The Many High-impact Applications of Data and Analytics in Insurance

April 25, 2025 11 min read

How insurers use data deluge to hone their competitive edge.

The insurance industry is at the epicenter of a technological transformation powered by data. In fact, a 2023 Deloitte survey found that 76% of insurance executives ranked data analytics as critical to modernizing their core business. Momentum is also growing around generative Artificial Intelligence (AI), which can autonomously synthesize novel data insights. According to McKinsey, tapping into advanced analytics techniques, which use AI and Machine Learning (ML) algorithms, could generate €1.2 trillion in global value. For incumbent insurers, the message is clear – adopt or risk disruption. In this article, we will look into the most transformative applications of big data across the insurance value chain and how industry leaders can capture their competitive advantage amid a call for a more customer-centric approach and greater business resilience.

Big Data in Insurance: Use Cases

Through vast new datasets and advanced analytical techniques, insurers have evolved from reliance on traditional broad demographics towards highly granular, individualized assessment of risks and behaviors. Multiple non-traditional data sources, from telematics to social media to IoT sensors, provide far more nuanced insights into decision-making.

Sophisticated Machine Learning algorithms empower insurers to continuously model complex correlations and patterns within disparate big datasets. This facilitates more accurate predictive modeling for everything from real-time risk indication and pricing to claims fraud detection and customer lifetime value projection.

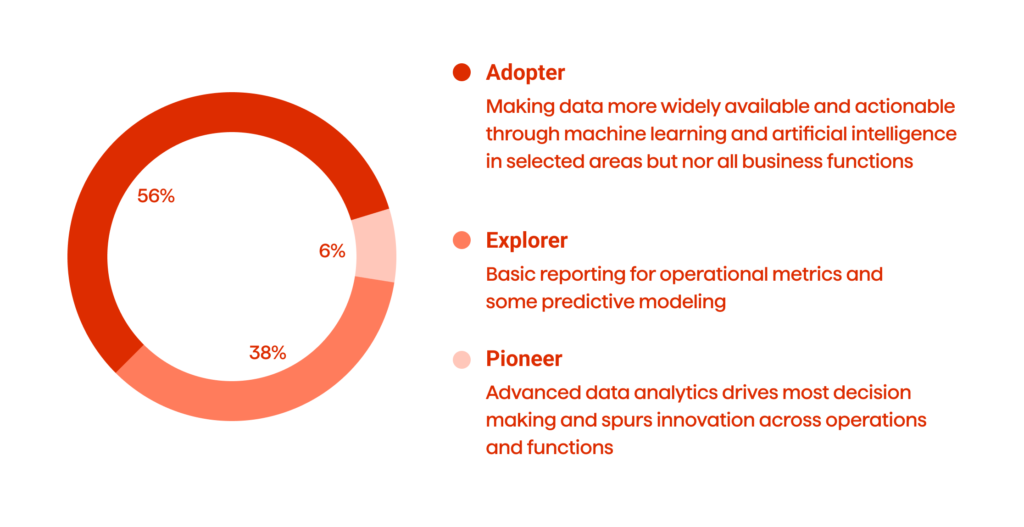

The stakes for proactive adoption of new technologies are only rising as big data continues proliferating. Few insurance companies can boast a status of pioneer in advanced analytics or Machine Learning (see Fig. 1). In the following section, we will examine emerging and long-lasting use cases of technologies in insurance to demonstrate how big data analytics can overhaul traditional insurance practices when applied correctly.

1. Big Data and Analytics for Fraud Detection

In the insurance industry, fraud is a persistent and costly challenge. From exaggerated claims to organized crime rings, fraudulent activities drain billions of dollars from insurance companies annually. In the US alone, this number is estimated to be more than $40 billion per year, according to the Federal Bureau of Investigation (FBI). Notably, the rise of big data and advanced analytics offers insurers an effective instrument to combat this pervasive problem.

Big data makes it possible for insurers to detect fraud in new ways. Through the integration of advanced analytics that has access to vast stores of internal claims data, insurance companies can build predictive models that identify suspicious claims and reveal potential fraud rings. Network analysis techniques can map out relationships in claims data to uncover connections between entities that may be colluding in organized fraud schemes.

Apart from that, Natural Language Processing (NLP) allows insurers to mine unstructured text from claims, emails, or other documents for semantic indicators of fraud. External data sources like public records, social media feeds, and credit reports provide additional signals on a claimant’s risk and fraud propensity. Examining a customer’s behavior across channels, including claims, web, call centers, and mobile, delivers a unified view to detect anomalies suggestive of fraud. In this way, big data systems create space for insurers to integrate, visualize, and analyze immense volumes of internal and external data to uncover subtle fraud indicators early on.

2. Claims Management Optimization in the Insurance Sector

Big data is rapidly emerging as a transformative force across the insurance claims process, from first notice of loss to final settlement. While claims management has been in dire need of new approaches for years, big data techniques triggered that transformation. They enable claims leaders to elevate performance across metrics from staff productivity to loss ratios. Data-driven insights hold the key to wringing more value from the claims process.

