How AI-driven Insights Help Raise Customer Engagement In Insurance Marketing

May 6, 2025 16 min read

The key areas where AI is transforming, optimizing, and elevating marketing in the insurance industry.

As we’ve mentioned in previous articles, insurance is on the verge of a massive AI-driven shift. Despite the challenges stemming from the industry being heavily regulated, insurance carriers are actively experimenting with predictive models in many areas, from claim processing to underwriting, fraud detection, pricing, and, increasingly, customer service and marketing.

By using advanced analytics and Machine Learning (ML) capabilities, insurance companies can extract valuable insights from large datasets that can help separate their clientele into more granular and distinctive groups based upon behavior, needs, and preferences. And this has huge implications for their marketing outcomes.

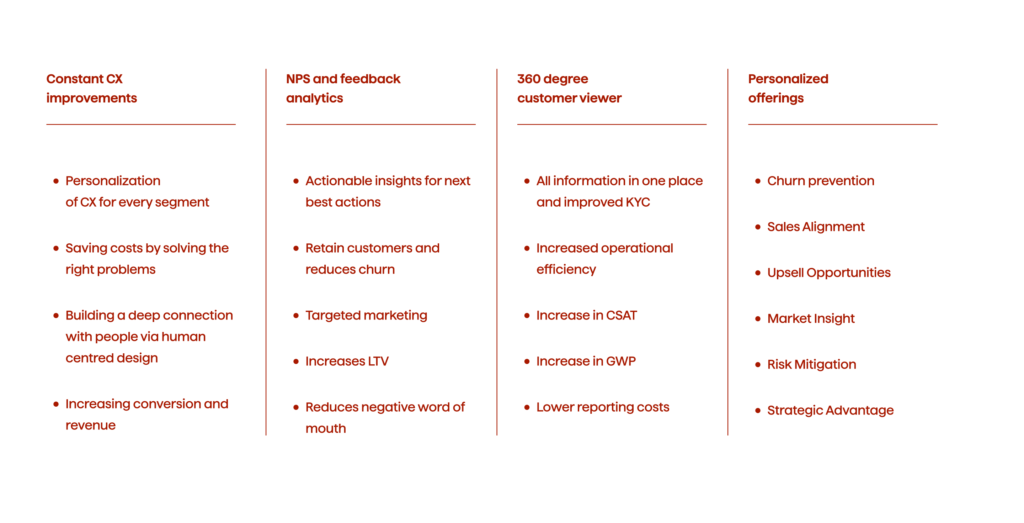

Having worked with both mid-sized and large insurance companies, we’ve thoroughly studied the industry’s overall marketing needs and pain points. Hence, based on the use case analysis, we’ve deduced that it makes the most sense to first focus on applying AI in these four areas:

- Creating a 360-degree customer view

- Personalized offerings

- Improving CX (Customer Experience)

- NPS (Net Promoter Score) and feedback analysis

Why is it Necessary for Insurers to Make Use of AI?

Creating A 360-degree Customer View

AI algorithms help organizations aggregate and integrate data from various sources to create a complete and accurate view of each customer. These sources typically include claims management systems, policy administration systems, CRMs (Customer Relationship Management), social media, etc. Within architectural considerations, Graph Neural Networks (GNNs) often emerge as an optimal choice for capturing intricate relationships within data sources.

GNNs create graphs in which data sources are the nodes and the edges are the relationships between them. For example, they can visualize a link between a CRM and a policy administration system to see if they share some customer data.

After the graph has been created, a message-passing algorithm is applied to move information between nodes, and after each iteration, the nodes update their state based on the messages from neighboring nodes. Post-graph creation, a message-passing algorithm is applied to transfer information between nodes. Iteratively, the vertices update themselves based on messages from adjacent nodes. After repeated interactions, the GNN converges, resulting in each node representing a single view of the customer. Once the system is ready, various marketing tasks could be performed with it, such as segmentation, personalized recommendations, etc.

