Streamlining Insurance Claim Management With AI: A Closer Look

May 6, 2025 11 min read

AI can dramatically expedite claims processing, given that the insurance carrier already has the foundation for its implementation.

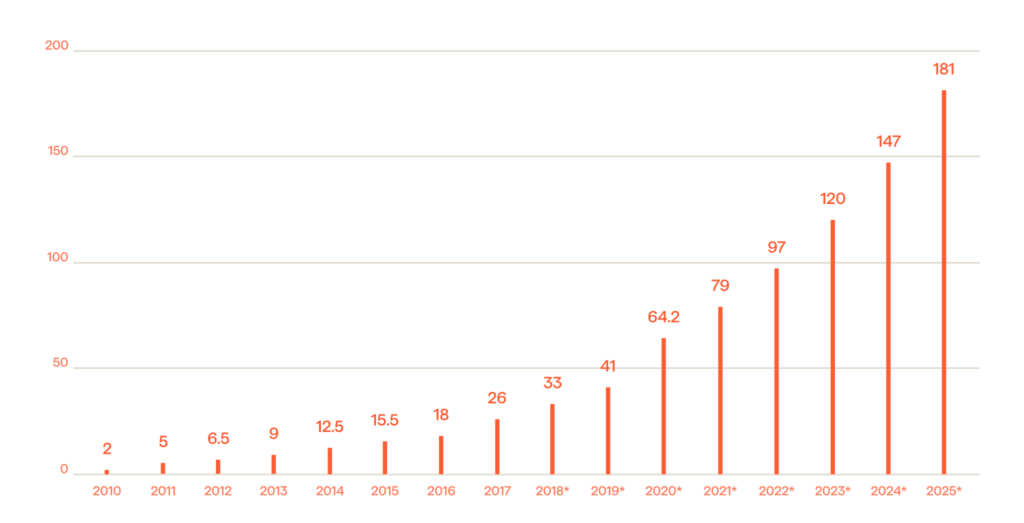

Data continues to grow in size, variety, and velocity (Figure 1.) This makes the core function of the insurance industry – risk management – as challenging as ever to handle. While there has been some recent momentum among carriers to embrace digital transformation, automation and optimization initiatives have mostly been confined to specific parts of different workflows.

The strategic integration of Artificial Intelligence (AI) throughout organizational operations, with a particular focus on enhancing the capabilities of knowledge workers, holds the potential to empower institutional insurers in effectively navigating the prevailing uncertainties and addressing the escalating threats emanating within the insurtech sector. Yet despite this recognition, insurance leaders are constrained by the slow pace of progress in the industry, because of the intricate web of regulatory oversight.

Remarkably, certain forward-thinking carriers, even within their modernized paradigms, continue to collect data through paper documentation or through non-standardized and unstructured digital formats. This practice results in critical deficiencies wherein employees, particularly claims adjusters, often find themselves bereft of immediate access to vital information when crucial decisions need to be made. This operational gap exerts a substantial toll on productivity and frequently culminates in costly errors. Moreover, the labor-intensive task of manually scrutinizing and extracting insights from data spanning a multitude of platforms, formats, and structures is an inherently laborious, intricate, and error-prone endeavor. The currently configured standard operating procedures are ill-suited to accommodate the dynamic pace of business expansion. Consequently, we are seeing a growing number of insurance executives gravitating towards the strategic deployment of AI as a means to more effectively manage their data assets.

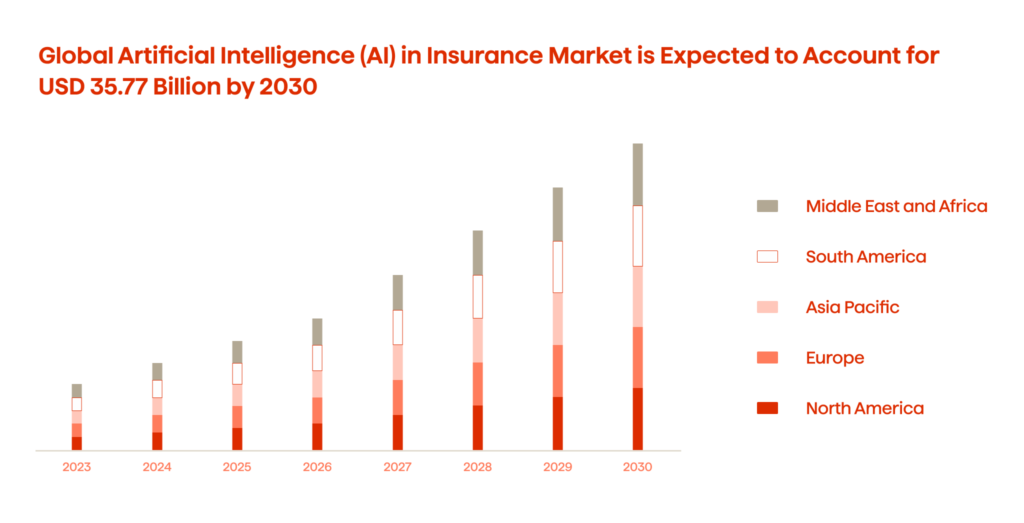

And with all this in mind, it is no shock that the global use of AI in the insurance market is expected to reach USD 33.77 billion by 2030 (Figure 2.)