With petabytes of historical claims data, organizations can finally see the shape of loss patterns over time, pinpointing inefficiencies from the past. Repetitive manual tasks are sloughing off as robotic process automation (RPA) and intelligent process automation (IPA) handle rote information gathering and documentation. Machine Learning further smoothes workflows by predicting upcoming surges in claims volume so staffing and resources can be aligned ahead of time.

Furthermore, insurance providers can identify high-risk claimants who may need additional guidance through the claims process based on analytics, thereby improving communication with policyholders. Proactive outreach also enhances the customer experience. Big data also enables insurers to analyze patterns in rejected claims due to insufficient coverage. These insights can inform efforts to refine policy coverage and address common coverage gaps.

3. AI and Predictive Analytics for Customer Retention and Churn Prevention

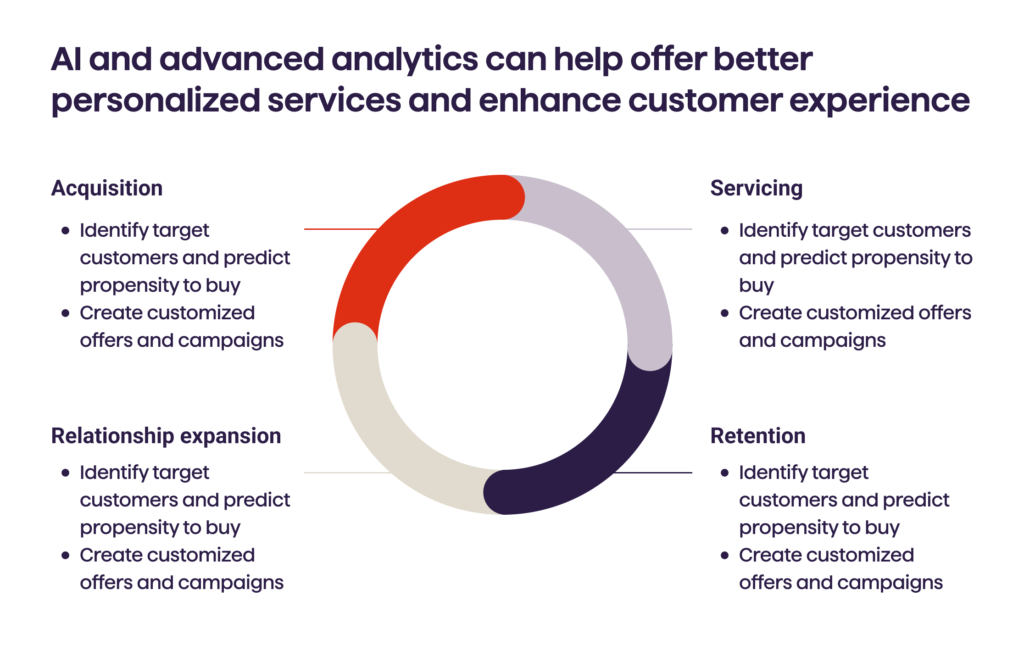

As a 2023 McKinsey research highlights, companies excelling in customer experience surpassed their counterparts in Total Shareholder Return (TSR) by 20% for life insurers and 65% for property and casualty (P&C) insurers between 2017 and 2022 The ability to drive great customer experience is associated with the adoption of AI or advanced analytics for delivering improved services (see Fig. 2). In particular, in order to develop effective customer retention strategies and prevent churn, insurers leverage big data to gain a deeper understanding of their policyholders. This implies collecting and thoroughly analyzing customer demographics, usage habits, service interactions, claims history, or other attributes necessary for specific goals.

Advanced analytics techniques like Machine Learning can then be applied to this data to build predictive models that identify individual policyholders who are most likely to churn. These models help insurers understand which customers need proactive retention efforts. Big data also enables insurers to discover common service problems, claim denials, premium increases, or other pain points.

Ongoing tracking of leading indicators from customer data enables insurance companies to continuously measure churn metrics and gauge the effectiveness of their retention strategies. This allows for the refinement of approaches over time. Big data implementation also facilitates cross-sell and upsell opportunities to provide added value that improves customer retention.

Explore how we digitized the finalization process for commercial insurance for HDI. Success story

4. Underwriting Optimization

Industry leaders use the potential of data in order to improve their risk evaluation strategy, deliver top-tier customer experience, and strengthen the decision-making process during underwriting. Carriers now use predictive modeling on large datasets for granular segmentation of risk. For instance, an auto insurer could analyze driving data, credit scores, and demographics to categorize drivers as low, medium, or high risk. This is far more advanced than traditional segmentation by standard factors like age and location.

In order to make this non-traditional approach work, insurance companies are increasingly tapping external datasets. To name one example, some of them analyze satellite imagery to evaluate roof conditions, vegetation density, pool safety, and other risk factors on a property-by-property basis. This delivers superior insight compared to relying on limited information like the home’s age. As McKinsey reports, there are a bunch of external data domains at disposal of carriers:

- Industry data (financial services, healthcare, energy, or oil and gas)

- Internet data (pricing, semantic web, SEO, and web advertising)

- Environmental data (climate, sustainability)

- Public data (government information)

- Individual data (consumer credit, brand affinity and loyalty.)

