The many high-impact applications of data and analytics in insurance

Explore essential applications of data and analytics in insurance. Learn how industry leaders use advanced analytics and generative AI for their competitiveness.

Embracing innovation: how technology is redefining the insurance industry in 2024.

The insurance industry stands at the threshold of a transformative era. As we step into 2024, a wave of technological innovation is reshaping this age-old sector. “In an industry driven by the meticulous assessment of risk, the rise of technology represents both a challenge and a tremendous opportunity,” says a leading industry expert.

This article digs deep into the top ten technology trends in the insurance sector. It highlights how digitalization, customer-centric approaches, and advanced risk management strategies are not just responding to change – they are driving it. From AI’s role in enhancing customer interactions to the pivotal use of IoT in risk assessment, these trends signify a dynamic shift towards a more efficient, responsive, and personalized insurance landscape.

Insurers are shifting to a more customer-focused model, utilizing advanced technologies to enhance accessibility and collaboration. This change aims to improve the customer experience and streamline operations, but it will require a cultural shift within companies.

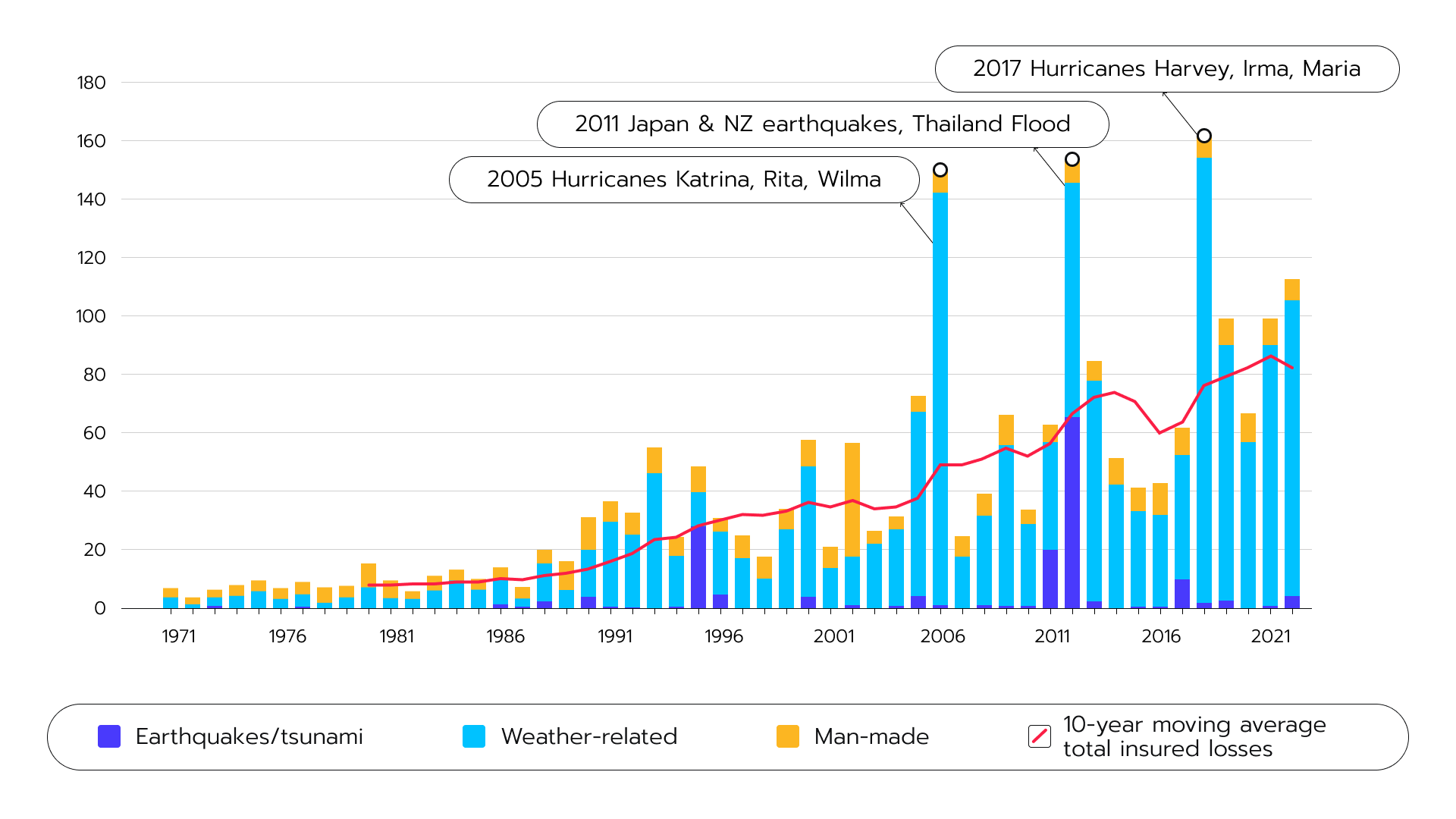

The increasing frequency and severity of global risks, from climate changes to cybercrime, are funneling attention on the insurance industry’s capacity to act as society’s “financial safety net” (see Fig.1). Insurers are realizing that merely reacting to risks is inadequate. In reality, there is a growing focus on preventing losses from occurring in the first place. Figure 1. Insured losses since 1970 in USD billion

Figure 1. Insured losses since 1970 in USD billion

To achieve this level of transformation, insurance companies are adopting new technologies, including generative AI, which are essential for harvesting actionable insights from the industry’s data.

