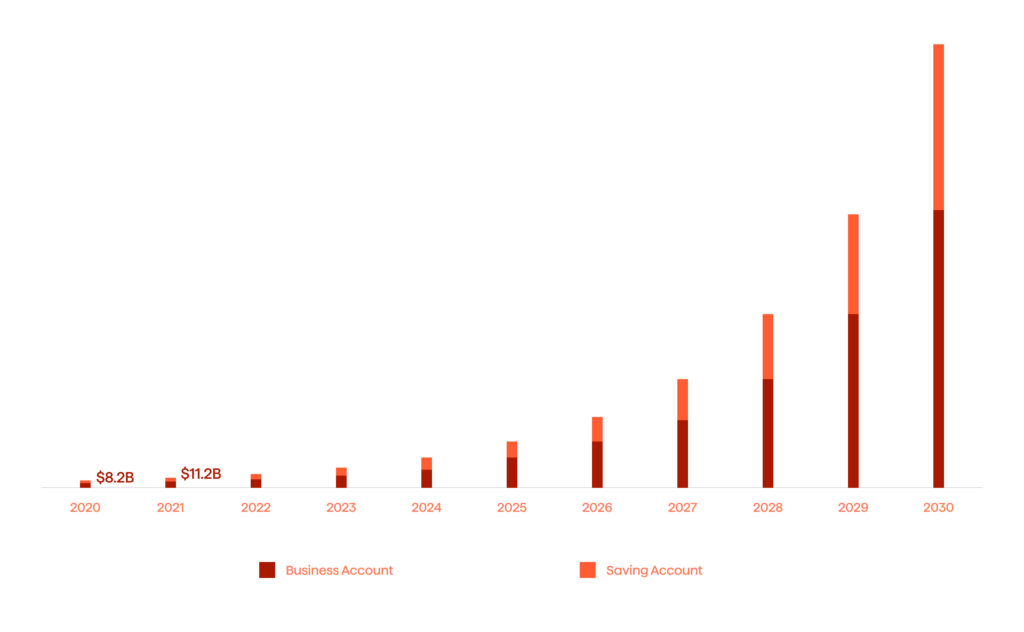

8. Confident Advancement of Neobanks and Digital Banking

The growth of neobanks and digital banking represents a significant shift in the financial landscape, challenging traditional banking models with innovative digital-first approaches. These digital-only banks are increasingly popular, especially among the younger tech-savvy generations, offering a more accessible, user-friendly, and cost-effective banking experience. The numbers behind the growing neobanking market speak for themselves (see Fig. 8).

Rapid Growth and Market Penetration

Neobanks are rapidly gaining market share due to their ability to offer streamlined customer-centric services. According to a report by Accenture, the number of neobank customers is anticipated to skyrocket, with digital banks expected to have over 145 million customers by 2024. This growth is driven by their lower operational costs, lack of physical branches, and ability to adapt to customers’ needs quickly.

Technology-Driven Banking Experience

Neobanks leverage cutting-edge technologies like AI, Machine Learning (ML), and big data in order to offer tailor-made banking experiences. Features such as real-time spending analytics, automated savings tools, and instant notifications are standard offerings that appeal to a demographic that prefers managing finances via mobile devices.

Targeting Younger Generations

Digital banks are top-rated among millennials and Gen Z consumers, who are generally more comfortable with digital services, and value the convenience and accessibility that neobanks provide. McKinsey’s research indicates that these younger demographics are more likely to switch to digital banks due to their preference for online interactions and fast efficient service.

Cost-Effectiveness

One of the critical advantages of neobanks is their cost-effectiveness. By operating entirely online and avoiding the overheads associated with traditional brick-and-mortar banks, neobanks can offer lower fees and better rates. This makes them particularly attractive to cost-conscious consumers and small businesses looking for affordable banking solutions.

The growth of neobanks and digital banking is reshaping the financial services industry. Neobanks have customer-centric models, use technology innovatively, and appeal to younger consumers. And, they are well-positioned to keep growing rapidly and significantly impacting traditional banking.