From our experience, we assert that AI represents an invaluable tool in providing insurers with a consolidated perspective on their clientele. It possesses the capability to harmonize historically disparate datasets that are intrinsic to the insurance domain, thereby facilitating unfettered access to critical insights for personnel engaged across the spectrum of the claims management lifecycle.

With the realization of such transparency, a realm of transformative possibilities unfolds. New customer journeys, firmly anchored in customer-centricity, emerge and they are accompanied by the attainment of profound insights into customer preferences and life circumstances. This newfound agility not only serves to fortify customer relationships through the delivery of enhanced experiences, but it also enables the provision of highly personalized quotations, policy recommendations, and targeted advertisements at every touchpoint within the customer lifecycle. These strategic imperatives collectively yield the potential for substantial improvements to the bottom line.

General uses of AI in claims insurance

In general, the entire administrative process surrounding claims management can be partially automated through AI. Various algorithms can be employed to analyze both numerical and natural language data. AI-enabled tools can swiftly sift through diverse knowledge bases, healthcare forms, policies, and other pertinent documents to retrieve the necessary information. Consequently, these models can enhance the capabilities of knowledge workers by aiding them in swiftly identifying eligible claims, detecting red flags indicative of fraudulent ones, and consistently determining the percentage of claims that should be paid out.

Currently, approximately 30% of a knowledge worker’s time is dedicated to locating and retrieving data from various sources. These technologies not only enhance staff effectiveness, but also, by handling tasks such as data entry, claim routing, and document review, they free up valuable time for more important and value-added tasks.

What trends are there right now on the side of claims management?

At present, approximately 31% of claimants express that they are not satisfied with the handling of their claims. This figure constitutes a substantial portion of a carriers’ client base, and the potential loss of these customers’ renewal premiums could translate into an estimated $170 billion in financial setbacks over the ensuing five years.

According to this study, the main cause of this dissatisfaction is, somewhat unexpectedly, not primarily associated with the amount disbursed in a settlement, although naturally it plays a role. Rather, the issue revolves around the expeditiousness of the claims process and the intricacies involved in navigating its various stages.

An equally pertinent statistic underscores that approximately 40% of inbound calls are straightforward requests for claim status updates. These routine inquiries represent a category where AI can competently and autonomously address inquiries, thereby optimizing operational efficiency.

The challenges claim adjusters face

Indemnity accuracy

Accurate indemnity valuation has consistently posed as one of the most formidable challenges for claims adjusters, and for several compelling reasons. Achieving precision in loss-valuation demands navigating a landscape fraught with factors such as vague policy language, frequent lack of meticulous underwriting and claims assessments, the need for vigilant fraud management, and the ever-evolving regulatory environment. With such a multitude of dynamic variables at play, the process can become daunting for adjusters as they endeavor to strike a balance between accuracy and operational efficiency. Compounding these challenges are the current issues with escalating inflation, chip shortages, supply chain disruptions, and more.

Manual Processes

The second key challenge is the manual processes many carriers still rely upon. The handling of paperwork, unstructured digital documents, and communication with all involved parties often consumes enormous amounts of an adjuster’s time. Also, manual data entry and calculations are prone to errors and inaccuracies. Subsequently, these issues can lead to disputes with claimants, cause undue delays, and result in additional administrative work. Besides that, outdated procedures are often the cause of inconsistencies, unequal workloads, inefficient resource allocation, and increased overheads.

Fragmentation Of Experience

An often-cited analogy is that while many insurers have made strides in creating digital highways, there are still frequent manual off-ramps every ten feet. What this implies is that although some automated and digital processes have been integrated into the workflow (e.g., claimants can capture images of their damaged vehicles and upload them to the carrier’s app), these processes still typically require adjuster intervention, often through phone calls, as the next step. Consequently, the overall claims experience remains fragmented, leading to potential additional challenges, particularly in the context of disabilities, group benefits, and other complex scenarios.

Customer Expectations

Expectations related to claims management continue to surge upwards. Shifts in customer behavior, coupled with competitive pressures, have created an environment where claimants anticipate swift service and a streamlined process. To thrive in this evolving landscape, carriers must implement higher levels of automation, prioritize the adoption of AI and other technologies on a larger scale, and place a heightened emphasis on customer-centricity.

So, Is There A Faster Path To Resolution In Claim Management With AI?

Within large insurance organizations, unnecessary delays persist in many phases of claim management processes, particularly in the case of straightforward claims. These delays often stem from prolonged turnaround times as claims traverse various teams’ procedures within the carrier. These disjointed stages not only result in increased customer inquiries but also introduce additional steps into the process. And, as for the high-end claims where extended adjudication and filing stages are to be expected, there are still massive optimization opportunities where AI can be properly implemented.