Digital customer data management systems are enabling insurers to collect, store, and analyze customer data more efficiently, leading to more personalized services. The implementation of real-time data processing systems allows insurers to respond promptly to claims, adjust policy terms, and provide updated information to customers, thus enhancing customer satisfaction.

Leveraging data analytics and AI, insurers are offering tailor-made policy recommendations, pricing, and services. This not only improves the satisfaction of the customer, but also builds loyalty and trust. Digital channels like mobile apps and AI-driven chatbots are revolutionizing customer interactions, making services more user-friendly and responsive.

Insurance companies are prioritizing digital solutions in all aspects of their business. This approach is critical for enhancing efficiency and customer satisfaction, and ensures business continuity during crises. Moreover, this digital-first strategy is equipping insurance firms to better predict and adapt to future trends, setting a new standard for innovation and service excellence in the industry.

Insurers must create seamless omnichannel customer journeys so as to improve the quality of their infrequent interactions with customers. Despite digitalization, the human element remains crucial, especially in life insurance, where agents are still the most trusted source for insurance products.

The customer-centric transformation in the insurance industry is a holistic approach encompassing technological advancements, cultural changes, and a concentration on personalized customer experiences. This shift is not just about adopting new technologies, but also about redefining insurance operations and customer engagement for a more connected and responsive future.

The shift towards self-service in the insurance industry is already significantly shaping policyholder experiences in 2024. This change is driven by the growing demand for digital solutions that allow customers to manage their insurance policies with greater autonomy and convenience.

The number of people willing to switch insurance providers due to the lack of a user-friendly customer portal has increased dramatically, indicating a clear preference for digital platforms. A vast majority of insurers now offer policy management capabilities via mobile apps, with custom insurance applications becoming the preferred channel for customer servicing.

Self-service platforms in the insurance industry are becoming increasingly vital, offering a range of features designed to strengthen the user experience and streamline policy management.

The incorporation of these essential features in self-service platforms demonstrates how insurance companies are evolving to meet the needs of the modern policyholder, ensuring ease of use, efficiency, and enhanced digital engagement.

Especially among younger demographics, there is a significant trend towards using digital channels for insurance interactions. Insurers are focusing on omnichannel strategies to provide seamless experiences across different communication platforms, thus enhancing customer engagement and loyalty.

The integration of InsurTech, utilizing AI, blockchain, IoT, and Natural Language Processing (NLP), is key to modernizing traditional insurance processes and enhancing self-service options. InsurTech is particularly vital in adapting to new challenges like climate change, as they offer tools for risk assessment and mitigation.

Chatbots, both rule-based and AI-powered, are increasingly used to provide automated assistance, handle policy inquiries, and process claims effectively. These technologies are employed to smoothly process vast amounts of consumer data, creating personalized experiences, and improving the accuracy and efficiency of self-service options.

The movement towards self-service in the insurance sector is a response to expanding customer needs and technological advancements. By incorporating digital solutions like InsurTech, predictive analytics, IoT, chatbots, and AI, insurers are not only enhancing policyholder autonomy, but also refashioning the insurance landscape towards a more productive and customer-centric model.