- Business data (B2B contract, B2B intent)

- Location data (Cell tower, IoT sensor, satellite, and drone images)

For low-risk customers, big data empowers insurers to provide top-notch customer experiences. Data insights allow insurers to simplify and customize the application process for these customers, only asking the most relevant questions. This approach enables straight-through processing (STP), where eligible applicants can get near-instant quotes, and there is no need for the involvement of an underwriter. This strategy greatly contributes to customer satisfaction and optimizes the underwriting process in general.

5. Personalized Communication

Generative AI-enabled intelligent chatbots provide insurance carriers with powerful new ways to deliver highly personalized and natural communication experiences to users. They can detect customer needs and sentiments, and offer relevant responses. Intelligent automation can also optimize employee productivity by handling routine inquiries. According to recent research, the application of generative AI in insurance will rise to approximately $8,099.97 million by 2032, showing a CAGR of 33.11% during the forecast period from 2023 to 2032.

Intelligent chatbots can hold human-like conversations and continue dialogues with customers over multiple sessions, building rapport through ongoing personalization. Aligning these bots with customer policy data and analytics further enhances the accuracy of information and allows the chatbots to notify customers about coverage changes, upcoming payments, and suitable products or services tailored to each individual’s needs and interests.

Whether it comes to informing customers about policy renewals, offering personalized tips for risk mitigation, or providing guidance during claims processes, these AI-driven interactions help keep customers engaged throughout their insurance journey. Overall, generative AI implementation can be divided into five primary domains: summarization, classification, generation, extraction, and question-answering, as IBM highlights.

6. Telematics and Usage-based Insurance

As we mentioned before, deployment of advanced analytics across diverse data domains is pivotal for insurers that strive to optimize their insurance programs. Similar is applicable to the case of usage-based insurance (UBI). UBI leverages telematics data to tie premiums to measured driving behaviors and vehicle usage. Telematics refers to technology that collects and transmits vehicle data through devices like onboard diagnostics dongles and connected car platforms. This variety includes driving metrics such as vehicle speed, acceleration, braking, cornering, or mileage. Usage-based insurance utilizes this telematics data to customize premiums based on actual driving behaviors and the accurate risk profile of customers. In the period from 2023 to 2032, the UBI market is forecast to reach a value of $267.4 billion, with a CAGR of 26.2%.

The demand for usage-based insurance has risen recently, mainly due to the potential of UBI to cut down insurance costs for drivers, Forbes indicates. This is enabled by the ability of telematics-based pricing to directly account for individual driving behaviors and risk profiles. With traditional demographic-based pricing, safe drivers essentially subsidize higher-risk groups. Proponents also argue that usage-based insurance promises to incentivize generally safer driving practices through direct financial rewards and gamification approaches that motivate better habits.

Overall, as sensor-laden connected cars proliferate, the data foundation for UBI will strengthen further. It means that insurers will need to work with diverse datasets and learn how to effectively harness insights from telematics. Also, seamless data infrastructure will be required to ingest and process high-velocity structured and unstructured data streams. Companies that build robust big data and analytics foundations will likely lead in the usage-based segment.

7. Crisis Modeling

Advanced analytics is key to navigating crises. In fact, risk management professionals are increasing their expenditure on risk management technology, with 65% indicating a rise in investment, according to a survey by PwC. Advanced analytics can significantly improve insurance carriers’ crisis modeling and disaster response through several key mechanisms:

- Real-time Exposure Monitoring. IoT sensors, satellites, drones, and computer vision enable real-time tracking of environmental conditions, property damage, supply chain disruptions, and policy exposures during an unfolding crisis. This monitoring allows for dynamic and responsive modeling.

- Rapid Claims Triage. AI can quickly sift through incoming claims and flag the most severe for priority response based on photos, adjuster reports, and historical claims data, facilitating efficient resource allocation.

- Scenario Analysis. With data simulations, insurers can stress test thousands of disaster scenarios to evaluate losses, liquidity needs, and business continuity preparations, which promotes strategic readiness.

- Predictive Supply/Demand Forecasting. Data mining helps project demand surges for labor and materials needed for repairs and replacements. Early supply chain insights improve logistical agility.

While most insurers still underutilize data analytics in crisis management, those able to leverage big data will gain sharper risk insights, optimized response, and competitive resilience. Harnessing data and analytics plays an indispensable role in advancing crisis preparedness and response.

Takeaways

Advances in big data have reached a tipping point for the insurance industry. Technology has already disrupted virtually every part of the insurance sector value chain, yet most carriers remain in the early stages of leveraging these capabilities. The imperative to evolve into truly customer-centric digital insurers has never been more urgent amid rising consumer expectations. Rather than playing catch up, insurers can take a proactive approach to big data adoption and emerge as pioneers of the industry’s analytical transformation. The question is: how will insurance companies use data to strengthen their readiness and respond to rising global risks? The answer remains open-ended.

Let’s start that conversation—reach out today to explore how data and analytics can power your next move.