Data Cleaning And Enrichment

Within this element, Named Entity Recognition, Part of Speech, Conference resolution, and Text models can be applied to both identify and correct errors, misspellings, and different inconsistencies within client data, as well as to extract information from unstructured sources such as reviews and social media posts to enrich existing datasets. Then, classification, regression, clustering, and anomaly detection algorithms can be used to detect incorrect policy numbers and claim information and predict various customer risk factors.

Finally, GNN architectures can clean data by exploiting the relationships between clients (i.e., to identify and eliminate duplicate information), as well as propagate data across the customer graph, such as demographics. This means, for instance, that if the GNN sees a client’s age, it could determine the probable age of their family members, which could then be used to create more personalized campaigns.

Segmentation And Profiling

GNNs can orchestrate client segmentation based on social circles, claims history, and policy purchase patterns. This analytical framework provides insights into purchasing decisions within groups of friends and families. But they’re just one option.

A range of traditional ML models, including K-means, SVMs (Support Vector Machine), Decision Trees, Division, and Random Forests, can also be leveraged to find patterns in a dataset based on various risk factors such as age, driving history, and health history. These models can be important tools not only for creating targeted marketing campaigns, but also for generating personalized risk mitigation strategies for each client.

Yet, another approach is training a Reinforcement Learning (RL) agent to learn which clients are the most important to the company. This happens when an agent interacts with customer data and gets rewarded each time they identify valuable clients. Once trained, it can segment incoming data into appropriate sections based on their lifetime value. With these insights, the carrier can focus more on directing their efforts toward valuable clients and creating impactful marketing campaigns.

Predictive Analytics

AI-powered predictive models enable the anticipation of client behavior, assessing the probabilities of claims filing or churn. These insights are helpful for developing proactive marketing campaigns and client retention strategies.

A variety of networks can be utilized to predict customer behavior and lifetime value and then prioritize marketing campaigns correctly.

Traditional models:

- Logistic regression. Effective for binary classification tasks, such as predicting whether a customer will churn or not.

- Decision trees. Lend themselves both for classification and regression tasks, and are particularly well-suited for predictive analytics due to being easy to interpret and capable of learning complex patterns in data.

- Random forests. Average the predictions of the decision trees and, therefore, tend to be more accurate and less prone to overfitting than individual trees.

- Gradient boosting machines (GBMs). GBMs, which are ensembles of simple algorithms, often tend to be more accurate than random forests. Also, they can be used for a broader range of tasks, such as classification, regression, and ranking.

- Support vector machines (SVMs). SVMs are an optimal option when dealing with high-dimensional data, but they can also be used for classification and regression tasks.

Deep learning models:

- Simple neural networks (NNs). NNs are well-suited for predictive analytics and can learn complex patterns in data while having a simple architecture.

- Convolutional neural networks (CNNs). CNNs are used mostly for image and video classification but can also be applied to Natural Language Processing (NLP) tasks such as text classification.

- Recurrent neural networks (RNNs). RNNs process sequential data, such as text and time series data.

- Long short-term memory (LSTM) networks. LSTM networks are a type of RNN that is optimized for learning long-range dependencies in sequential data.

- Graph Neural Networks (GNNs). GNNs, as we’ve mentioned, perform well in terms of modelling dependencies between data objects, such as clients. This also makes them very well-suited for predictive analytics as they can efficiently estimate probable client behavior.

Overall, our clients report the following benefits from using AI for a 360-degree view creation:

- Data consolidation

- Enhanced operational efficiency

- Improved customer satisfaction scores

- Increased Gross Written Premiums (GWP)

- Lower reporting costs

The Business Advantages Of Having An Ai-enabled 360-degree Customer View

Enhanced Customer Understanding

AI makes it easy to collect and analyze large amounts of information from various and diverse sources, enabling organizations to gain a deeper understanding of customer behaviors and preferences, along with better risk profiles. For instance, by analyzing customer interactions, the models can output patterns and trends of clients’ needs, expectations, and pain points.