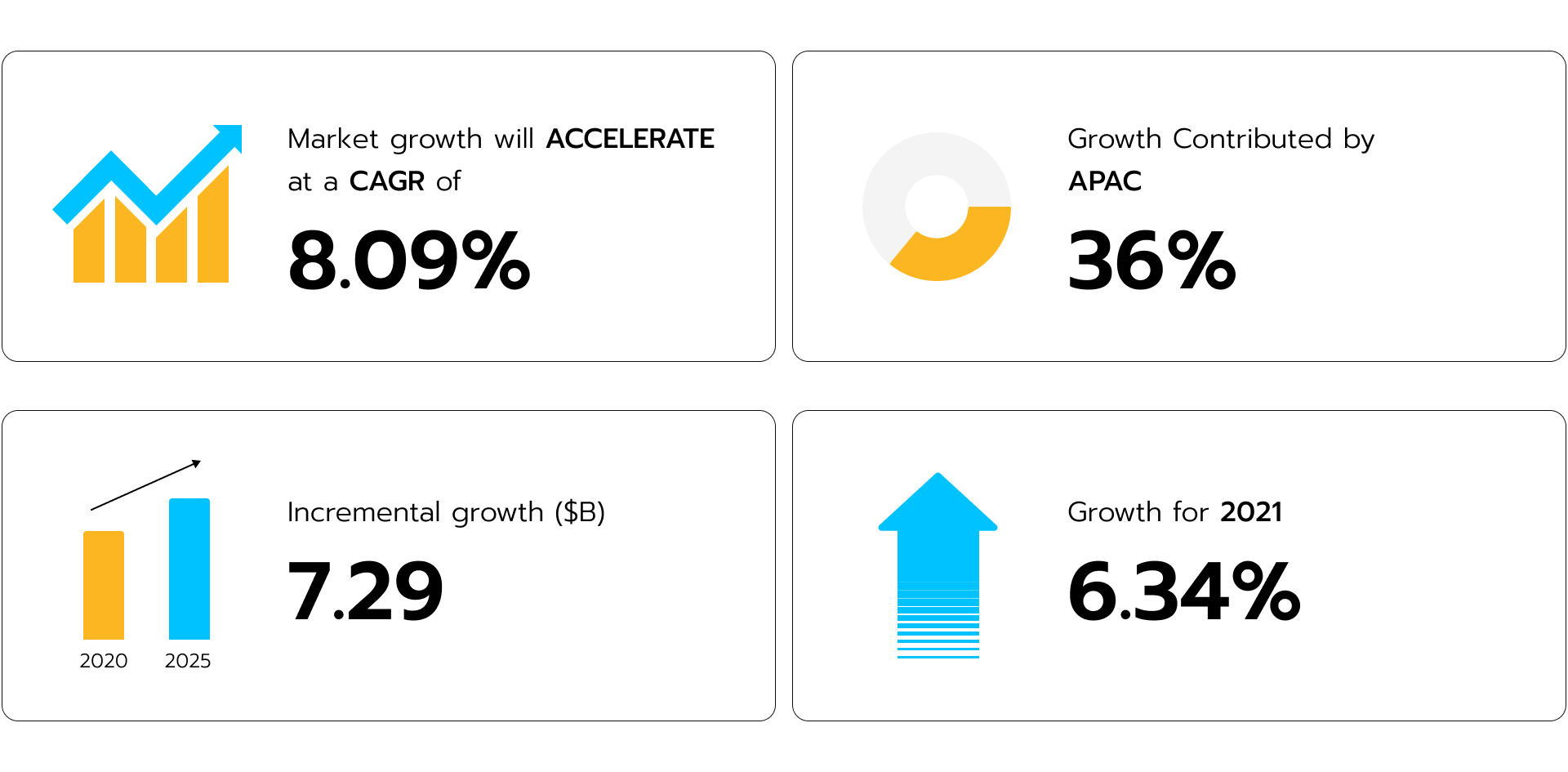

At the moment, the movement towards custom insurance apps and customer portals is driven by a significant increase in the number of people willing to switch insurance providers due to a lack of user-friendly customer portals. This shift has prompted a majority of insurance companies to enhance their digital capabilities (see Fig. 2). Figure 2. The global insurance software market

Figure 2. The global insurance software market

In an era where convenience and efficiency are paramount, insurance companies are increasingly focusing on enhancing the accessibility and functionality of their platforms in order to provide a superior user experience.

These advancements in insurance platforms reflect a significant shift towards a more digital and customer-centric approach, where ease of access, personalization, and informed decision-making are key to enhancing customer satisfaction and streamlining insurance processes.

InsurTech, employing technologies like AI, blockchain, IoT, and NLP, is shaking up traditional insurance processes. This goes beyond basic digitalization to transforming legacy-driven insurance processes and addressing critical operations such as underwriting, fraud protection, and claims processing. InsurTech is particularly important in addressing emerging risks like climate change, as they help insurers protect their policyholders and mitigate associated financial risks.

Predictive analytics and ML are diversifying how insurers interact with their customers. By analyzing vast datasets, insurers can customize policies, identify risks, and tailor marketing strategies more effectively.

For example, car insurance providers are using predictive analytics to analyze driving behavior from telematics data, adjust premiums, and offer safe driving incentives. ML algorithms help identify fraudulent claims and provide custom-fit policy recommendations.

Real-time data processing enables insurers to respond quickly to claims and adjust policy terms, enhancing customers’ peace of mind. By leveraging data analytics and AI, insurers can offer personalized policy recommendations, pricing, and services, thus improving customer satisfaction, and building loyalty and trust.

Digital transformation is making claims processes faster and more proficient. Automation and AI are used to quickly assess claims, reducing waiting times and improving customer experiences. Digital channels, including mobile apps and AI-driven chatbots, are revolutionizing the way customers interact with their insurers. These innovations make interactions more convenient and accessible, leading to more content customers.

The advancement in custom insurance apps and customer portals in 2024 will reflect a significant shift in the insurance industry towards a more digital and customer-centric approach. This trend is driven by the growing demand for user-friendly digital platforms and the need for insurers to stay competitive. By embracing these trends and integrating advanced technologies, insurers can elevate customer experiences, improve operational efficiency, and adapt to the evolving digital topography.

As we move into the new year, insurers are increasingly adopting an omnichannel approach in order to cater to the evolving customer expectations in this current digital age. This strategy involves creating consistent and integrated experiences across various communication channels, including online platforms, phone calls, and in-person interactions. The aim is to enhance customer engagement and loyalty by providing a seamless experience, regardless of the touchpoint.

The insurance industry is undergoing a significant transformation so as to become more customer-centric. This shift is driven by the need to adapt to changing customer expectations, technology, climate risks, and market dynamics. Insurers are embracing advanced technology and modifying company culture to build up collaboration and increase the accessibility of customer data.

Customer Experience (CX) has emerged as a key differentiator and a source of competitive advantage in the insurance industry. Insurers that have excelled in CX have shown better financial performance, including higher Total Shareholder Return (TSR), revenue growth, and employee satisfaction, compared to their peers.

In the rapidly evolving insurance landscape of 2024 and beyond, insurers are encountering a unique set of challenges and opportunities as they strive to enhance customer experiences. Navigating the complexities of fragmented customer journeys, balancing digital innovation with the essential human touch, and tailoring services through technology are at the forefront of this transformation.

As insurers adapt to the changing dynamics of customer interactions, addressing these hurdles and capitalizing on the opportunities they present is pivotal for success. By seamlessly integrating digital and human elements, and focusing on a personal touch, insurers are poised to redefine customer engagement, offering experiences that are as enriching as they are efficient.

Developing best-in-class digital capabilities is essential for insurers. This includes providing intuitive digital platforms, reliable mobile apps, and competent chatbots for better customer engagement and retention.

Advanced data analytics and AI are being used to provide more personalized and accomplished services. This includes predictive analytics for policy optimization and risk assessment, as well as ML to uncover patterns and insights from large datasets.