9. Evolution of Cybersecurity and Cyber Resilience

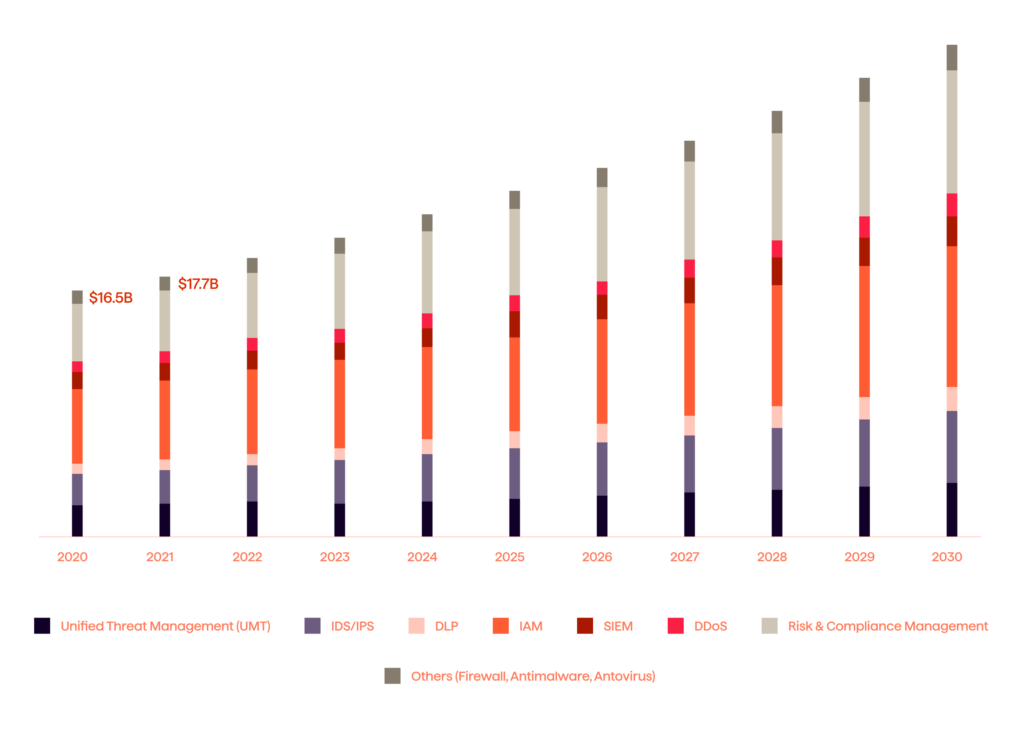

The ever-changing digital finance landscape makes the evolution of cybersecurity and cyber resilience a critical concern. Cyber threats are becoming more sophisticated and the financial sector is advancing its defense strategies in response. All these tendencies are mirrored in the growing cybersecurity market (see Fig. 9).

The focus is increasingly on developing automated defenses, integrating comprehensive cybersecurity frameworks, and formulating strong preparedness plans. Implementing AI is a critical component in this evolution, although it introduces some stumbling blocks.

Automated Defense Mechanisms

Automation in cybersecurity is becoming essential in detecting and responding to threats rapidly. AI and ML algorithms can analyze vast datasets to identify potential threats, sometimes even before execution.

According to a report by McKinsey, automated systems can detect known types of cyberattacks and identify new patterns that could signify materializing threats. This proactive approach to cybersecurity is paramount in an arena where threats evolve rapidly.

Integrated Cybersecurity Frameworks

Financial institutions are moving towards more integrated cybersecurity frameworks. These frameworks consolidate security tools and processes into a cohesive system that offers a comprehensive defense strategy. Deloitte highlights the importance of such integration, noting that it enables organizations to manage their cybersecurity risk more effectively and respond to incidents more methodically.

Preparedness and a Response Plan

Preparedness plans are essential for minimizing the impact of cyber incidents. These plans involve regular cybersecurity assessments, employee training programs, and clear protocols for responding to breaches. The Financial Stability Board (FSB) emphasizes the importance of preparedness in maintaining a financial system’s resilience. It suggests that financial institutions should have detailed recovery plans and regular drills in order to test their effectiveness.

Role of AI in Cybersecurity

AI plays an influential role in enhancing cybersecurity, but also brings additional obstacles. While AI can significantly improve threat detection and response times, it also creates new vulnerabilities. Attackers can target AI systems so as to disrupt their operations, or even learn how to evade detection.

Furthermore, as noted by a study from the European Union Agency for Cybersecurity (ENISA), ensuring the security of AI itself is a growing concern, particularly as these systems become more integral to financial cybersecurity strategies.