The insights uncovered from claims data can aid in enhancing risk assessments, allowing the creation of detailed risk mitigation strategies.

Finally, the patterns found in demographic information are highly useful for generating targeted marketing materials.

Personalized Customer Experiences

Since AI can predict preferences, it can assist insurers in proactively offering relevant and highly-personalized products and services. These tailored recommendations can be based on past purchases, browsing behavior, and demographic information. With an AI-enabled 360-degree customer view, companies can deliver far more personalized and effective campaigns and services, catering to the key pain points, requirements, and expectations of each customer segment. Ultimately, this focus on the specific issues each group faces translates into increased customer satisfaction and engagement.

Optimized Marketing Strategies

Marketing strategy optimization is yet another noteworthy benefit resulting from the use of AI for a 360-degree view creation. Predictive algorithms excel in pinpointing the most impactful marketing messages and channels, thus furnishing the insights necessary to navigate marketing campaigns towards optimal yield. Furthermore, the models can optimize messages specifically for the most promising channels detected for each segment. When based on these comprehensive data-driven insights, campaigns achieve a vastly increased likelihood of engagement and conversion.

Personalized Product Development

Having an AI-enabled 360-degree customer view, insurance companies can create highly personalized insurance products. AI can identify gaps in the existing suite of offerings and help design solutions that address them. The implications of this approach are far-reaching. If used in this way, the models can substantially improve customer satisfaction while helping manage risks.

The examples here include:

- Data-based premiums for auto insurance. Premiums are adjusted based on insights into individuals’ driving habits. Companies can reward safe drivers with lower costs.

- Home insurance centered on telematics. Specific policies can be created based on clients’ existing home safety features and risk factors, such as location and proximity to fire stations.

- Wellness-based health insurance. Companies can offer discounted premiums for individuals who maintain healthy lifestyles and regularly undergo preventive care procedures.

- Life insurance contingent upon lifestyle and medical history. Insurance carriers can use AI to personalize coverage levels and pricing based on factors such as family medical history, genetic predispositions, and a client’s lifestyle habits.

What networks are typically used?

- Feedforward neural networks (FFNNs). Can predict proper auto insurance premiums based on individuals’ driving habits. They can also classify homes into risk categories in the area of home insurance.

- Convolutional neural networks (CNNs). Are highly effective in visual data processing, which is particularly useful in home and medical insurance.

- Recurrent neural networks (RNNs). Are typically applied to analyzing sensor data from home security systems and wearable device data for health insurance.

- Generative adversarial networks (GANs). Aid in generating new medical records and images of homes for training supervised learning neural networks and CNNs.

CX Improvement

In terms of CX improvement, AI is being used for personalization, automation, customer service, and fraud detection.

Personalization

AI algorithms contribute to delivering a personalized marketing experience (i.e., tailored messages and offers) to each client. This is achieved by analyzing customer data and discerning their needs and preferences. Classical methods identify clients likely to be interested in specific insurance products based on purchasing history, demographics, and other data. NLP models analyze client feedback and extract common themes, providing insights into areas for CX improvement.

What networks are used?

- Neural networks (NNs). They are well-suited for personalization tasks because they can identify features with huge predictive power, as well as subtle patterns in large datasets with extreme accuracy.

- Recurrent Neural Networks (RNNs). RNNs, designed for sequential data processing, perform well on personalization tasks that involve context. They can help design offerings based on predicted behavior.

- Long Short-Term Memory (LSTM) Networks. This type of RNN architecture remembers information for a long period of time, which makes it well-suited for tasks that involve long-term dependencies. Typically, they’re applied to predict customer behavior based on data that is spread out over time, such as their past purchases or customer service interactions.

- Transformers. Transformer networks offer more efficiency in terms of handling sequential data, as they can do so in a parallel manner.

- Graph Neural Networks (GNNs). GNNs, designed to establish connections between data points, are often used to recommend products or services to customers based on their social connections or their past interactions with other customers.