Insurers are zeroing in on how to streamline customer interactions across all channels. This includes enhancing the digital customer data management systems and implementing real-time information processing for timely and accurate services.

Despite the digital shift, phone calls remain a crucial component of the omnichannel strategy. Calls often lead to higher conversion rates and more revenue compared to web leads. Therefore, insurers are focusing on personalizing phone call experiences to boost conversions and customer loyalty.

To adapt to the saturated digital advertising landscape, insurers are expected to adopt conversation intelligence solutions. These technologies will enable insurers to offer tailored policies, streamline claims processing, and provide proactive risk management services, all while purposely planning seamless omnichannel experiences.

The push towards omnichannel customer experiences in the insurance industry is in direct response to the changing vistas of customer expectations and technological advancements. By integrating various communication channels and leveraging data analytics, AI, and tailored strategies, insurers are aiming to enhance customer engagement, increase satisfaction, and stay competitive in a rapidly evolving market. This approach not only benefits the customers, but also contributes significantly to the insurers’ operational efficiency and profitability.

InsurTech, utilizing technologies such as AI, blockchain, and IoT, is fundamentally transforming traditional insurance processes. This transformation is enhancing underwriting, risk assessment, and customer service, leading to increased performance and improved risk mitigation.

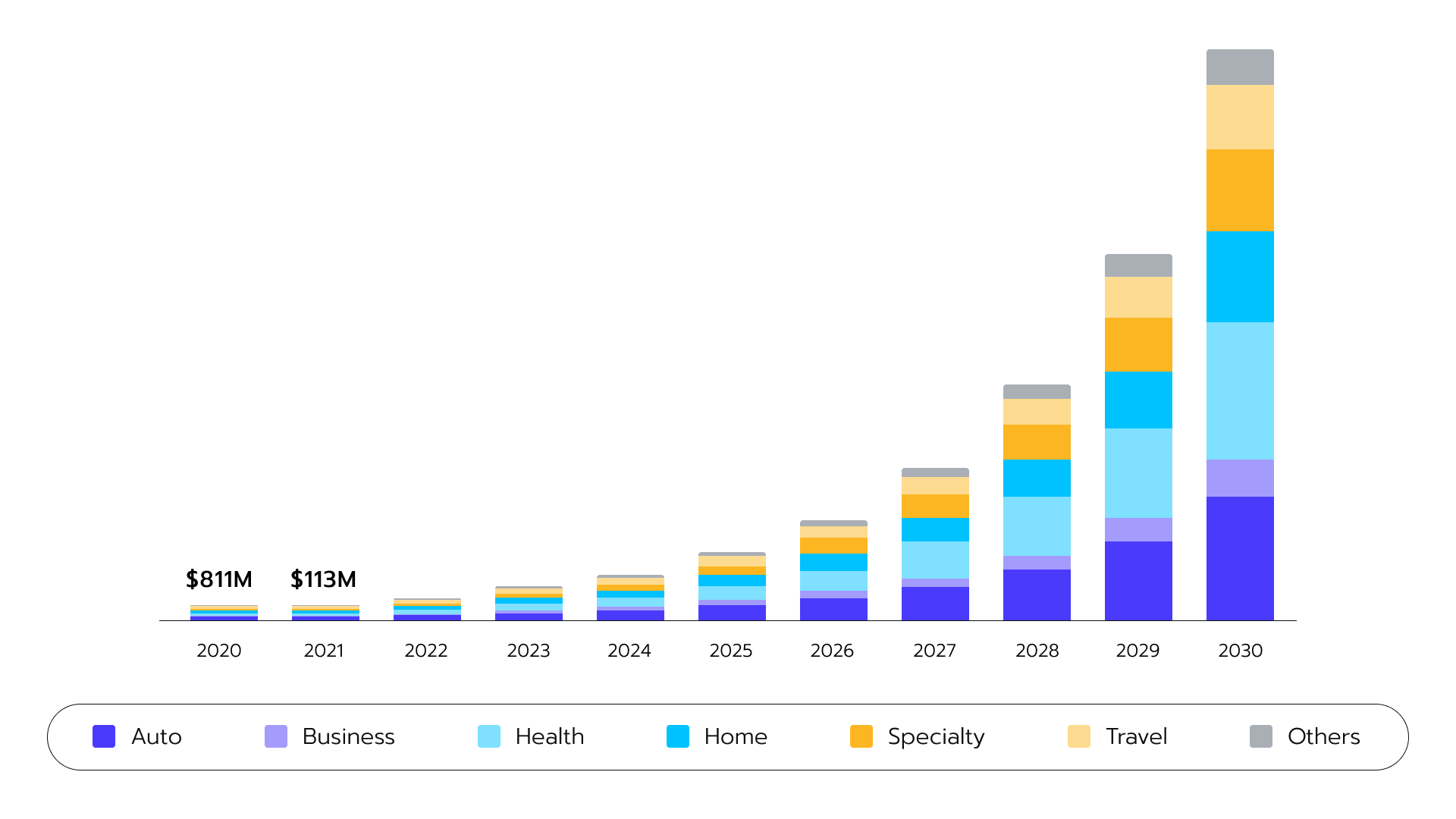

What is more, the InsurTech market is expected to explode in the upcoming years, reaching a staggering 52.7 percent growth rate up until 2030 (see Fig.3). Figure 3. The U.S. Insurtech market

Figure 3. The U.S. Insurtech market

AI and predictive analytics are recalibrating how insurers understand and manage risk. Advanced algorithms enable insurers to analyze vast data sets for better risk assessment, resulting in more accurate underwriting and pricing models. This leads to competitive advantages and upgraded customer experiences.