How we approach the AI-enabled claims processing transformation at Avenga

Our approach to the AI-enabled claims processing transformation at Avenga begins with the optimization of the First Notice of Loss (FNOL) and the entire claims lodgement phase. AI technology, sometimes complemented by Robotic Process Automation (RPA) bots, is perfect for expediting eligibility checks based on policy matching, providing policy explanations and guidance, and ensuring prompt handling of basic checks during the initial claim submission. As claims information is not typically structured in a manner that allows claims teams to easily retrieve answers to specific questions that are needed to advance the resolution, AI algorithms are employed to retrieve, summarize, and categorize the complex documentation required.

The next logical steps, therefore, are:

- Simplifying and accelerating initial data intake through various channels such as web portals and mobile applications (for which chatbots and other Natural Language Processing (NLP) technologies are used).

- Establishing a robust backend infrastructure to support AI algorithms that are capable of verifying covered events, predicting claim complexity levels, identifying potential high-cost claims, and calculating the likelihood of litigation.

When it comes to adjudication, the process is frequently characterized by labor-intensive demands. Even in the case of straightforward claims, personnel are required to meticulously review claims and their associated documentation, calculate the extent of loss, engage with claimants across various communication channels, potentially delve into prior interactions if they are on record, and undertake a substantial volume of data entry tasks.

We use AI to streamline this complex procedure, turning to a simple binary determination for the algorithm. Specifically, we employ Generative AI (GenAI) for collecting preliminary info, extracting relevant data from various sources, and categorizing pertinent documents. Then, Computer Vision (CV) models are used to evaluate the damages based on the visual evidence presented by a claimant, and specially trained fraud-detection ML algorithms identify potential fraudulent activities. Used separately or together, in any configuration that suits the carrier’s requirements, we’ve learned that these tools can significantly enhance an organization’s operational efficiency and accuracy.

Insurance carriers must maintain a comprehensive understanding of the AI model’s inherent limitations. Regardless of the technological advancements achieved, there will still be certain categories of claims, notably those of a highly emotional, large-scale, or complex nature, that will forever remain out of the scope of what AI can handle. Examples of these include ENO (Errors and Omissions), DNO (Directors and Officers liability) in the commercial domain, and severe accidents in the realm of life insurance.

So, in this area, the strategic focus lies in the optimization of specific parts of the processing, which involves the automation of select stages while reserving human intervention for cases necessitating manual exception handling.

As we transition to the culminating phases of claim resolution ᅳ settlement and closure ᅳ AI presents an array of promising prospects. Settlement manifests in several diverse forms, ranging from financial disbursements to repairs or replacements. Each of these scenarios triggers distinct workflows, necessitating discrete steps. For instance, in the case of a financial payout, claim management systems of record must be consulted, and payment mechanisms must be promptly activated to compute the requisite amounts and facilitate fund transfers to either claimants or repair entities.

When the context pertains to component replacement or repair, our supply chain management solutions are invoked to ensure the seamless delivery of essential materials. Through seamless integration with our existing platforms, AI technologies have empowered us to automate the majority, if not the entirety, of these processes, particularly within the domain of high-frequency and low-complexity claims. And, human intervention is reserved exclusively for scenarios warranting exceptional scrutiny.

If the downstream tasks are API-compatible, we deploy ML-driven orchestration tools. In cases demanding integration with legacy systems, which are characterized by less flexibility, we employ AI-driven process automation solutions.

An equally vital aspect of the settlement phase pertains to client engagement and communication. Leveraging GenAI-enabled communication tools, we expeditiously disseminate notifications across the channels preferred by our clients. This approach substantially alleviates the burden on our clients’ contact centers, enhances the customer experience, and maintains their clients being well-informed about the progress of their claims.

Additionally, AI can be leveraged for automated claims review at the final closure step. We’ve had lots of success helping insurance carriers utilize predictive models for the quick identification of potential areas of process improvement, and important trends in claim categories and any associated costs. Also, the models can get us comprehensive insights and recommendations as to the optimal offers and policy enhancements.

Summing Up

AI (GenAI, CV, and other types of models) is making its way deeper into the insurance arena despite the industry’s stringent regulatory frameworks. Algorithms are already being utilized by many carriers worldwide, including our own clients, for use cases such as helping claim adjusters make faster and more accurate decisions.

As adoption continues to grow, the implications will become even more significant. AI/ML predictive models hold immense promise in terms of helping carriers fight fraudulent claims, which currently cost them approximately USD $80 billion annually and account for over 10% of all insurance claim costs.

They can also reduce the processing time for simple routine claims from days to seconds, provided the organization has the necessary infrastructure and integrations in place to facilitate end-to-end automated workflows. If implemented correctly, the models can free up claim adjusters to focus on more value-added tasks and drastically elevate an organization’s efficiency.

If you would like to learn more about how AI is reshaping claim processing or are considering launching a transformative AI initiative, reach out to our experts right now for a free consultation!