Emerging Threats and Continuous Adaptation

The cybersecurity landscape continuously expands, with new threats coming on the scene regularly. Financial institutions must, therefore, remain vigilant and adapt their strategies accordingly. This involves staying abreast of the latest cyber threats and technological advancements, and periodically updating their cybersecurity measures.

As cyber threats continue to flourish, so must the strategies to combat them. The financial sector’s focus on automated defenses, integrated frameworks, and preparedness plans is critical. And, since the sector must maintain robust cybersecurity and resiliency, the careful implementation of AI is also essential.

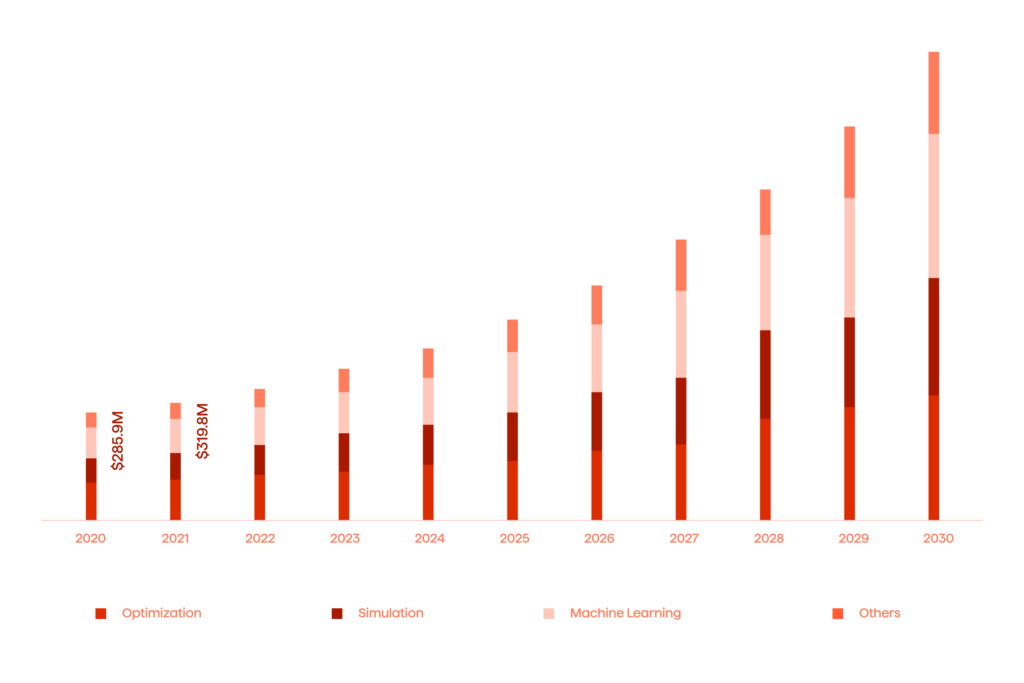

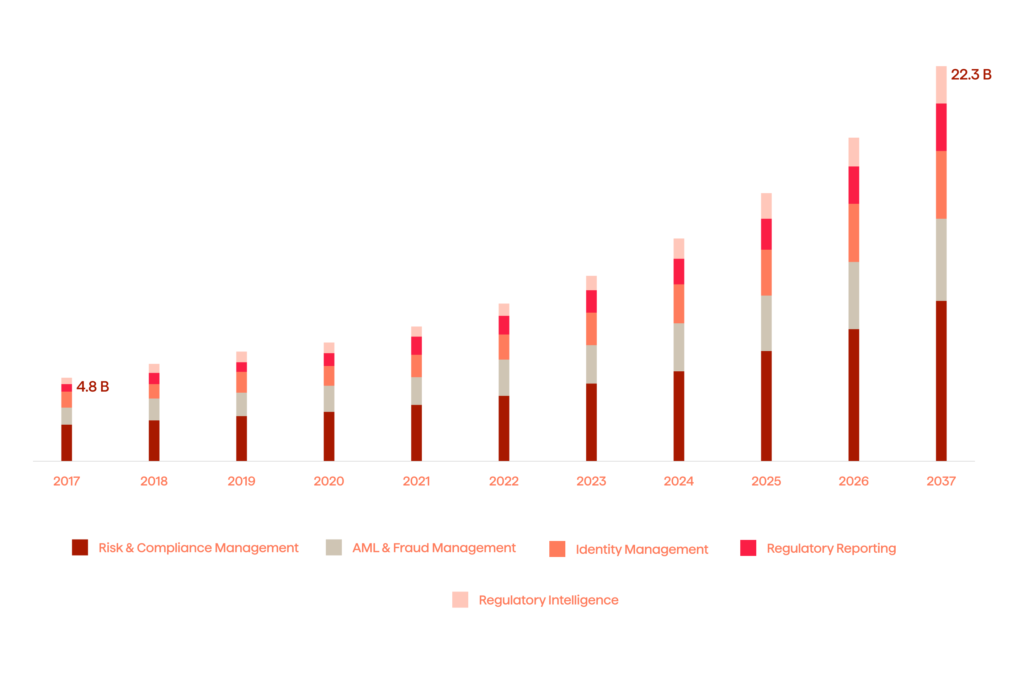

10. Regulatory Technology (RegTech) Advancements

RegTech advancements are set to play a crucial role in transforming how financial firms manage compliance and risk. This technology offers innovative solutions to navigate these challenges dynamically and cost-effectively. Regulatory environments are becoming increasingly complex, which is why RegTech is being applied in an increasing number of realms (see Fig. 10).

Efficient Compliance Management

RegTech utilizes advanced technologies like AI, ML, big data analytics, and blockchain to streamline the compliance process. According to a report by Deloitte, RegTech can automate tasks such as monitoring transactions for suspicious activities, thus ensuring faster and more accurate compliance with Anti-Money Laundering (AML) and KYC (Know Your Customer) regulations. This automation significantly reduces the time and resources traditionally required for compliance.

Risk Management and Analysis

RegTech tools are increasingly used for risk management. These tools can identify potential risks by analyzing large datasets and providing insights that help financial institutions make more informed decisions.

A study by PwC highlights how RegTech can be instrumental in credit risk modeling, market risk analysis, and operational risk management, by offering a more nuanced approach to identifying and mitigating risks.

Adherence to Regulatory Frameworks

Financial institutions operate in an environment with rapidly evolving regulations. RegTech solutions enable these institutions to keep pace with regulatory changes and ensure adherence. For instance, technologies like blockchain can provide a transparent and immutable record of transactions, aiding in regulatory reporting and audit trails, as noted in a study by McKinsey & Company.