AI is instrumental in detecting fraud by analyzing patterns and anomalies in claims data. This capability significantly reduces fraudulent claim payouts and improves overall operational efficiency.

Blockchain technology is being explored for its potential to automate insurance processes, particularly in claims and underwriting. Smart contracts execute insurance agreements based on predefined conditions, increasing transparency and reducing the need for intermediaries.

Blockchain offers a secure and transparent way to manage insurance data that enhances the trust between insurers and policyholders.

IoT devices, like telematics in vehicles and smart home sensors, provide real-time data that insurers use for dynamic risk assessments and premium adjustments. This technology leads to more personalized insurance plans and encourages safer behaviors among policyholders.

IoT enables insurers to gather detailed data on incidents, leading to more accurate claims processing and faster resolution times.

As the insurance industry forges ahead with digital transformation, it encounters both challenges and opportunities. Integrating cutting-edge InsurTech solutions with legacy systems presents complex issues that require strategic planning, while navigating the evolving regulatory landscape poses its own set of dilemmas. These developments are crucial for insurers to enhance their operational efficiency and offer customer-centric services.

The digitalization of legacy processes through InsurTech represents a pivotal shift in the insurance industry. By leveraging AI, blockchain, and IoT, insurers are not only improving their operational adaptability, but also paving the way for more sophisticated risk assessments, fraud detection, and customer-centric services.

This transformation is not only a response to technological advancements, but also a strategic move to address emerging issues like climate change and evolving customer expectations. As the industry continues to adapt, embracing these technologies will be important for insurers so as to remain competitive and responsive to the changing market.

Predictive analytics is becoming increasingly essential in the insurance industry, as it enables insurers to make data-driven decisions, optimize pricing, and streamline claims management. This technology leverages data from various sources, reshaping the way insurers approach risk assessment, customer engagement, and fraud detection.

AI and ML are revolutionizing the insurance industry by enabling sophisticated data analysis. This technology helps in understanding complex patterns in customer behavior and risk factors, leading to more informed decision-making.

AI algorithms are used to analyze vast amounts of customer data so as to offer custom-fit insurance policies and premiums, enhancing risk prediction and mitigation strategies.

Insurers are utilizing technology to individually design interactions and services, making them more relevant and engaging for each customer. This includes using chatbots and AI-driven interfaces for real-time customer service, and providing instant personalized responses and policy recommendations.

Advanced analytics tools are employed to navigate the complexities of data protection laws like GDPR, ensuring insurers remain compliant while effectively utilizing customer data.

Insurers are revising their investment strategies and policy offerings in response to global economic trends, such as high inflation and rising interest rates. This involves more dynamic pricing models that consider the changing economic landscape.

In 2024, predictive insurance analytics, powered by AI, ML, and real-time data, will be playing a pivotal role in reshaping the insurance terrain. This evolution enables insurers to offer tailored services and make informed decisions, catering to the dynamic needs of the market and their customers. This forward-thinking approach is essential for insurers to stay competitive and responsive in an ever-changing industry.

Predictive insurance analytics, bolstered by AI, ML, and real-time data, will be revamping the insurance industry in 2024. This technological advancement enables insurers to provide more personalized services, make data-driven decisions, and adapt to changing market dynamics. As the industry continues to grow, leveraging these innovative tools will be crucial for insurers to remain competitive and responsive to their customers’ needs.