- Bayesian Networks. These models can handle uncertainty and provide insights into the factors that are most likely to influence customer behavior. Bayesian networks are often used to predict customer behavior or to generate personalized recommendations based on probabilistic reasoning.

Automation

AI networks automate various tasks, including parts of lead generation, email marketing, and social media marketing, that enhance staff operational efficiency. This allows employees to focus on more strategic tasks like developing new marketing campaigns and strengthening client relationships.

- Lead generation. AI aids in identifying prospects and delivers targeted marketing messages.

- Email marketing. AI-enabled tools create and send personalized emails, especially in circumstances like a prospect abandoning their shopping cart on an insurance carrier’s website.

- Social media marketing. AI handles posting, ad scheduling, and client interactions.

For automation purposes, essentially the same set of networks can be applied, but with slightly different purposes.

- Deep NNs. NNs can be employed to create chatbots that can comprehend and react to natural language, as well as perform sentiment analysis tasks to determine the clients’ satisfaction level. These models can be trained to answer questions, handle issues, and give direction.

- RNNs. With RNNs and their gated variants (GRUs, LSTMs), foreign-language customer inquiries and marketing materials can be automatically translated. By making their services more approachable, businesses can reach more clients on a global scale. Also, by using these networks, carriers can individualize experiences by identifying common interests and tastes of a demographic segment. With better-directed automated communication, insurance organizations can make a stronger appeal to clients and promote more loyalty.

- Transformers. In the context of automation, transformers are mainly used for producing highly personalized content such as product descriptions, social media posts, and email messages. Additionally, a common application is image processing where the models can automatically assess damaged property, accident scenarios, etc.

- Bayesian. Bayesian networks can be leveraged to estimate the Customer Lifetime Value (CLV) of each customer, and this information can then be used to automate targeted marketing campaigns and allocate resources more effectively.

Customer Service

AI-enabled chatbots and virtual assistants serve as effective tools for enhancing customer service. They provide 24/7 responses to basic questions and efficiently sift through large amounts of data to deliver necessary information, such as policy specifications to a client.

Whether rule-based, CNN, RNN, LSTN, or if utilizing a transformer architecture, AI tools can significantly streamline and optimize multiple customer service workflows for insurance companies.

The benefits of using AI for CX improvement include:

- Personalization of CX for every segment

- Reduction of operational costs

- Facilitation of a deeper connection with clients

- Increase in conversion and revenue

NPS And Feedback Analytics

Net Promoter Score (NPS) is a metric of customer loyalty helping companies determine how likely each client is to recommend their services. It is calculated by subtracting the detractors (those who aren’t willing to recommend the organization) from the percentage of clients who are promoters (those who will). AI can be used in various ways to improve NPS and feedback analytics. These include:

- Determining customer pain points. Insurance companies benefit from using AI-powered sentiment analysis tools as they identify the most common customer complaints and suggestions.

- NPS Segmentation. AI can evaluate factors pointing to the possibility of a client becoming a detractor and segment the customer base accordingly. This gives carriers an opportunity to target their marketing and customer service efforts better.

- Predicting behavior. As mentioned earlier, many models can be utilized to predict customer churn and the possibility of them reacting positively to specific marketing campaigns. These insights can help organizations determine clients at risk of churning and target them with special offers that can dramatically increase retention.

- Outreach automation. Client outreach, such as sending highly personalized emails or follow-up messages, can be largely automated with AI. This can improve customer service, gather more insights, and ultimately increase sales.

Benefits of using AI for NPS improvement and feedback analysis include:

- Reduced churn and increased retention

- Highly targeted and more effective marketing campaigns

- Higher Customer Lifetime Value (LTV)

- Reduced negative word of mouth

Model Architecture Options

In addition to all the networks listed above, the following models are frequently used in the context of NPS and feedback analytics: ensemble models, GANs, autoencoders, and Feature Agglomerative Networks (FANETs).