Cost Reduction

One of the most significant benefits of RegTech is its potential to reduce costs associated with compliance and risk management. By automating routine tasks and providing more accurate risk assessments, RegTech can lower the operational costs of maintaining compliance. The Financial Stability Board (FSB) notes that adopting RegTech solutions can lead to a more beneficial allocation of resources within financial firms.

Digital Operational Resilience Act (DORA)

DORA is reshaping many financial regulations. It emphasizes the need for operational resilience in the digital era. RegTech solutions are essential for DORA compliance, and they are driven by technologies like AI and blockchain. These solutions aid in system monitoring, vulnerability identification, and the rapid response to cybersecurity threats. They also facilitate comprehensive operational record-keeping.

Challenges and Future Outlook

While RegTech offers numerous advantages, it also faces a variety of dilemmas, particularly regarding the integration of existing systems and data security. Additionally, as RegTech matures, financial institutions must ensure their staff are adequately trained to use these new technologies effectively.

Despite these challenges, the future of RegTech looks promising. As financial regulations adapt and become more complex, the demand for comprehensive tech-driven compliance solutions is expected to grow.

RegTech is emerging as an indispensable tool for financial firms, as it enables more efficient compliance processes, improved risk management, and adherence to complex regulatory frameworks, all while reducing operational costs.

Takeaways

Just within the first month of 2024, the FinTech industry is already rapidly evolving. Key trends like AI, neobanks, and green fintech are reshaping finance. This transformation is not only revolutionizing service delivery, but also consumer expectations. Financial institutions are facing the hurdles of balancing innovation with responsibilities in AI ethics, data privacy, and cybersecurity amidst the many technological advancements flooding the industry.

Success in this dynamic environment hinges on agile adaptation and the ability to leverage technology. And, this leads to innovation and sustainable growth. The future of finance is digital and every business has the opportunity to be part of this change.

For those ready to embrace these trends, Avenga can guide you through the journey of FinTech innovation. Reach out to us and take a step towards a digitally-driven financial future.