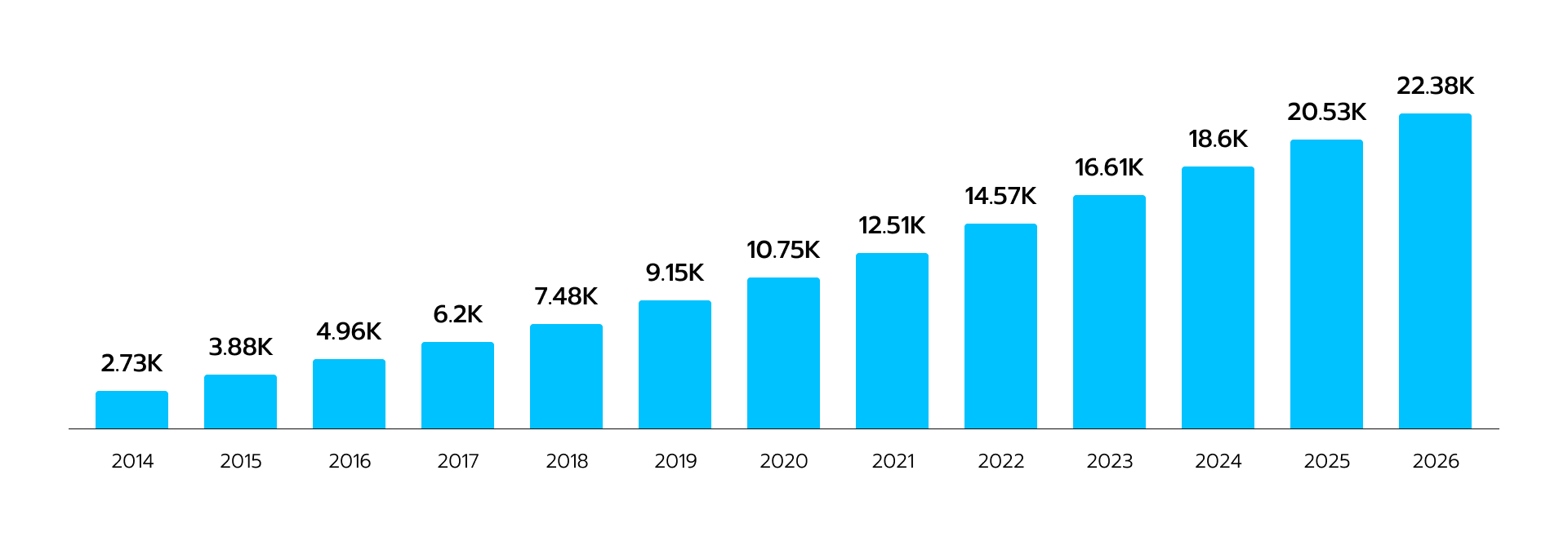

The integration of the IoT and telematics will be significantly reorienting the insurance industry in 2024. These technologies are refashioning the way insurers assess risk and manage claims, especially in the insurance sector. The overall trend is mirrored by the fact that the number of IoT devices globally has been expanding rapidly since 2014 (see Fig. 4). Figure 4. The number of IoT devices in the world

Figure 4. The number of IoT devices in the world

IoT and telematics devices provide insurers with the real-time data that is essential for accurate risk assessments. This data includes information about driving behavior, vehicle usage, and environmental conditions, which are essential for customizing insurance plans and premiums.

The integration of telematics data streamlines the claims management process by providing accurate and timely information about incidents. This leads to faster claims resolutions and improved customer satisfaction.

In the automotive sector, telematics devices track driving behavior, including speed, braking patterns, and route history. Insurers use this data to offer personalized insurance plans that reflect the individual’s driving habits, potentially rewarding safer drivers with lower premiums.

Telematics technology not only aids in risk assessment, but also plays a crucial role in accident prevention and response. Advanced systems can detect potential accidents and alert drivers, thereby reducing the likelihood of incidents. In the event of an accident, telematics data can be used to provide immediate assistance to the driver.

Insurers are leveraging IoT and telematics data to develop new insurance products that cater to the evolving needs of customers. This includes policies for electric vehicles (EVs), renewable energy projects, and smart home technologies.

The insurance industry is forming strategic partnerships with technology companies and other sectors in order to harness the full potential of IoT and telematics. These collaborations are driving innovation in product offerings and distribution channels.

The integration of IoT and telematics in the insurance industry heralds a new era of digital transformation. However, this advancement brings its own set of obstacles, particularly in the areas of data privacy, security, and regulatory compliance. Insurers must also explore innovative insurance models that leverage the insights provided by these technologies to remain ahead in the competitive landscape.

IoT and telematics are at the forefront of the digital transformation in the insurance industry. By providing real-time, actionable data, these technologies are enabling insurers to offer more personalized and profitable services. The impact of IoT and telematics extends beyond risk assessments and claims management, influencing the development of innovative products and business models.

As the industry continues its digital journey, the integration of these technologies will play a critical role in shaping the future of insurance, offering opportunities for enhanced customer engagement, improved risk management, and operational efficiency.

In the coming years, AI-powered chatbots will play an increasingly prominent role in the insurance industry. These advanced virtual assistants are transforming how insurers interact with customers by automating customer assistance, handling policy inquiries, processing claims, and providing round-the-clock support.