Ensemble models are a method that improve accuracy and overcome the limitations of individual ML algorithms by combining them into a single architecture. In the context of NPS and feedback analysis, they can be used to enhance sentiment analysis, predictive analytics, and chatbot development. For example, an ensemble model could be used to analyze customer feedback and identify common complaints and suggestions.

Autoencoders work with compressed representations of data. They can be used to reduce the dimensionality of customer feedback data, making it far easier to analyze, which can help improve the accuracy of other algorithms working with NPS data. Autoencoders can also be used to generate new customer feedback data, which can be used to train ML models or to test new marketing campaigns.

FANETs are a type of neural network that can be used to learn about the most important features in a dataset. Their properties are beneficial in terms of identifying the most important factors that drive customer satisfaction, reducing the dimensionality of customer feedback data and identifying patterns in it.

Best Tips For AI Implementation Within Insurance Organizations:

- Ensure data is clean and accurate, as this directly affects the accuracy of the AI models.

- Incorporate a variety of data sources. The more data fed into the algorithms, the better they will understand customers’ needs and preferences.

- Monitor the accuracy of the models’ outputs and make adjustments as needed.

Summing Up

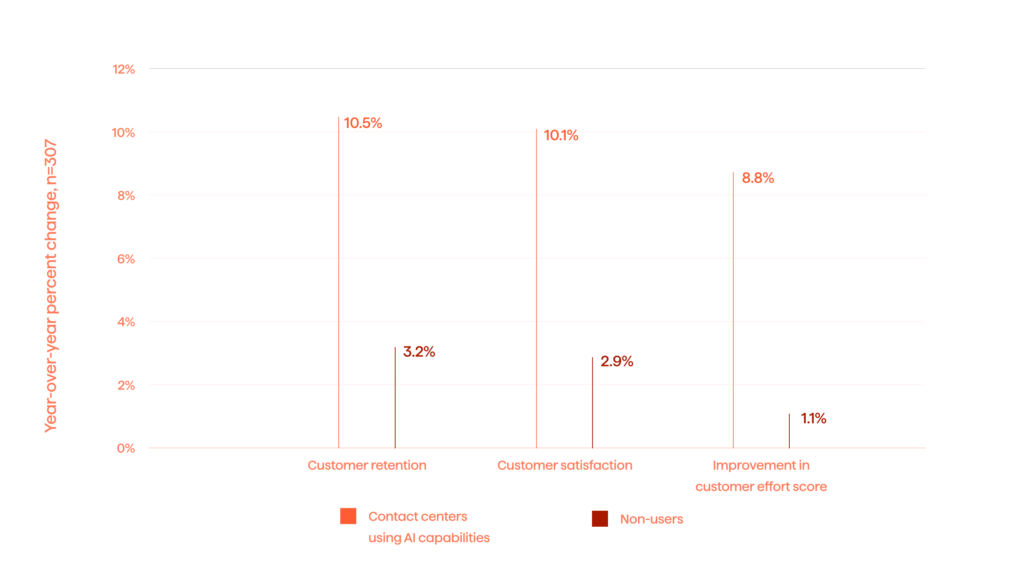

AI models can substantially enhance an insurance carriers’ lead identification and targeting by leveraging intricate patterns within market and customer data. AI, and lately GenAI, are therefore being increasingly adopted by insurers as their inherent capabilities make segmenting and targeting relevant audiences far easier. This leads to more effective quality lead identification and facilitates enhanced lead-activation campaigns.

Additionally, AI proves invaluable for optimizing marketing strategies through meticulous A/B testing of various elements, such as copy, layouts, and SEO strategies. After comprehensive analysis, the models can offer data-driven recommendations that ensure the highest return on investment (ROI) and automate lead-nurturing campaigns that are tailored to individual patterns as prospects progress through their journey.

Beyond marketing applications, AI demonstrates versatile utility post-acquisitions, especially in onboarding and retention. If you’d like to learn how AI can help your organization raise engagement and enhance marketing outcomes, reach out to our experts right now.