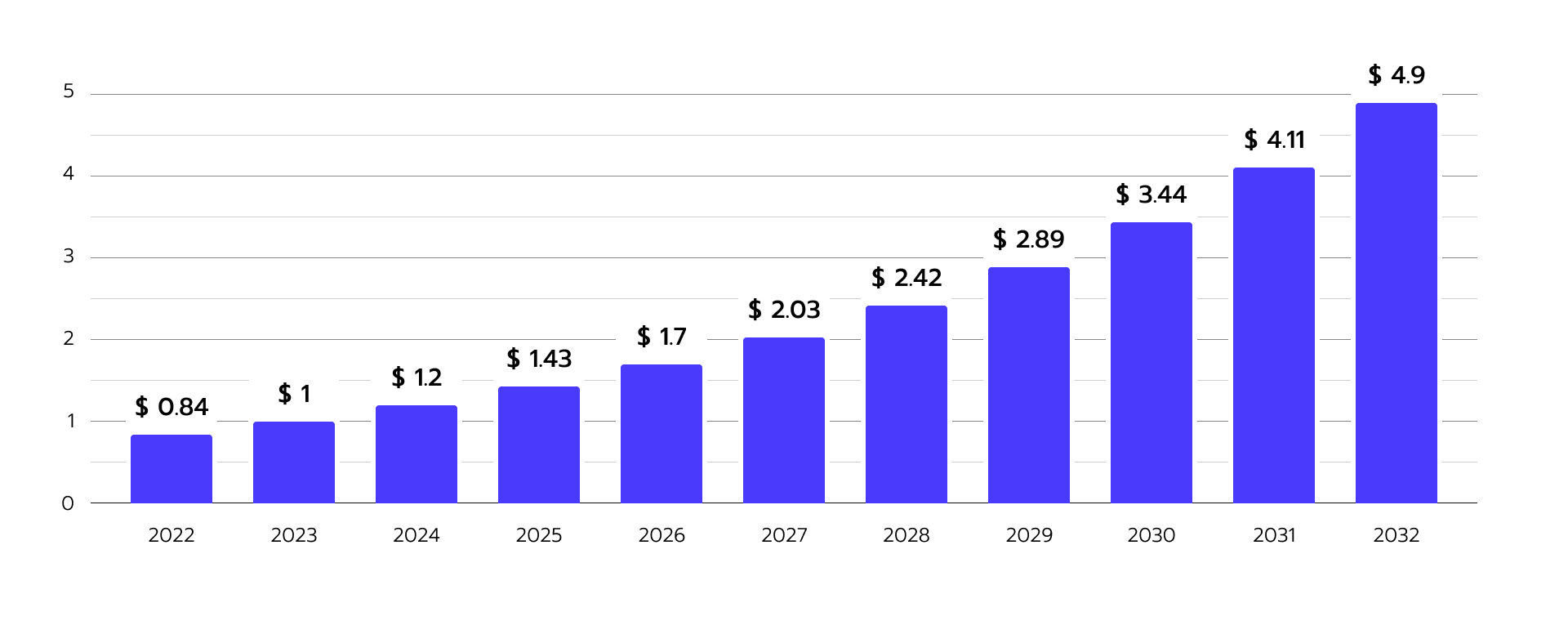

The integration of chatbots is enhancing customer service while significantly boosting the quality of the insurers’ operations. Today, all these factors result in the unprecedented interest in chatbots globally (see Fig. 5). Figure 5. Chatbot market size, 2023 to 2032 in USD billion

Figure 5. Chatbot market size, 2023 to 2032 in USD billion

Within the insurance sector of 2024, AI-powered chatbots have become indispensable tools. They streamline customer interactions, intensify operational efficiency, and offer tailor-made services. These intelligent virtual assistants represent a strategic shift towards a more interactive customer-centric approach within the insurance industry.

Chatbots guide customers through claims processes, along with automate document collection and verification, resulting in faster claims resolution and increased trust in the insurance provider.

Advanced chatbots help in detecting and preventing insurance fraud by analyzing customer data and identifying suspicious patterns, thus saving costs and maintaining a fair insurance ecosystem.

In demonstrating the practical impact of AI in the insurance industry, several leading companies have deployed chatbots to augment their customer experience. Maya from Lemonade, ABIE from Allstate, and Zurich Insurance’s Zara are prime examples, each bringing unique capabilities to policy purchasing, claims processing, and customer advisement.

These real-world applications of AI chatbots by Lemonade, Allstate, and Zurich Insurance illustrate the tangible benefits of technological integration in the insurance industry. By streamlining processes and enhancing customer service, these chatbots set a benchmark for innovation, showcasing the potential of AI to alter the insurance landscape.

As we look towards the future of the insurance sector in 2024, chatbots are set to play a transformative role. The continuous advancements in AI and NLP, coupled with their integration into omnichannel strategies, are poised to elevate the efficiency and effectiveness of customer service in the digital age of insurance.

Insurance chatbots are not just a technological advancement, but a strategic necessity for insurers. By leveraging AI-powered chatbots, the insurance industry is enhancing customer service, streamlining operations, and reshaping traditional business models.

These chatbots represent a crucial element in the digitalization of the insurance sector, driving proficiency, personalization, and customer-centric innovation. As the industry continues to mature, the role of chatbots in insurance will become increasingly vital, marking a new era of customer service and operational excellence.

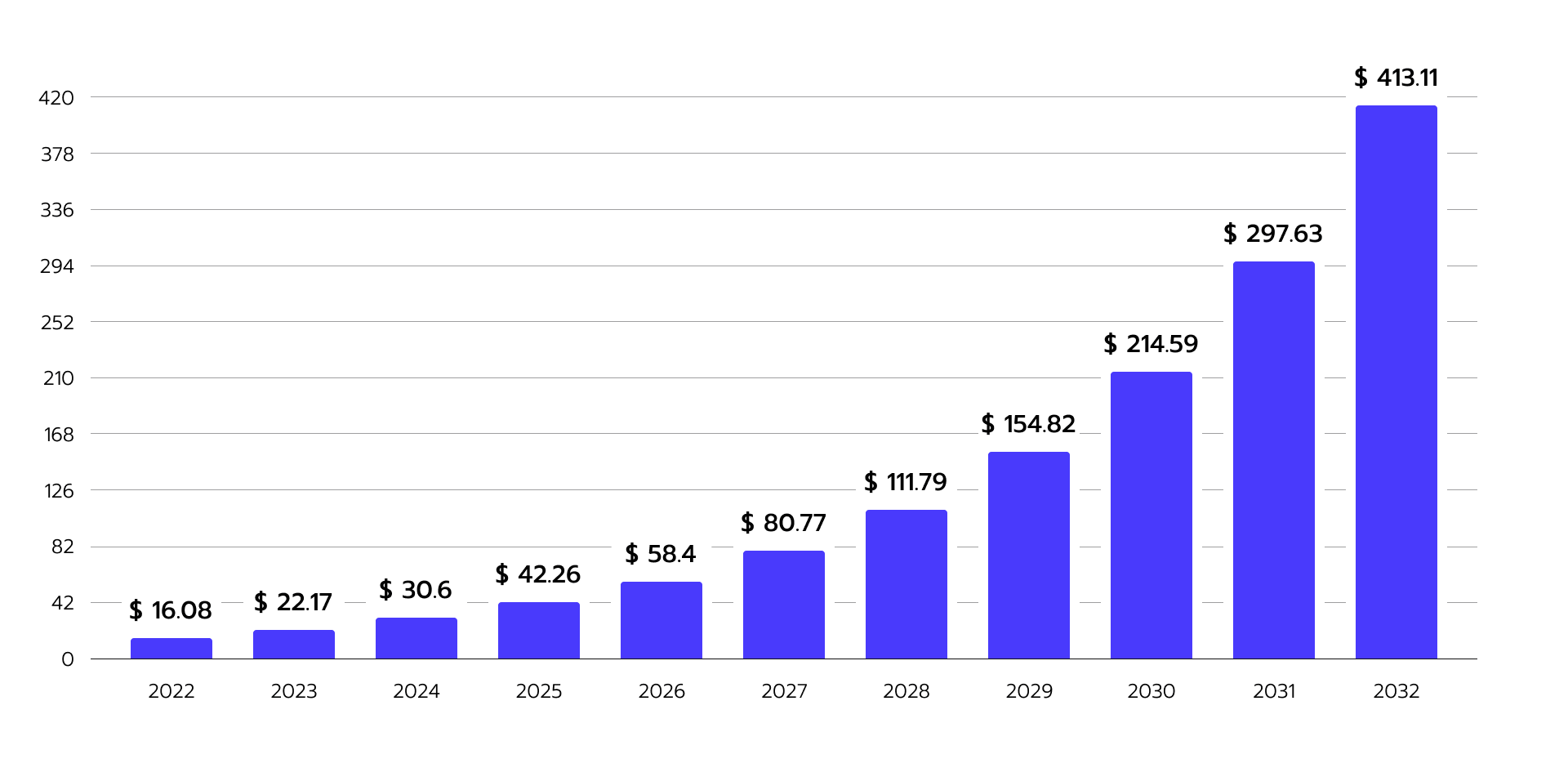

One can see that the insurance industry is increasingly leveraging AI and NLP in order to automate processes and improve decision-making. These technologies are revolutionizing the industry by enhancing the understanding of customer queries, automating claims processing, and providing custom-tailored recommendations. These underlying factors are urging companies to invest in the given realm (see Fig. 6). Figure 6. NLP market size, 2023 to 2032 in USD billion

Figure 6. NLP market size, 2023 to 2032 in USD billion

AI and NLP will continue to alter dramatically the insurance industry in 2024. These technologies enhance customer service, automate claims processing, and provide personalized policy recommendations, thereby transforming traditional insurance practices into more potent and customer-focused operations.

The integration of AI and NLP in the insurance sector marks a significant leap towards a more dynamic and customer-centric industry. By enhancing customer interactions, streamlining claims processing, and personalizing policy recommendations, these technologies are setting new standards for efficiency and customer satisfaction in the insurance world.

The advancements and innovations in AI and NLP are making over the insurance industry, particularly in fraud detection, risk assessment, and integration with other cutting-edge technologies. These developments are enhancing the accuracy and performance of insurance services and paving the way for more secure and transparent operations.

Integrating AI and NLP with technologies like IoT and blockchain signifies a transformative phase in the insurance industry, offering more sophisticated risk assessments and fraud detection capabilities. These advancements are improving operational efficiencies and shaping a future where insurance services are more reliable, secure, and tailored to individual needs.

As the insurance industry embraces the advancements in AI and NLP in 2024, it faces a spectrum of dilemmas and prospects for the future. Navigating regulatory compliance and ensuring the ethical use of technology, along with the need for continuous innovation and adaptation, are vital areas that will determine the success and integrity of AI and NLP applications in insurance.

Within 2024, the application of AI and NLP in the insurance industry is set to become more widespread and sophisticated. These technologies are not just upgrading traditional processes but are also opening new avenues for personalized customer service, decisive claims processing, and reinforced risk management. As the industry continues to embrace these cutting-edge ideas, insurers who effectively integrate AI and NLP into their operations will be well-positioned to lead in the digital age, offering tailored, efficient, and secure services to their customers.

The insurance industry is significantly leveraging next-level process automation and virtualization technologies. Key technologies such as digital twins and 3D/4D printing are being adopted for predictive maintenance, transforming the claims experience, and revamping underwriting and risk management. These advancements are reshaping how insurance products and services are delivered, making processes more robust and customer-centric.

The insurance industry of 2024 is witnessing a significant transformation with the adoption of digital twins. These advanced virtual models are revolutionizing risk assessment and claims management and are offering new perspectives on risk visualization, all of which are marking a new era of breakthroughs in the insurance sector.

Now, 3D/4D printing technologies are being utilized in the insurance industry for efficient claims processing and new product development. These technologies can be used to quickly create parts or models needed for claims resolution or to develop new insurance products tailored to specific customer needs.

Industrial IoT enables real-time monitoring of equipment, which allows insurers to provide predictive maintenance services. This proactive approach helps in preventing claims by addressing issues before they escalate into more significant problems.

The adoption of next-level process automation and virtualization technologies is already a game-changer for the insurance industry in 2024. These technologies are not only improving operational efficiency and risk management but also enabling insurers to offer innovative and customer-centric products and services. As the industry continues to evolve, insurers that leverage these technologies will be better positioned to meet changing customer needs and stay ahead in a competitive market.

As we navigate through 2024, the insurance industry is progressing rapidly. Integrating AI, IoT, and advanced analytics is transforming insurance services. It is also reshaping customer expectations.

In this dynamic environment, success lies in agile adaptation and technological leverage. These pave the way for advancement and sustainable growth. With the future of insurance becoming increasingly digital, there’s an open invitation for every business to be part of this transformative journey.

For those ready to embrace these changes, Avenga is here to guide you through the exciting path of digital insurance innovation. Reach out to us and step into the future of digitally-driven insurance solutions.

Start a conversation

We’d like to hear from you. Use the contact form below and we’ll get back to you shortly.